Understanding a company’s financial health benefits investors, managers, and shareholders. One essential indicator that provides information into how well a business manages its accounts receivable is days sales outstanding (DSO). DSO measures the average number of days it takes for a company to collect payment after a sale has been made. This indicator is important as it reflects the effectiveness of a company’s credit and collection policies.

This article will explain the concept of DSO, its significance, and how it is calculated. By exploring what high and low DSO values indicate, you can better understand a business’s operational and financial implications. A thorough comprehension of DSO can help you make informed decisions to enhance financial management and optimize cash flow.

What Is DSO (Days Sales Outstanding)?

Days sales outstanding (DSO) is a financial metric that measures the average number of days it takes for a company to collect payment after a sale. It evaluates the efficiency of a company’s credit and collections processes. A lower DSO indicates efficient credit management and quicker cash collection, while a higher DSO suggests potential cash flow issues.

⚠️Tip: Regular monitoring of DSO helps identify trends and take corrective actions promptly.

Key Takeaways

- Days sales outstanding (DSO) measures the average number of days it takes for a company to collect payment after a sale.

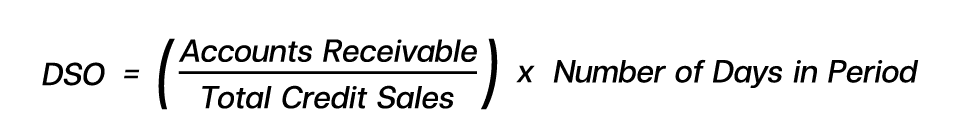

- DSO is calculated by dividing accounts receivable by total credit sales and multiplying by the number of days in the period.

- Calculating DSO helps businesses manage cash flow and assess credit risk.

- A lower DSO indicates efficient cash collection and strong liquidity.

- A higher DSO may signal issues with customer payments or credit policies.

Why Is DSO (Days Sales Outstanding) Important?

Days sales outstanding (DSO) is important to evaluate for several reasons.

Cash Flow Management

DSO directly impacts a company’s cash flow. Faster receivables collection means more cash is available for day-to-day operations, investments, and growth opportunities.

Financial Health Indicator

A low DSO indicates a company’s efficiency in managing its receivables, suggesting good credit policies and customer reliability. Conversely, a high DSO may signal issues with cash flow or inefficiencies in the collection process.

Operational Efficiency

Monitoring DSO helps companies identify and address billing and collection process inefficiencies. Businesses can improve their operational efficiency and financial performance by optimizing these processes.

Credit Policy Assessment

DSO helps assess the effectiveness of a company’s credit policies. If DSO increases, it might be time to reevaluate credit terms and tighten credit controls to reduce the risk of bad debts.

Investor Confidence

Investors and shareholders closely watch DSO as an indicator of a company’s financial health and operational efficiency. A consistently low DSO can enhance investor confidence and attract potential investors.

Benchmarking and Comparison

DSO allows for benchmarking against industry standards and competitors. Companies can use DSO to weigh their performance relative to peers and identify areas for improvement.

How to Calculate DSO (Days Sales Outstanding)

Days sales outstanding (DSO) is a simple tool for evaluating a company’s receivables collection efficiency. Here’s a step-by-step guide to calculating DSO:

- Determine the Period: Choose the period you want to calculate DSO, typically a month, quarter, or year.

- Gather Required Data: Here is the important information that is required for calculating

- Total Accounts Receivable: The total amount of money owed to the company by its customers at the end of the period.

- Total Credit Sales: The total sales made on credit during the period. This does not include cash sales.

- Apply the Formula: To determine the average number of days it takes for a company’s accounts receivable, use the following formula:

Example Calculation:

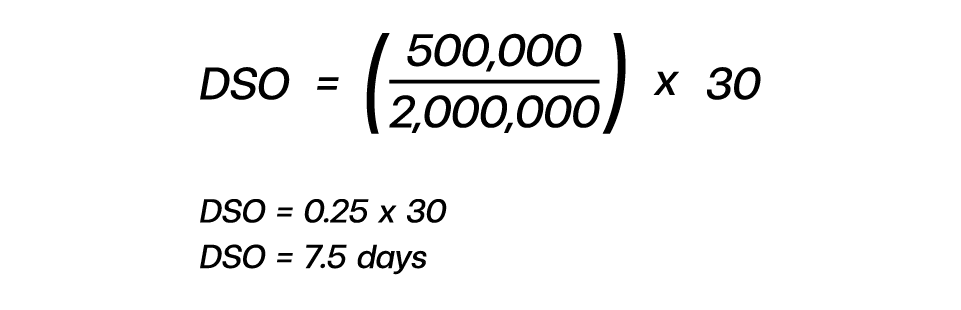

If a company has $500,000 in accounts receivable and $2,000,000 in total credit sales over a 30-day period, the DSO calculation would be:

This result means it takes the company an average of 7.5 days to collect payment after making a sale on credit.

What Does a High DSO Mean?

A high days sales outstanding indicates that a company is taking longer to collect customer payments, which can signal inefficiencies in the collection process and potential cash flow problems. This delay might result from weak credit policies or customers experiencing financial difficulties. Additionally, a high DSO increases the risk of bad debts and negatively impacts key financial ratios, affecting the company’s overall financial health and attractiveness to investors. To address a high DSO, companies should review credit policies, improve invoicing and collection processes, and closely monitor accounts receivable.

What Does a Low DSO Mean?

A low days sales outstanding (DSO) indicates that a company collects payments from its customers quickly, which is generally a positive sign. It reflects efficient credit management and strong cash flow, enabling the company to reinvest in operations, pay off debts, and cover expenses promptly. A low DSO also suggests that the company has effective collection processes and possibly strict credit policies, ensuring timely payments. Additionally, it implies that customers are financially healthy and reliable. Overall, a low DSO contributes to a company’s financial stability and attractiveness to investors.

Conclusion

Days sales outstanding (DSO) is important for estimating a company’s efficiency in collecting payments. A low DSO indicates strong cash flow and effective credit management, enhancing financial stability and investor appeal. Conversely, a high DSO suggests cash flow problems and collection inefficiencies, requiring improved credit policies. Regularly monitoring and managing DSO is essential for maintaining healthy cash flow and financial health. Optimizing DSO improves financial performance, reduces bad debts, and boosts investor confidence, making proactive management crucial for companies.

FAQs

Days sales outstanding (DSO) is a financial metric that measures the average number of days it takes for a company to collect payment after a sale. It evaluates the efficiency of a company’s credit and collections processes.

A company can reduce its DSO by implementing stricter credit policies, offering discounts for early payments, improving invoicing processes, and regularly following up on overdue accounts.

DSO should be monitored regularly, typically on a monthly basis. This helps companies quickly identify and address any issues in their receivables process.

A good DSO number varies by industry, but generally, a DSO of 45 days or less is considered good. It indicates that the company collects its receivables within a reasonable time frame.

A company can improve its DSO by tightening credit policies, offering incentives for early payments, enhancing the efficiency of the billing process, and actively managing overdue receivables.

Related Articles:

- PCR Ratio: Easy Step to Analyze Market Trend

- Moneyness: Trade Options With Great Confidence

- Balance Sheet: Explained Core Concepts Made Simple

- AMO Order: Time Value in After-Hours Trading in India

Read more: Stocks