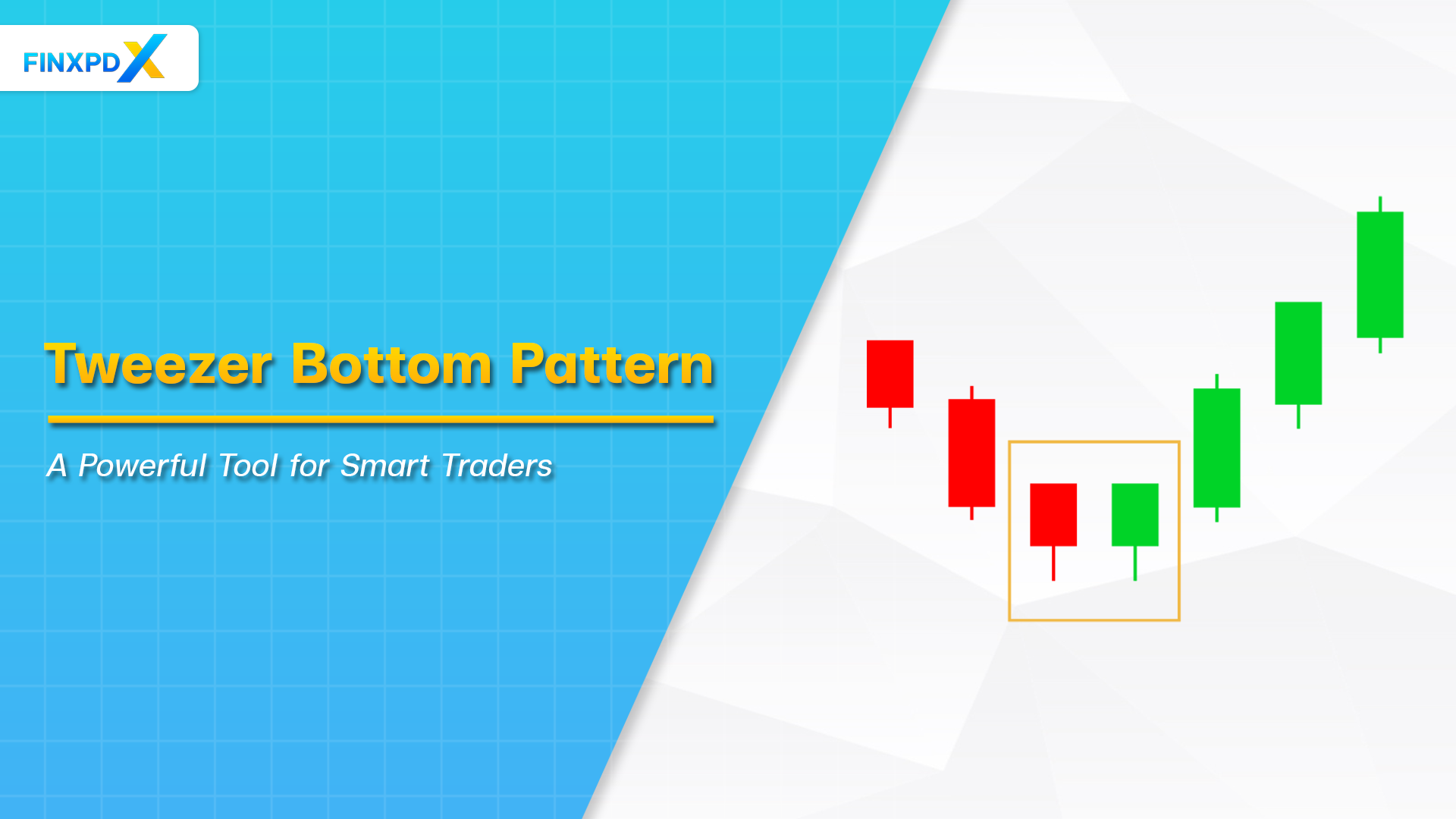

Candlestick patterns are essential in technical analysis because they enable traders to make well-informed decisions. The tweezer bottom pattern is one of these patterns that stands out as a significant reversal signal, indicating potential bullish reversals in the market.

