Intraday trading offers investors an exciting opportunity to profit from daily price movements in the stock market. In India, the fast-paced and dynamic nature of intraday trading attracts many traders looking to maximize their returns within a single trading session. Identifying the right stocks to trade each day is crucial for success.

In this article, we will explore the concept of intraday stocks and compare the top 10 intraday stocks today to consider in India. We will highlight why these stocks are beneficial for potential growth and provide the factors influencing their performance and whether they make a good investment.

What Are Intraday Stocks?

Intraday stocks are bought and sold within the same trading day. This strategy, known as intraday trading, allows traders to capitalize on price movements within the stock market’s trading hours. Intraday trading attracts investors for its potential quick returns, with profits possible within hours or minutes. The goal is to capitalize on short-term market swings, but success requires a thorough understanding of market dynamics, quick decision-making, and a strong strategy.

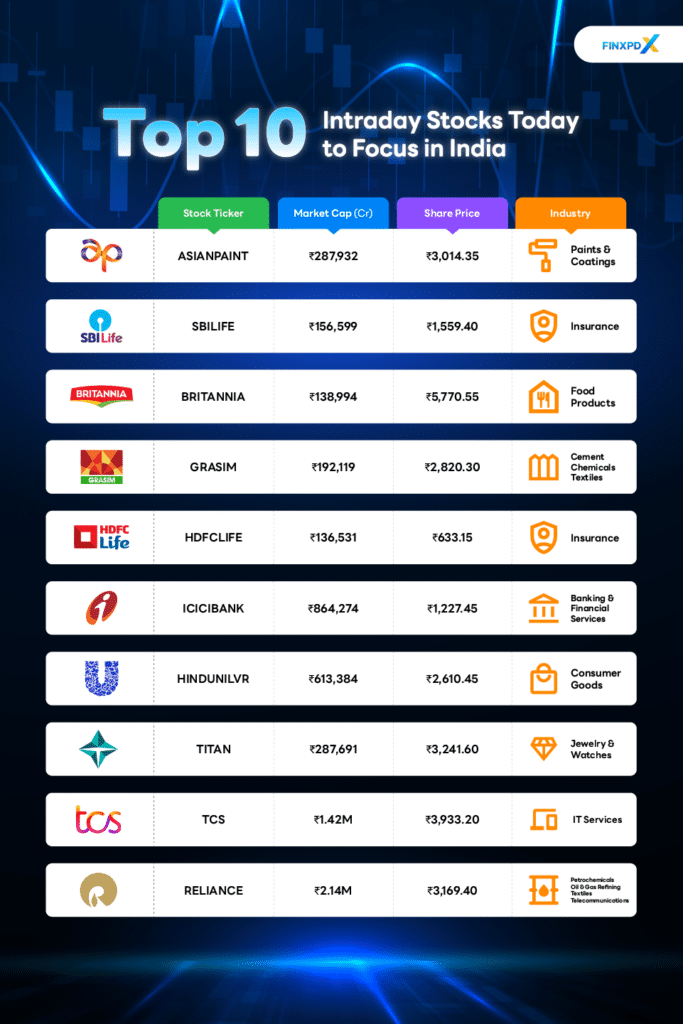

Top 10 Intraday Stocks Today

Intraday trading involves buying and selling stocks within the same day, capitalizing on short-term price movements. Identifying the right stocks is crucial for success, and this section will highlight the top 10 intraday stocks today in India based on key metrics: company name, stock ticker, market cap, share price, PE ratio, and dividend yield per annum. These stocks are chosen for their liquidity and volatility, offering promising opportunities for quick profits.

1. Asian Paints Ltd.

Ticker: NSE: ASIANPAINT

Market Cap (Cr): ₹287,932

Share Price: ₹3,014.35

PE Ratio: 52.63

Dividend Yield (p.a.): 1.11%

Overview

The first of top 10 intraday stocks today is Asian Paints Ltd., founded in 1942. It is India’s leading paint manufacturer and the third-largest paint company in Asia. With a market capitalization of ₹287,932 crore, Asian Paints showcases robust financial health and strong market presence. The current share price of ₹3,014.35 reflects solid market performance. Its PE ratio of 52.63 indicates high investor expectations for future growth, while an annual dividend yield of 1.11% provides shareholders with a reliable source of revenue.

