In trading, knowing the situation in the market is important. The put call ratio (PCR ratio) is a tool that helps with this. It’s a simple way to see what traders feel about the market, whether optimistic or cautious. This ratio is like a quick check on the market’s mood. By understanding the PCR ratio, traders can make smarter decisions. This guide will explain how important the PCR ratio is, how to use it, and what to be aware of. It’s like having a helpful guide in the complex world of trading.

What Is PCR Ratio?

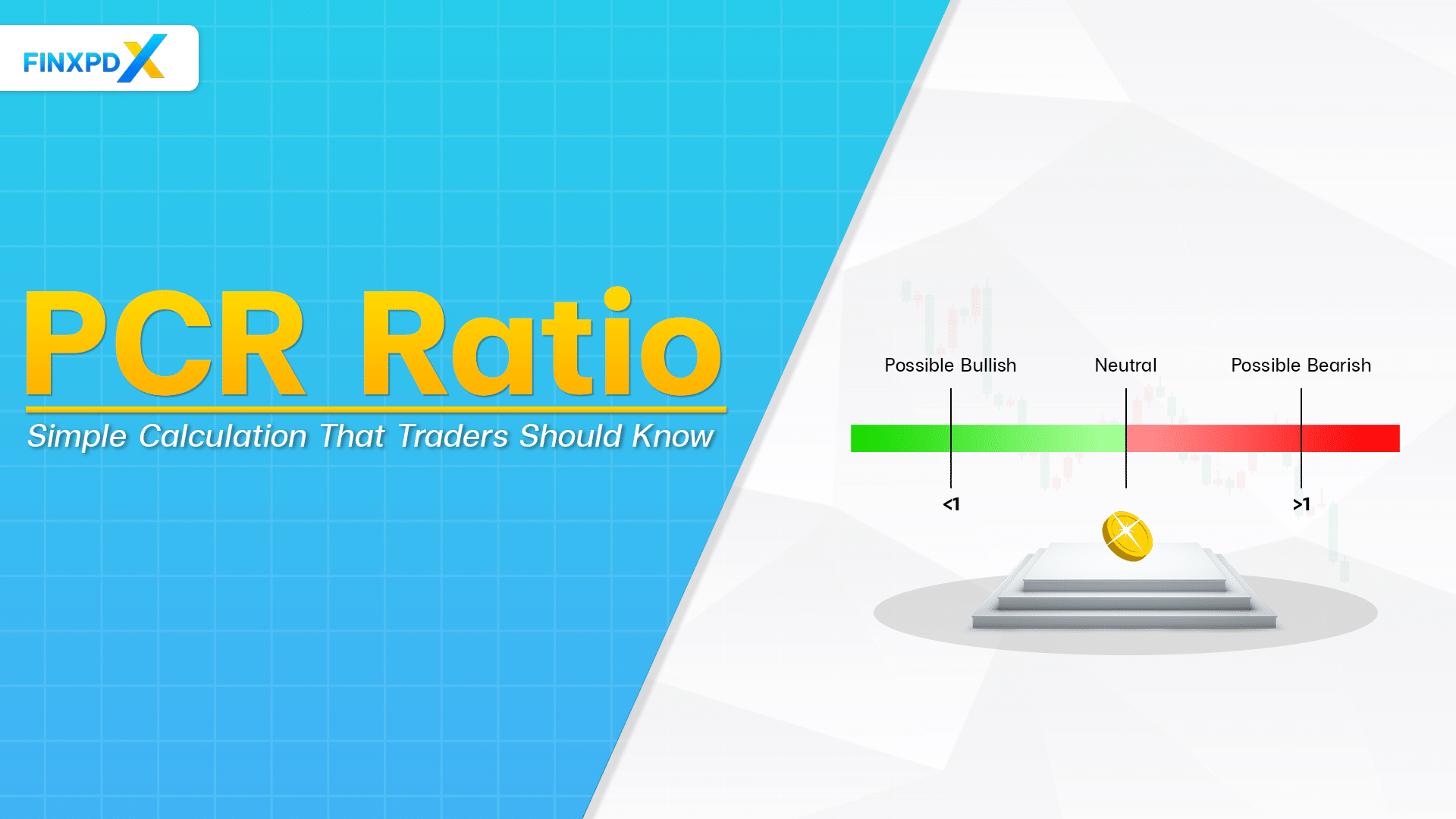

The put call ratio (PCR ratio) is a concept in trading. It’s a tool that helps traders understand market sentiment. So, the real meaning of it is a simple calculation where you divide the number of traded put options by the number of traded call options. Put options predict that a stock or market will go down, and call options predict that it will go up.

By comparing these two, the PCR ratio hints at what traders forecast for the market. If more puts are being bought, it suggests that traders are worried and expect the market to fall. On the other hand, if more calls are being bought, it suggests optimism and an expectation that the market will rise. This ratio can be a powerful indicator, especially when it reaches extreme levels, as it helps predict possible market movements.

Key Takeaways

- The put call ratio (PCR) is an indicator that compares the volume of traded put options to call options, reflecting market sentiment.

- The PCR ratio reflects a gauge of market mood, where a higher ratio indicates bearish sentiment and a lower ratio suggests bullishness.

- PCR can assist in timing market entries and exits, acting as a guide for strategic trading decisions.

- Extreme PCR values can offer contrarian trading opportunities, signaling potential overreactions in the market.

Importance of PCR Ratio

Understanding the PCR ratio is helpful for anyone involved in the trading world. It’s not just another number; it holds significant value in several ways.