This article will guide you through the structure of the tweezer bottom pattern, how to accurately identify it on a chart, the psychology that underpins it, and how it differs from its counterpart, the tweezer top pattern.

What Is Tweezer Bottom Pattern?

The tweezer bottom pattern is a bullish reversal candlestick pattern commonly found in technical analysis. It is named for its similar tweezers, consisting of two or more candlesticks with nearly the same lows that form the bottom of the tweezer shape. This pattern signals a level of support where buyers are stepping in to push prices higher.

Key Takeaways

- The tweezer bottom pattern is a bullish reversal candlestick pattern indicating a potential market trend change from bearish to bullish.

- The tweezer bottom pattern forms at the end of a downtrend, consisting of two or more candles with similar lows.

- The first candle of the tweezer bottom pattern is bearish, while the second candle is bullish, signaling potential buying pressure.

- The tweezer bottom candlestick pattern suggests that the selling pressure is weakening and buyers may be gaining control.

- The tweezer bottom candlestick pattern is commonly used in various markets, including forex, stocks, and commodities, for identifying potential buying opportunities.

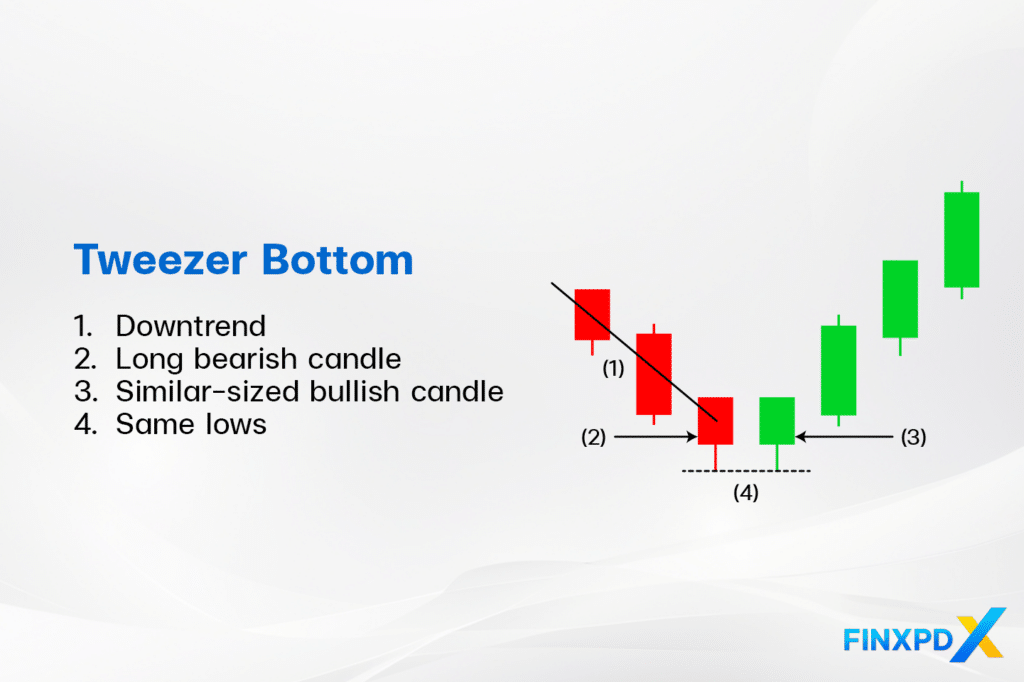

What Is the Structure of Tweezer Bottom Pattern?

