New technologies and the emergence of new trading platforms are causing rapid changes in the online trading industry. Valutrades broker shows how modern brokers are changing to meet the needs of traders everywhere. This broker has grown because more people want to trade easily and reliably. This forex trading broker review will explore how the trading industry has changed and how platforms like Valutrades are making trading easier for everyone around the world.

Valutrades: Overview

Established: 2012

Headquarters: London, UK

Trading Platforms: MetaTrader 4, MetaTrader 5

Mobile Trading: Yes

Minimum Deposit: $0

Account Types: Standard account, ECN account

Valutrades was launched in 2012 and quickly established itself as a reputable online broker. Based in London, UK, it serves a diverse clientele, ranging from novice to experienced traders. This broker is well-known for its robust trading platforms, MetaTrader 4 and MetaTrader 5, among the most popular in the trading community. These platforms offer a variety of tools and features that cater to the needs of serious traders who demand efficiency, flexibility, and performance.

One of Valutrades’s standout features is its zero minimum deposit policy, which makes it highly accessible for traders at all levels. Whether you’re just starting or looking to manage an extensive portfolio, Valutrades offers a conducive environment for your trading activities.

Regulation and Registration

Valutrades is regulated by the Seychelles Financial Services Authority (FSA) with securities dealer license No. SD028 and by the UK Financial Conduct Authority (FCA), with a register number of 586541. These regulations ensure that Valutrades adheres to high financial integrity and consumer protection standards.

All client funds are kept in segregated accounts with top-tier banks, separate from company funds, ensuring security and proper management. Additionally, Valutrades offers Guaranteed Negative Balance Protection, meaning clients can never lose more than their account balance. However, unlike its UK operations which are protected by the Financial Services Compensation Scheme offering up to £85,000 per person in compensation, the Seychelles branch does not offer equivalent investor protection. Both branches maintain reliable digital security measures, including fully encrypted client areas to safeguard personal and financial information.

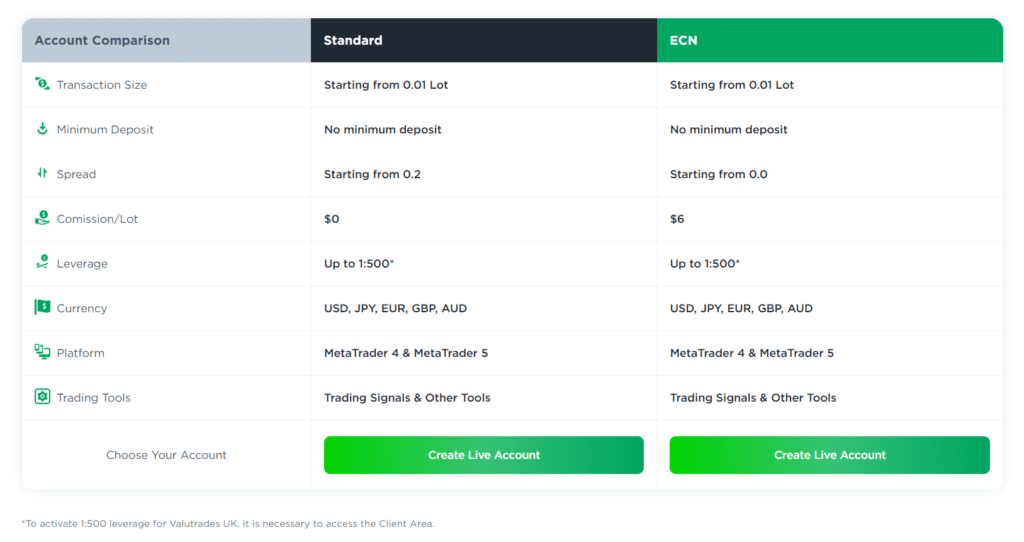

Account Types of Valutrades

Valutrades provides suitable choices with its Standard and ECN accounts. Each account type comes with specific features that enhance trading efficiency and adaptability.

Standard Account

- Minimum Deposit: No minimum deposit

- Spreads: Starting from 0.2

- Commissions: $0

- Transaction Size: Starting from 0.01 lot

- Leverage: Up to 1:500

ECN Account

- Minimum Deposit: No minimum deposit

- Spreads: Starting from 0.0

- Commissions: $6

- Transaction Size: Starting from 0.01 lot

- Leverage: Up to 1:500

Deposit and Withdrawal

Valutrades provides a variety of convenient deposit methods to accommodate its clients’ diverse needs, ensuring flexibility and security in fund transfers. Clients can choose from several options: traditional bank wires, e-wallets like Skrill and Neteller, various cryptocurrencies, PIX for Brazilian clients, and local bank transfers using China UnionPay Cards for Asian clients. Valutrades emphasizes that there is no minimum deposit requirement, allowing traders to tailor their financial strategy to their needs. Importantly, the broker does not accept third-party transactions.

