In the world of trading, recognizing patterns is crucial for success. One interesting candlestick pattern is the three black crows. Specifically, this pattern is a key indicator of a bearish market. Additionally, featured among the 35 powerful candlestick patterns, this formation is essential for traders looking to navigate market downturns effectively. Spotting the three black crows can help traders see potential market declines early and turn them into opportunities.

In this article, we’ll explore the details of the three black crows pattern. Specifically, we will cover its formation and significance. Moreover, we will examine its advantages and limitations. Lastly, we will compare it to the three white soldiers pattern.

What Is Three Black Crows Pattern?

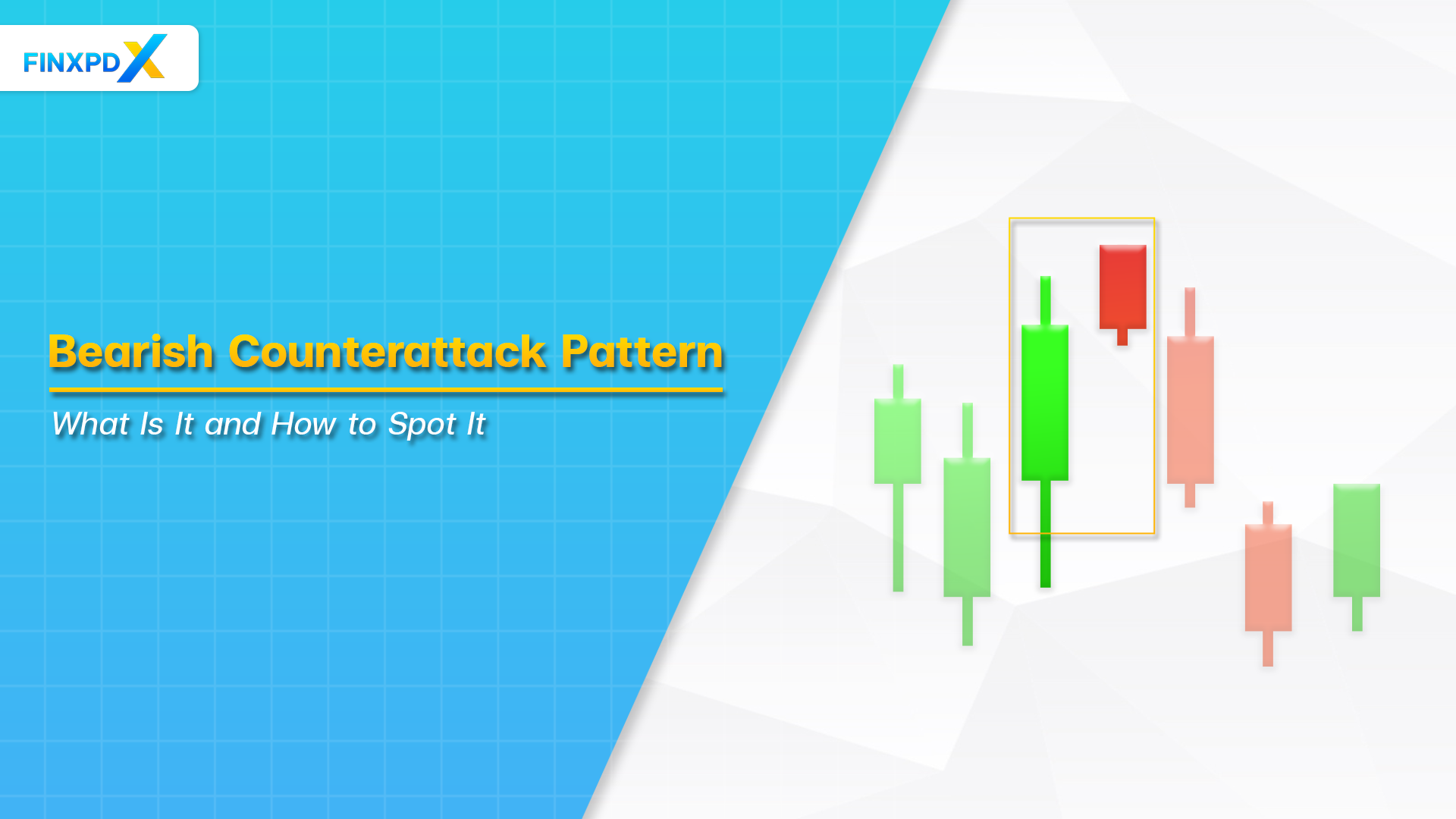

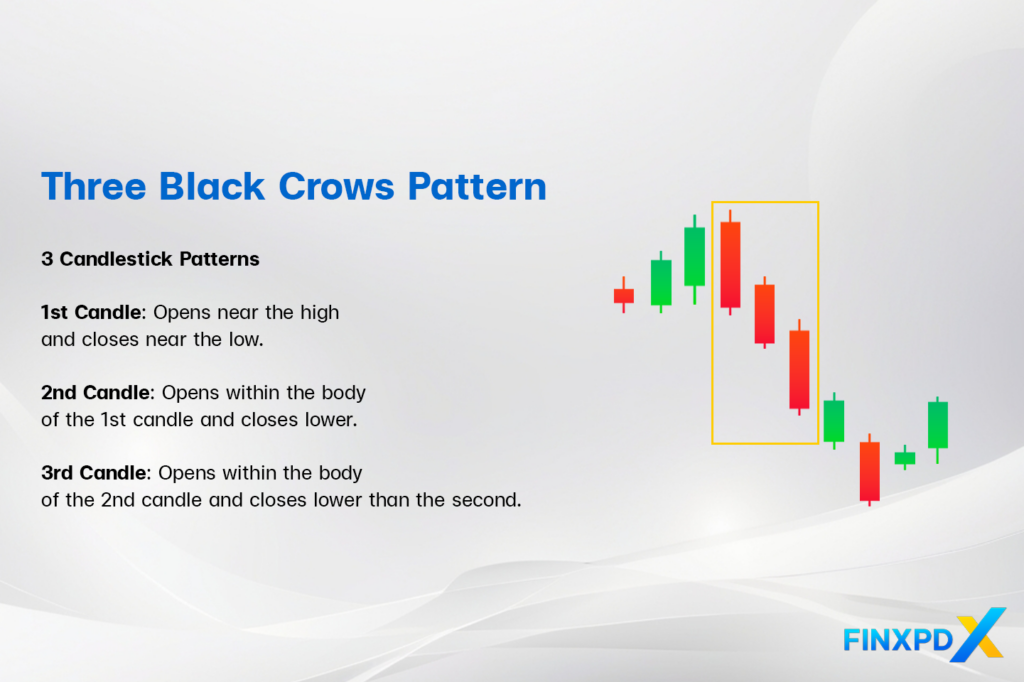

The three black crows pattern is a bearish candlestick pattern often seen in financial charts, specifically forex trading. This pattern consists of three consecutive long-bodied red (or black) candlesticks that open within the real body of the previous candle and close lower than the previous candle’s low. Moreover, this formation signals a strong reversal from a bullish to a bearish trend, indicating that the sellers have taken control of the market.

Key Takeaways

- The three black crows pattern is a bearish reversal pattern in technical analysis.

- Three black crows pattern signals a potential shift from an uptrend to a downtrend.

- Three black crows candlestick consists of three consecutive long-bodied red (or black) candlesticks opening within the previous candle’s real body.