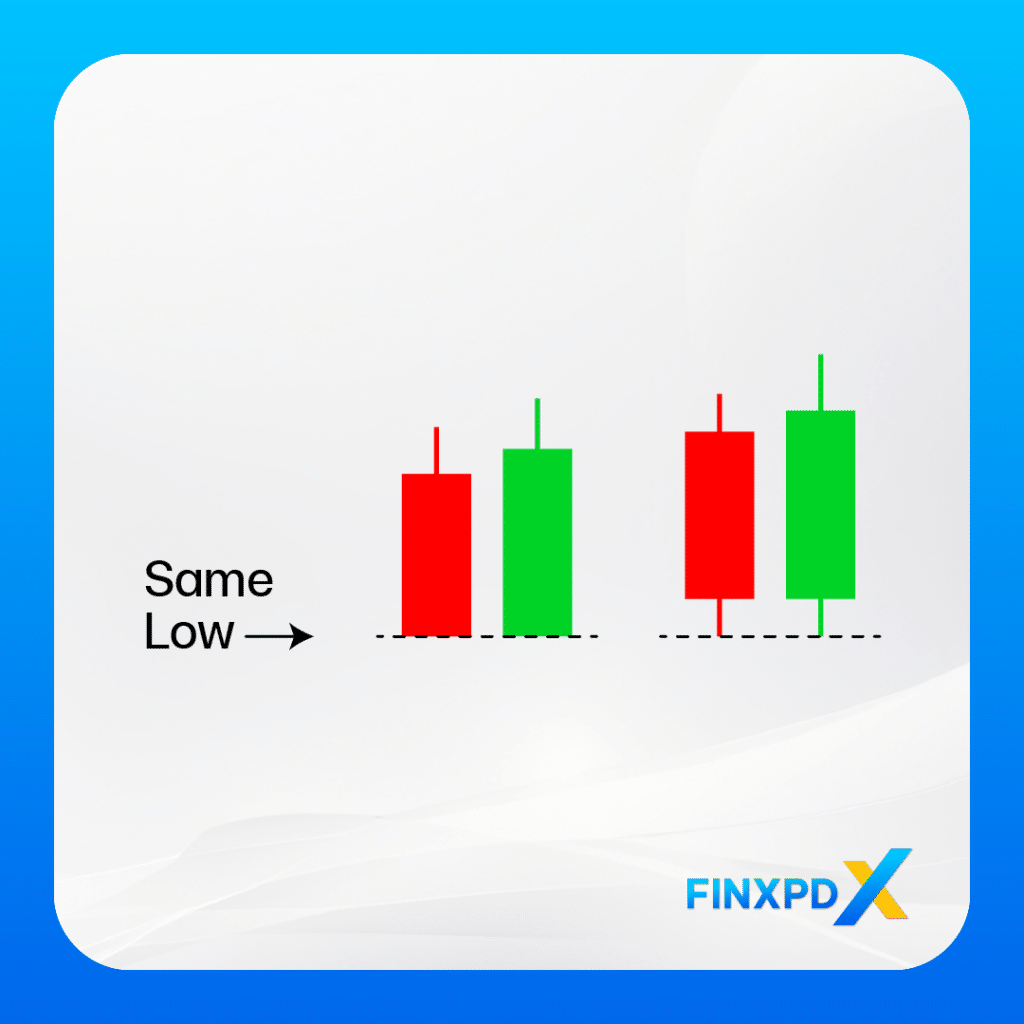

This pattern consists of two or more candlesticks with the following characteristics:

- Candlesticks Involved: Consists of at least two candlesticks.

- First Candlestick: Typically bearish with a long body.

- Second Candlestick: Typically bullish with a similar-sized body.

- Lows: Both candlesticks have almost the same low, creating a support level.

⚠️Tip: The support level is where the price stops falling and begins to rise again.

The tweezer bottom is one of many candlestick patterns. To explore more, you can download our e-book on candlestick patterns by clicking the button below.

Click the button below to download the PDF

How to Identify Tweezer Bottom Pattern on a Chart

Identifying the tweezer bottom candlestick pattern on a chart involves analyzing candlestick formations. Follow these key steps to recognize the pattern:

1. Look for a Downtrend: Ensure the market is in a downtrend, with lower highs and lower lows.

2. Identify Two Consecutive Candlesticks:

- First Candlestick: Bearish with a long body

- Second Candlestick: Bullish with a similar low to the previous candle

3. Check for Matching Lows: Ensure both candlesticks have nearly low points, indicating a strong support level.

4. Confirm With Volume: Increase volume on the second candlestick to strengthen the reversal signal.

5. Use Additional Indicators: Support the pattern with moving averages, RSI (below 30), or MACD bullish crossover.

How Tweezer Bottom Pattern Indicates Trend Reversals

The tweezer bottom pattern reflects a significant psychological shift in the market, indicating a potential reversal from a downtrend to an uptrend. Here’s an insight into the psychology behind this pattern:

1. Appearance at the End of a Downtrend

The pattern appears at the bottom of a downtrend. The first candlestick shows continued selling pressure, but the second candle’s inability to set a new low indicates that sellers are losing momentum.