Withdrawing funds from Valutrades is designed to be straightforward. Clients must log into their client area, select their trading account, and choose their desired withdrawal method. This process ensures the withdrawal source is the same as the deposit source to comply with anti-money laundering regulations. Valutrades provides detailed step-by-step guides for depositing and withdrawing funds, facilitating a user-friendly experience for all traders.

Products in Valutrades

From traditional asset classes like forex and commodities to more niche markets such as oil and CFDs, Valutrades equips its clients with the necessary tools to explore and engage with multiple markets efficiently.

- Forex

- Commodity

- Oil

- CFD

Trading Platform of Valutrades

Valutrades provides its clients with robust and versatile trading platforms, specifically MetaTrader 4 and MetaTrader 5. These platforms are renowned for their reliability and a wide array of features catering to novice and experienced traders.

- MetaTrader 4

- MetaTrader 5

Fees of Valutrades

Valutrades emphasizes highly competitive spreads that begin at 0.0 pips alongside a commission rate of $3 for each transaction side. The broker’s pricing structure is clear and includes additional fees under certain circumstances. Some financial instruments are only tradable at specific times due to varying time zones, and extra fees may apply if positions are kept open after trading hours. Overnight fees are charged on positions that extend beyond a single trading day.

The amount of these fees varies depending on the asset, including different rates for pairs like CAD/JPY, EUR/CHF, and EUR/USD, as well as for commodities and indices.

Valutrades Promotions

Unfortunately, this broker does not offer any promotions at the moment.

Customer Support

- Email: [email protected]

- Live Chat: 24/5

- Phone: +44 (0) 20 3141 0888

Pros & Cons

Pros

- Low fees

- Quick execution

- MetaTrader 4 and 5 accessibility

- Extensive deposit/withdrawal options

- No minimum deposit requirement

Cons

- Limited trading instrument selection

- 24/5 customer support

- Account type limitation

Pros Explained

- Valutrades provides competitive pricing with low commissions and spreads starting from zero, significantly reducing trading costs and appealing to new and experienced traders.

- Valutrades ensures rapid trade execution, minimizing slippage and ensuring traders get their expected prices.

- Valutrades supports MetaTrader 4 and MetaTrader 5, allowing traders to select the best software for their style.

- Valutrades ensures easy fund management for traders globally by offering a wide array of deposit and withdrawal methods, including bank transfers, e-wallets, and cryptocurrencies,

- Valutrades is accessible to traders with limited capital by providing an option to start trading with as little as $1, particularly benefiting those new to trading who prefer to start small.

Cons Explained

- Valutrades has a restricted range of trading instruments, mainly affecting traders looking to diversify their portfolios with non-forex assets like commodities and stocks.

- The absence of weekend support could be challenging for traders needing assistance during off-hours.

- Valutrades may only meet the needs of some trading strategies and preferences, which could be restrictive for traders seeking more tailored features due to the limitation of account selection.

Is Valutrades Worth Considering?

Valutrades presents several appealing features for traders, including low fees with spreads starting from zero, rapid execution connected to high liquidity sources, and support for both MetaTrader 4 and MetaTrader 5 platforms. These benefits make it a strong option for traders seeking cost-efficiency and advanced trading tools. The platform’s extensive deposit and withdrawal options and the absence of a minimum deposit requirement enhance its accessibility, particularly for new or low-capital traders.

However, drawbacks such as the limited range of trading instruments and weekday-only customer support may discourage those seeking more variety in assets or needing round-the-clock assistance.

It’s important to consider Valutrades if its strengths align with your trading priorities. This guidance can help you make an informed decision. However, if you require broader asset options and continuous support, exploring other brokers might be advisable.

FAQs

Valutrades is a forex and CFD broker established in 2012 and regulated by the FCA and the FSA. Its outstanding features include low spreads and no minimum deposit.

To open an account, visit the Valutrades website, complete the registration form, submit the necessary documents for verification, and fund your account to begin trading upon approval.

Valutrades accepts deposits through bank wires, e-wallets like Skrill and Neteller, cryptocurrencies, and region-specific options like PIX for Brazil and local bank transfers in Asia.

Log in to your client area, choose your trading account, select a withdrawal method, specify the amount, and submit your request. Withdrawals must be made using the same method as the deposit.

Valutrades offers MetaTrader 4 and MetaTrader 5, which are available for desktop, web, and mobile and provide versatile tools for trading and analysis.

Related Articles:

- Fxglory Review: An Ultimate Guide to Its Trading Services

- IUX: A New Era for Stock Market Enthusiasts

- CXM Direct: Services, Features, and User Feedback

- Interactive Brokers: 40 Years of Excellence for Traders

Read more: Broker Reviews