2. SBI Life Insurance Company Ltd.

Ticker: NSE: SBILIFE

Market Cap (Cr): ₹156,599

Share Price: ₹1,559.40

PE Ratio: 82.44

Dividend Yield (p.a.): 0.17%

Overview

The second of top 10 intraday stocks today is SBI Life Insurance Company Ltd., established in 2000. This company is a joint venture between the State Bank of India (SBI) and BNP Paribas Cardif. With a significant market capitalization of ₹156,599 crore, the company showcases strong financial stability and market presence. Its current share price is ₹1,559.40, reflecting robust market performance. The high PE ratio of 82.44 indicates investor optimism regarding future growth. Despite this, the company offers a modest annual dividend yield of 0.17%, providing a small income stream to shareholders.

3. Britannia Industries Ltd.

Ticker: NSE: BRITANNIA

Market Cap (Cr): ₹138,994

Share Price: ₹5,770.55

PE Ratio: 64.71

Dividend Yield (p.a.): 1.28%

Overview

The third of top 10 intraday stocks today is Britannia Industries Ltd., established in 1892. It is a leading player in India’s food industry, renowned for its biscuits, dairy products, and snacks. With a market cap of ₹138,994 crore and a share price of ₹5,770.55, it shows strong market performance. The PE ratio of 64.71 indicates high investor expectations for growth. Additionally, the company offers an annual dividend yield of 1.28%, providing a steady income stream for shareholders.

4. Grasim Industries Ltd.

Ticker: NSE: GRASIM

Market Cap (Cr): ₹192,119

Share Price: ₹2,820.30

PE Ratio: 30.56

Dividend Yield (p.a.): 0.36%

Overview

The next one in top 10 intraday stocks today is Grasim Industries Ltd., founded in 1947. It is a flagship company of the Aditya Birla Group and a leading player in industries such as cement, textiles, and chemicals. With a market capitalization of ₹192,119 crore and a share price of ₹2,820.30, Grasim showcases financial stability and establishes a strong market existence. The 30.56 PE ratio indicates that investors have medium growth expectations. In contrast, stockholders receive a tiny income stream from the 0.36% yearly dividend yield.

5. HDFC Life Insurance Company Ltd.

Ticker: NSE: HDFCLIFE

Market Cap (Cr): ₹136,531

Share Price: ₹633.15

PE Ratio: 86.37

Dividend Yield (p.a.): 0.32%

Overview

The fifth of top 10 intraday stocks today is HDFC Life Insurance Company Ltd., established in 2000. It has grown into one of India’s leading life insurance providers, offering diverse individual and group insurance solutions. HDFC Life shows powerful financial health and an important market existence, with a market cap of ₹136,531 crore and a share price of ₹633.15. Its high PE ratio of 86.37 reflects strong investor expectations for growth and provides a modest annual dividend yield of 0.32%.

6. ICICI Bank Ltd.

Ticker: NSE: ICICIBANK

Market Cap (Cr): ₹864,274

Share Price: ₹1,227.45

PE Ratio: 19.77

Dividend Yield (p.a.): 0.80%

Overview

The further top 10 intraday stocks today is ICICI Bank Ltd., founded in 1994. It has grown into one of India’s largest private sector banks, offering a comprehensive range of banking products and services. With a market cap of ₹864,274 crore and a share price of ₹1,227.45, the bank demonstrates strong financial stability and market leadership. With a PE ratio of 19.77, investor expectations for growth are slightly higher growth. The annual dividend yield of 0.80% offers shareholders a consistent income stream.

7. Hindustan Unilever Ltd.

Ticker: NSE: HINDUNILVR

Market Cap (Cr): ₹613,384

Share Price: ₹2,610.45

PE Ratio: 59.71

Dividend Yield (p.a.): 1.61%

Overview

The next top 10 intraday stocks today is Hindustan Unilever Ltd., founded in 1933. This company is a leading consumer goods company in India, known for its diverse range of high-quality products. With a market capitalization of ₹613,384 crore and a share price of ₹2,610.45, HUL shows an effective financial base and market leadership. Its PE ratio of 59.71 reflects high investor expectations for growth. With a 1.61% annual dividend yield, stockholders are provided with an annual source of income.

8. Titan Company Ltd.

Ticker: NSE: TITAN

Market Cap (Cr): ₹287,691

Share Price: ₹3,241.60

PE Ratio: 81.87

Dividend Yield (p.a.): 0.34%

Overview

Titan Company Ltd., established in 1984, is one of top 10 intraday stocks today. It is a prominent player in the Indian lifestyle industry known for its watches, jewelry, and eyewear. With a market cap of ₹287,691 crore and a share price of ₹3,241.60, Titan emphasizes effective financial stability and strong market performance, as shown by its market cap of ₹287,691 crore and a share price of ₹3,241.60. The high PE ratio of 81.87 suggests that investors have high expectations for growth. Additionally, the company offers an annual dividend yield of 0.34%, providing a small income to shareholders.

