In the dynamic world of forex trading, STARTRADER emerges as a new player, distinguishing itself with a blend of innovative technology and user-friendly services. Established in 2018, this UK-based brokerage firm has quickly made a name for itself among traders worldwide.

In this forex trading broker review, we will give you a more exclusive STARTRADER review. You might be wondering if this is the right broker to choose. We aim to equip you with all the information to make an informed decision about whether STARTRADER aligns with your trading aspirations and needs.

STARTRADER: Overview

Established: 2018

Headquarters: United Kingdom

Trading Platforms: MetaTrader 4, MetaTrader 5, Copy Trade, Web Trader

Mobile Trading: Yes

Minimum Deposit: $50

Account Types: Standard, ECN

Founded in 2018 and headquartered in the United Kingdom, STARTRADER has established itself in the competitive forex trading market. Its offerings include popular trading platforms like MetaTrader 4, MetaTrader 5, copy trade, and web trader, each with its unique set of features to cater to different trading preferences.

Recognizing the importance of mobile trading in today’s market, STARTRADER provides options for trading on mobile devices, enabling traders to stay connected with the markets on the move. This feature reflects the evolving nature of trading in the digital age.

Regulation and Registration

STARTRADER operates under a robust regulatory framework across various jurisdictions. It is registered with the SVGFSA in Saint Vincent and the Grenadines. STARTRADER International PTY Limited extends its reach in Hong Kong. Additionally, STARTRADER LIMITED is regulated by the Seychelles Financial Services Authority (FSA), while STARTRADER PRIME GLOBAL PTY LTD falls under the oversight of the Australian Securities and Investments Commission (ASIC).

In Cyprus, IV Markets Ltd, associated with Startrader Ltd, adheres to the local regulatory standards. This global regulatory presence underscores STARTRADER’s commitment to compliance and transparency in its financial operations.

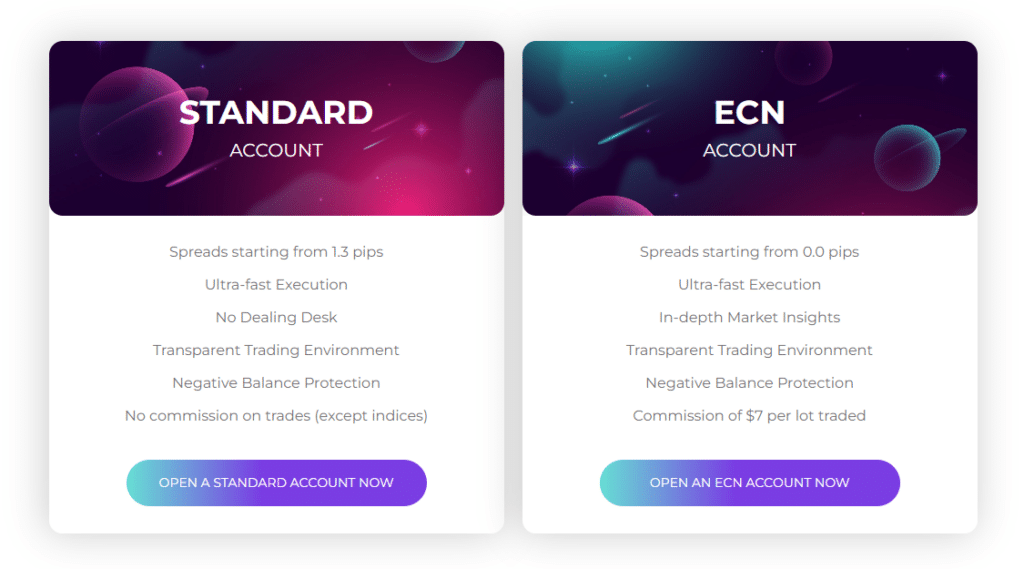

Account Types of STARTRADER

STARTRADER provides distinct features across its trading accounts, focusing on elements crucial for traders. Here’s a summary of the key aspects:

Standard Account

- Minimum Deposit: $50

- Spread: Starting from 1.3 pips

- Commission: No commission on trades (except indices)

- Maximum Leverage: Specific to the instrument and market conditions, with high leverage options available

- Instruments: Access to over 50 currency pairs, 70+ stocks, 10+ commodities, and 20+ indices

ECN Account

- Minimum Deposit: $50

- Spread: As low as 0.0 pips

- Commission: $7

- Maximum Leverage: Varies based on the instrument and market conditions, offering high leverage options

- Instruments: Includes the same wide range as the Standard account – over 50 currency pairs, 70+ stocks, 10+ commodities, and 20+ indices

Deposit and Withdrawal

STARTRADER prioritizes a seamless and secure trading experience by offering an array of fee-free deposit and withdrawal options. Traders can easily manage their transactions through a secure client portal designed for convenience and safety.