Reflecting Market Sentiment

The PCR ratio acts as a barometer of investor sentiment. It gives traders a glimpse into the prevailing mood in the market, whether it’s fear or greed, caution or optimism. This sentiment is a key driver of market movements, and understanding it can help traders anticipate trends.

Contrarian Indicator

The PCR ratio serves as a contrarian indicator. When the ratio is exceptionally high or low, it can signal that the market might be reaching a point of overreaction. For example, a high PCR ratio might suggest the market is overly pessimistic, potentially indicating a market bottom. Conversely, a low ratio could indicate excessive optimism, signaling a market top.

Risk Management Tool

By observing changes in the PCR ratio, traders can better adjust their strategies to manage potential risks. It helps make more informed decisions, especially when combined with other market indicators and analyses.

How to Analyze PCR Ratio

This part focuses on a complex approach to PCR (put call ratio) analysis. We will consider the behavior of option sellers, key market players compared to the retail public, typically on the buying side. Here’s a summarized interpretation:

| The Result Ratio | Analysis |

|---|---|

| PCR increase in up trending markets | An increasing PCR during slight pullbacks in an overall rising market signals optimism. This trend suggests put option writers are actively engaging, anticipating the continuation of the upward market trend. |

| PCR decreases at resistance levels | When the PCR drops as the market approaches resistance levels, it hints at a bearish outlook. This change implies that call option writers are preparing for limited market growth or potential downturns. |

| PCR decrease in down trending markets | Reducing the PCR in a downward-trending market also points to bearish sentiment. It indicates that call options are being sold off, with expectations of the market’s continued decline. |

This approach to PCR analysis, focusing on the behavior of influential option sellers, provides critical insights into understanding market directions.

Enhancing Trading Strategies With PCR Ratio

Incorporating the put call ratio (PCR) into trading strategies can significantly enhance decision-making and market performance. Here’s how traders can leverage this metric:

Timing Market Entries and Exits

The ratio can serve as a guide for timing market entries and exits. A high PCR might suggest an opportune time to enter the market, anticipating a potential rebound. Conversely, a low PCR could signal an optimal exit point before a downturn.

Balancing Portfolios

Traders can use the ratio to balance their portfolios. Shifting towards defensive assets might be wise in a market with a high PCR (bearish sentiment). Conversely, a low PCR (bullish sentiment) might suggest an opportunity to take on more aggressive positions.

Risk Management

PCR can help with risk assessment and management. Understanding market sentiment through PCR helps traders adjust their risk levels and prepare for potential market volatility.

Strategic Contrarian Trading

Sometimes, going against the market sentiment (contrarian trading) can be profitable. A very high or low PCR can signal overreactions in the market, providing opportunities for contrarian strategies.

Complementary Tool

The PCR should be used as a complementary tool alongside other analysis methods, such as technical and fundamental analysis, to make more informed trading decisions.

5 Limitations of the PCR Ratio

While the put call ratio (PCR) is a valuable tool in market analysis, knowing its limitations is necessary. Here are 5 key restrictions to consider:

Market Context Dependency

The interpretation of the ratio heavily depends on the broader market context. The PCR ratio’s signals can only be accurate if other market factors are considered.

Complementary Analysis Essential

PCR should not be used in isolation. It’s most effective when used with other indicators, as relying solely on PCR can result in incomplete analysis.

Delayed Reaction

The PCR ratio often reflects what has happened in the market rather than predicting future movements. This delay can limit its effectiveness in fast-moving market conditions.

Generalization Limitations

The PCR ratio is a general indicator and does not account for the nuances of individual stocks or sectors. It provides a broad market sentiment but may need to be more accurate for specific trading decisions.

Extreme Value Misinterpretation

Extreme PCR values can sometimes be misinterpreted. High or low extremes might not always signify market tops or bottoms but can be driven by other factors like options expiry or large trades.

Conclusion

As we conclude our exploration of the put call ratio (PCR), it’s clear that while this metric offers valuable insights into market sentiment and trends, it is not a magic bullet. The PCR ratio is a powerful tool in a trader’s arsenal, providing clues about market psychology and potential movements. However, its effectiveness hinges on the trader’s ability to interpret it in the broader market alongside other indicators.

Traders and investors should use the PCR ratio judiciously, incorporating it into a diversified strategy rather than relying on it exclusively. Understanding both its strengths and limitations is necessary to leverage its insights effectively. Like any trading tool, the greatest success comes from a balanced approach, combining data analysis with market experience and intuition.

FAQs

The put call ratio (PCR) is a market sentiment indicator that measures the volume of put options traded relative to call options. It’s used to gauge the market’s bearish or bullish mood.

A good PCR ratio varies depending on market conditions and context. Generally, a PCR above 1 indicates bearish sentiment, while below 1 suggests bullishness. However, interpretation depends on historical norms for the specific market.

The PCR ratio is calculated by dividing the total number of traded put options by the total number of traded call options over a specific period.

The PCR ratio helps predict market trends by indicating the prevailing sentiment among investors. High PCR values can signal bearish sentiment and potential market downturns, while low values can indicate bullish sentiment and upward trends.

A PCR ratio of 1 suggests a neutral market sentiment, where the volume of put options equals the volume of call options. This equilibrium can imply uncertainty or a transitional phase in market sentiment.

Related Articles:

- Option Selling Guide: Boost Your Investment Portfolio

- Option Chain: Learn the Key Factors for Successful Trade

- Market Mood Index: The Useful Tool for Market Prediction

Read more: Stocks