9. Tata Consultancy Services Ltd.

Ticker: NSE: TCS

Market Cap (Cr): ₹1.42M

Share Price: ₹3,933.20

PE Ratio: 30.36

Dividend Yield (p.a.): 1.87%

Overview

Another top 10 intraday stocks today is Tata Consultancy Services Ltd. (TCS), founded in 1968. This company is a global leader in IT services, consulting, and business solutions. Presenting financial stability and outstanding market performance, TCS maintains a market cap of ₹1.42 trillion and a share price of ₹3,933.20. Its PE ratio of 30.36 shows its slightly higher growth projections, and its 1.87% annual dividend yield offers stockholders a yearly source of income.

10. Reliance Industries Ltd.

Ticker: NSE: RELIANCE

Market Cap (Cr): ₹2.14M

Share Price: ₹3,169.40

PE Ratio: 30.78

Dividend Yield (p.a.): 0.32%

Overview

The last of top 10 intraday stocks today is Reliance Industries Ltd., established in 1973. It is one of India’s largest conglomerates interested in petrochemicals, refining, oil, telecommunications, and retail. Reliance displays remarkable financial stability and market power with a market cap of ₹2.14 trillion and a share price of ₹3,169.40. A minor income stream is provided for shareholders by its 0.32% annual dividend yield, while its PE ratio of 30.78 indicates that investors have low expectations for growth.

What Factors Affect the Intraday Stocks?

This type of trading requires a sharp awareness of various factors influencing stock prices throughout the day, especially in the top 10 intraday stocks today, which change constantly. Understanding these factors is important for making informed and timely trading decisions.

Market News and Events

Intraday stock prices are significantly influenced by market news and events, such as economic data releases, corporate announcements, and geopolitical events. Positive news can drive prices up, while negative news can cause them to drop, making it essential for traders to stay updated on current events.

Market Sentiment

The overall mood of investors, known as market sentiment, affects stock prices. High investor confidence can increase prices, while fear and uncertainty can lead to sell-offs. Whether bullish or bearish, market trends also play an important role in shaping sentiment.

Technical Indicators

Technical analysis is necessary for intraday trading. Indicators like moving averages, RSI, and volume indicators help traders identify trends, potential reversal points, and the strength of price movements. These tools assist in making informed trading decisions.

Liquidity

Liquidity, or the ease with which stocks can be bought or sold, impacts price stability. High liquidity typically leads to more stable prices, while low liquidity can cause significant price swings, making it an essential factor for intraday traders to consider.

Time of Day

Intraday price movements vary throughout the trading day. The opening bell often sees high volatility as traders react to the news, the midday period usually experiences lower volatility, and activity increases again towards the closing bell as traders close positions.

Are Intraday Stocks a Good Investment?

Intraday stocks offer quick profits by trading within a single day. This can be exciting because you can see quick returns and avoid risks from holding stocks overnight. However, it also comes with high risks and requires a strong understanding of market trends and technical analysis. The fast-paced nature can be stressful, and frequent trades can lead to higher transaction costs. While experienced traders might find intraday trading rewarding, beginners might find long-term investing safer and more suitable. Remember to use top 10 intraday stocks as your guide for your further trading.

Conclusion

In summary, intraday trading offers an exciting avenue for those looking to capitalize on short-term market movements. It demands a thorough understanding of market dynamics, a strong strategy, and the ability to make quick decisions under pressure. By focusing on stocks with strong market performance and staying attuned to the factors affecting stock prices, traders can enhance their chances of success. Nonetheless, the high-risk nature of intraday trading necessitates a cautious approach, especially for those new to the market. This guide on India’s top 10 intraday stocks today will help you to make informed decisions for your future growth.

FAQs

Intraday stocks are those that traders buy and sell within the same trading day. They aim to capitalize on short-term price movements, with positions closed before the market closes.

Intraday trading involves both buying and selling within the same day. Traders buy stocks to profit from price rises and sell stocks (short selling) to profit from price falls, closing all positions before the market closes.

Choose stocks and consider their high liquidity, volatility, market trends, and volume. Use technical analysis tools and monitor news and market sentiments.

The first and last hours of the trading day are often the most volatile, providing good opportunities for intraday trades.

Yes, but it requires learning, practice, and a disciplined approach. Beginners should start with a demo account and small trades.

Related Articles:

- List of the Best 10 Ethanol Stocks in India

- The 10 Best Railway Stocks in India for 2024

- Top 10 Green Energy Stocks Investing in Indian

- Best 9 Tyre Stocks in India: The Rising in Demand

Read more: Stocks Reviews