The deposit methods include bank wire transfers, VISA/Mastercard, and various online wallets like STICPAY, Perfect Money, Skrill, and Neteller. It’s important to note that bank wire transfers may take 3 to 5 working days to be reflected in your account. Withdrawals follow a timely protocol, with forms submitted after 21:00 (GMT) processed the next day and those received before 07:30 (GMT) handled the same day. Additionally, any international telegraphic transfer fees incurred are the client’s responsibility, typically around USD$20.

Products in STARTRADER

STARTRADER provides a wide range of instruments, including:

- Forex

- Shares

- Indices

- Metals

- Commodities

Trading Platform of STARTRADER

STARTRADER offers two of the advanced trading platforms, and other useful platforms. These platforms are renowned for their robust features and user-friendly interfaces, making them popular choices among forex traders globally.

- MetaTrader 4

- MetaTrader 5

- Copy Trade

- Web Trader

Fees of STARTRADER

STARTRADER offers two account types: a commission-free Standard account and a commission-based ECN account. In the Standard account, forex spreads start from 1.3 pips or $13 per 1.0 lot, with no commissions. The ECN account offers raw spreads from 0.0 pips plus a $7 commission per standard round lot, which can be over 46% cheaper than the Standard account.

There are no internal deposit fees or inactivity fees charged by STARTRADER. However, a $20 fee is applied for bank wire withdrawals. The average trading costs for various instruments are as follows: EUR/USD and GBP/USD at 1.3 pips ($13), WTI Crude Oil at $0.036, Gold at $0.17, and Bitcoin at $34.25. The minimum raw spreads in ECN accounts are 0.0 pips, and minimum standard spreads in Standard accounts are 1.3 pips. The minimum commission for forex in ECN accounts is $7 per lot.

STARTRADER Promotions

STARTRADER offers various promotional bonuses to enhance its clients’ trading experience. These incentives provide additional value and support as traders navigate the markets. These are all of their current promotions, each tailored to meet different trading strategies and goals to ensure that every trader can take advantage of these opportunities to maximize their trading potential.

1. 20% Accumulated Bonus

- STARTRADER offers a 20% bonus credit on deposits, with a maximum credit of $10,000 per client. The bonus is credited directly to trading accounts.

- Participants eligible covers for clients in regions including MENA, Europe, Africa, India, Latam, Vietnam, Canada, and New Zealand. The promotion is available from May 13th to December 31st, 2024.

- For excursion, accounts with leverage exceeding 1:500, Cent accounts, Cryptocurrency accounts, PAMM, and MAM are not eligible.

- Clients must opt-in via the client portal and can participate by making deposits over $250.

- Bonus credit increases trading leverage but cannot be withdrawn. They can be used to cover losses but are deducted if withdrawals are made from the deposit or profits.

- The bonus cannot be combined with other promotions. Withdrawal of funds before completing the terms will result in proportional deduction of the bonus.

2. 50%/20% Deposit Bonus

- First deposit provides a 50% bonus on your first deposit up to a $500 credit, and subsequent deposits provide a 20% bonus on additional deposits. The maximum bonus is $10,000 USD per client during the promotion.

- Participants eligible covers all areas except MENA, Europe, Africa, India, Latam, Vietnam, New Zealand, Australia, Canada, and China. The promotion is available from May 13th, 2024, to December 31st, 2024.

- Promotion is accessible to users who have accounts with STARTRADER. Accounts with leverage over 1:500 or designated as Cent, Cryptocurrency, PAMM, and MAM accounts are excluded.

- The bonus cannot be withdrawn, but can be used to hedge losses. Profits from the bonus can be withdrawn, but the credit itself will be deducted if a withdrawal is made.

- This promotion cannot be combined with other promotions. Engaging in prohibited trading practices may lead to disqualification and penalties.

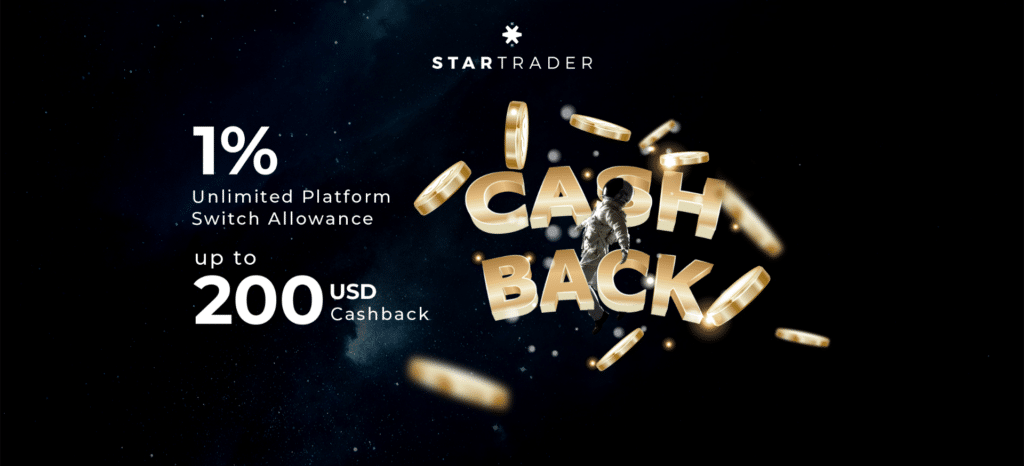

3. 1% Switch Allowance

- Clients withdrawing from other brokers and depositing into STARTRADER can enjoy a 1% switch allowance on the deposited amount.