- Each candlestick in the pattern closes progressively lower, indicating strong selling pressure.

- Three black crows and three white soldiers patterns indicate strong momentum, suggesting potential trend changes.

How to Identify the Three Black Crows Pattern

The three black crows pattern is a bearish reversal signal that can help traders identify potential downward trends in the market. Here’s how you can spot this pattern:

Three Consecutive Bearish Candlesticks: Three consecutive long candlesticks on the chart should each have a close that is near or at the period’s low.

Steady Decline: Each candlestick should open within the previous candlestick’s real body and close lower, indicating a steady decline in the stock’s price.

Minimal Shadows: The candlesticks should have short or no lower shadows, emphasizing that sellers maintained control throughout the trading periods.

Occurs After an Uptrend: This pattern typically appears after a significant uptrend, signaling that the bulls are losing control and a bearish reversal may be imminent.

Volume Confirmation: Volume should ideally increase during the formation of the three black crows. As a result, this increase confirms the strength of the bearish trend.

The Significances of the Three Black Crows Pattern in Trading

The three black crows pattern is a powerful tool in technical analysis. Here are the main reasons that make this pattern significant in trading:

Indicates Bearish Reversal

The primary significance of the three black crows pattern is its clear indication of a bearish reversal. Generally, this pattern appears after an uptrend and signals that the bullish momentum is waning. Consequently, it suggests a potential shift to a downtrend.