2. Format of Matching Lows

The critical feature of the tweezer bottom is the nearly same lows of two consecutive candlesticks. This indicates that the price has reached a strong support level where it consistently stops falling, showing that buying interest is counteracting the selling pressure and preventing further price decline.

3. Intervention by Buyers

The second candlestick opens at or near the low of the first and closes higher, indicating that buyers are stepping in at the support level. This bullish candlestick shows that buyers are now strong enough to counter the selling pressure. Traders interpret this as a sign that the downtrend might be ending and that an upward movement is likely to follow.

4. Shift in Market Psychology

The failure to push prices lower after testing support suggests a shift in market sentiment from bearish to bullish. Traders interpret this as a sign that the downtrend might end and that an upward movement will likely follow.

Tweezer Bottom vs. Tweezer Top Pattern

The tweezer bottom and tweezer top patterns are candlestick formations used in technical analysis to signal potential trend reversals. While both indicate possible trend changes, they have distinct characteristics. The table below highlights the key differences and similarities between these two patterns.

| Feature | Tweezer Bottom Pattern | Tweezer Top Pattern |

|---|---|---|

| Characteristics |  |  |

| Trend Reversal Signal | Bullish reversal from a downtrend | Bearish reversal from an uptrend |

| Market Sentiment | Shift from bearish to bullish | Shift from bullish to bearish |

| Candlestick Formation | Two or more candlesticks with similar lows | Two or more candlesticks with similar highs |

| First Candlestick | Bearish | Bullish |

| Second Candlestick | Bullish | Bearish |

| Occurrence | Appears at the bottom of a downtrend | Appears at the top of an uptrend |

| Volume Consideration | Higher volume strengthens the signal | Higher volume strengthens the signal |

| Trading Strategy | Enter long positions | Enter short positions |

| Risk Management | Set stop-loss below support | Set stop-loss above resistance |

| Reliability | Need confirmation to avoid false signal | Need confirmation to avoid false signal |

Conclusion

In summary, the tweezer bottom pattern is a bullish reversal signal in technical analysis, marking a potential shift from bearish to bullish trends. It consists of two or more candlesticks with nearly identical lows and appears at the end of a downtrend. The first candlestick is bearish, followed by a bullish one, indicating buyer intervention and a shift in market sentiment. By understanding and utilizing these patterns, traders can better navigate market movements, identify key turning points, and optimize their trading strategies for improved outcomes.

FAQs

The tweezer bottom pattern is a bullish reversal candlestick pattern formed by two candles with similar lows at the end of a downtrend. It suggests that selling pressure is subsiding and buying interest is increasing, potentially reversing the price trend.

A tweezer bottom indicates that the market sentiment is shifting from bearish to bullish. It suggests that the selling pressure is weakening, and buyers are gaining control, potentially leading to an upward price movement.

The tweezer bottom pattern can be used in various financial markets, including stocks, forex, commodities, and cryptocurrencies. It applies to any market with a clear downtrend and candlestick charts.

Common entry strategies include buying after confirming the pattern with additional bullish signals. Exit strategies involve setting profit targets at key resistance levels and using stop-loss orders below the pattern’s low to manage risk.

Similar patterns to the tweezer bottom, which signals a bullish reversal, include the hammer, morning star, and bullish engulfing. The hammer has a small body and long lower wick, the morning star is a three-candlestick pattern indicating a reversal, and the bullish engulfing features a small bearish candle followed by a larger bullish candle.

Related Articles:

- Cashback Forex: Your Guide to Extra Earnings

- Hammer Candlestick: Make Reversal Opportunities

- Three White Soldiers Pattern: Key to Profitable Trading

- Morning Star Pattern: Unlock Your Bullish Trading Skills

Read more: Forex