- STP accounts receive $5/lot cashback, ECN accounts receive $2/lot cashback, up to a maximum of $200.

- Participants eligible covers all areas except Vietnam. The promotion is available from January 1, 2024, 00:00 to June 30, 2024, 23:59 (MT4 time).

- Clients must have made successful withdrawals from other platforms and deposited into STARTRADER. Each client can claim this once. Excludes Cent accounts, Cryptocurrency accounts, PAMM, and MAM accounts.

- Clients must provide withdrawal proof when applying for the promotion.

Customer Support

- Email: [email protected]

- Live Chat: 24/5

- Instagram: star trader.international

- YouTube: @Startrader.international

Pros & Cons

Pros

- Offers promotions periodically

- Support for major trading platforms

- Low minimum deposit

Cons

- Lengthy withdrawal process

- High spreads on Standard accounts

- Limited broker reputation, causing concern among customers

- No top-tier license

Pros Explained

- STARTRADER offers various promotions from time to time, such as deposit bonuses or cashback rewards, providing additional benefits to traders.

- STARTRADER offers access to MetaTrader 4, MetaTrader 5, copy trade, and web trader. These platforms are widely recognized for their advanced trading tools, comprehensive charting capabilities, and automated trading features.

- STARTRADER requires a relatively low minimum deposit of just $50 to start trading. This low entry barrier makes it accessible for a wide range of traders, including beginners or those who prefer to start trading with a smaller capital outlay.

Cons Explained

- Withdrawals at STARTRADER typically take 3-5 working days. This duration is a crucial consideration for traders who need to plan for their financial requirements or reinvestment strategies.

- Spreads of 1.3 pips on STARTRADER’s Standard accounts can be considered relatively expensive, particularly when compared to the industry norms for major currency pairs.

- STARTRADER, having been established in 2018, is relatively new in the forex trading industry. This shorter track record can result in less visibility and recognition in the crowded brokerage market.

- Despite being regulated by several international bodies, STARTRADER does not hold a license from a top-tier regulator like the UK’s Financial Conduct Authority (FCA) or the US’s Commodity Futures Trading Commission (CFTC).

Is STARTRADER Worth Considering?

STARTRADER offers an accessible entry point with a low minimum deposit and a range of account options. Its notable advantage is its support for major trading platforms like MetaTrader 4, MetaTrader 5, Copy Trade, and Web Trader. Additionally, periodic promotions can offer added value.

However, there are areas to consider carefully. The higher spreads on standard accounts might not be cost-effective for all trading strategies. The withdrawal process, taking 3-5 working days, might not align with the needs of traders who seek quicker access to their funds. Additionally, the lack of a top-tier regulatory license might be a concern for those who prioritize such credentials in a broker.

While STARTRADER offers accessibility and a range of platform options, it might not be the best fit for those prioritizing low spreads, quick withdrawals, and stringent regulatory compliance.

FAQs

STARTRADER is a forex and CFD broker established in 2018, headquartered in the United Kingdom. It offers trading services on various platforms, including MetaTrader 4 and MetaTrader 5, and provides a range of account types to cater to different traders.

STARTRADER provides access to popular trading platforms such as MetaTrader 4, MetaTrader 5, Copy Trade, and Web Trader.

STARTRADER offers two main types of accounts: Standard and ECN. The Standard account features spreads starting from 1.3 pips with no commission, while the ECN account offers spreads as low as 0.0 pips with a commission of $7 per lot traded.

STARTRADER allows deposits and withdrawals through various methods, including bank wire transfer, credit/debit cards, and online wallets. Withdrawals typically take 3-5 working days to process, with a fee of approximately $20 for international telegraphic transfers.

Yes, STARTRADER is regulated by several international bodies, including the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA), the Seychelles Financial Services Authority (FSA), and the Australian Securities and Investments Commission (ASIC).

Related Articles:

- VT Markets Review: A Critical Look for Informed Investing

- LiteFinance: A New Chapter After LiteForex’s Rebranding

- Blueberry Markets Review: Your Ultimate Guide to Trading

- ActivTrades Review: Exploring Its Innovative Trading Tools

Read more: Broker Reviews