Confirm Selling Pressure

The formation of three consecutive bearish candlesticks effectively demonstrates sustained selling pressure. Additionally, each candlestick opening within the previous one’s body and closing near its low indicates that sellers are in control. Thus, this reinforces the bearish sentiment.

Predicts Market Sentiment

The pattern helps traders gauge market sentiment. A three black crows pattern indicates that traders are becoming increasingly negative about the asset’s future performance. As a result, this negativity can lead to more selling and subsequent price declines.

Triggers Sell Signals

For traders and investors, the appearance of a three black crows pattern can serve as a sell signal. Specifically, it suggests that it might be a good time to exit long positions. Alternatively, they might consider shorting the asset to capitalize on the anticipated downtrend.

Confirm Volume Increase

The three black crows pattern becomes more significant when it is accompanied by high trading volumes. Indeed, high volume during pattern formation explicitly confirms the strength of the bearish trend. Furthermore, it increases the possibility of continued downward movement.

Advantages and Limitations of the Three Black Crows Pattern

Advantages

- Clear Bearish Reversal Signal: Identifies a bearish reversal after an uptrend.

- Increased Confidence: Supports the trend change with three consecutive bearish candlesticks.

- Enhanced Trading Strategies: Becomes effective when combined with other technical indicators.

Market Sentiment Indicator: Indicates growing negativity and seller control.

Limitations

- False Signals: Can produce false signals in volatile markets.

- Context Requirement: Needs other indicators for accurate interpretation of market conditions.

- Delayed Entry: Can delay entry points in waiting for three candlesticks.

- Short-Term Focus: May not reflect long-term trends, limiting its use for long-term traders.

Three Black Crows vs. Three White Soldiers Pattern

Knowing the three black crows and three white soldiers patterns can boost a trader’s ability to spot potential market reversals. Although both patterns are key in technical analysis, they represent opposite market sentiments.

| Feature | Three Black Crows | Three White Soldiers |

|---|---|---|

| Characteristics |  |  |

| Trend Indicated | Bearish Reversal | Bullish Reversal |

| Opening Prices | Within the previous candle’s body | Within the previous candle’s body |

| Closing Prices | Lower with each subsequent candle | Higher with each subsequent candle |

| Market Sentiment | Increasing selling pressure | Higher with each subsequent candle |

| Typical Context | After an uptrend, near resistance levels | After a downtrend, near support levels |

Conclusion

In summary, the three black crows pattern, consisting of three consecutive long-bodied red (or black) bearish candlesticks, signals a shift from bullish to bearish sentiment in trading. Additionally, it enhances confidence in trend changes and trading strategies when used with other indicators. However, it can produce false signals and requires contextual confirmation. Moreover, it may delay entry points and is more suited for short-term trends. Understanding this pattern helps traders anticipate market reversals and make informed decisions. Would you like to learn more about using the other powerful candlestick patterns in your trading strategy? Explore our website to enhance your potential benefits.

Click the button below to download PDF

FAQs

The three black crows pattern is a bearish candlestick pattern that indicates a potential reversal from an uptrend to a downtrend. It consists of three consecutive long-bodied bearish candles, each closing lower than the previous, with little to no wicks.

The three black crows pattern is generally considered reliable, especially when confirmed with other technical indicators or volume analysis. However, it should not be used in isolation and is more effective when combined with other analysis methods.

Traders should confirm the pattern with additional technical indicators or volume analysis. If confirmed, they may then consider entering short positions. Alternatively, they might consider exiting long positions to take advantage of the anticipated downtrend.

The three black crows pattern is most effective on daily or weekly charts. Moreover, longer time frames provide more reliable signals. This occurs because each candlestick represents more significant market data and sentiment.

The opposite of the three black crows pattern is the three white soldiers pattern. Notably, this bullish reversal pattern consists of three consecutive long-bodied bullish candles. Therefore, it indicates a potential reversal from a downtrend to an uptrend.

Related Articles:

- Piercing Pattern: An Interesting Analysis Skills

- Bullish Engulfing Candle: Powerful Trade Signal

- Three White Soldiers Pattern: Key to Profitable Trading

- Dark Cloud Cover Pattern: Hidden Warnings From the Market

Read more: Forex