For traders, the shareholder’s fund is a valuable metric that offers insights into a company’s financial structure and market standing. This figure, also known as shareholder’s equity, is calculated by deducting total liabilities from the company’s assets. This metric reveals the net value owned by shareholders. It is a key indicator of a company’s ability to generate value and sustain financial stability, directly impacting stock price movements and trading decisions.

This article will explain the components and significance of the shareholder’s fund, enhancing traders’ ability to effectively assess potential risks and investment opportunities.

What Is a Shareholder’s Fund?

The shareholder’s fund, also known as shareholder’s equity or owner’s equity, is a key financial metric that represents the residual interest in a company’s net assets after accounting for all liabilities. It measures the company’s net worth, reflecting what shareholders would receive if the company liquidated all assets and settled all debts. This fund is a fundamental component of a company’s balance sheet, calculated by subtracting total liabilities from total assets. The components of this fund typically include:

- Paid-in Capital: The total capital shareholders have invested directly in the company.

- Retained Earnings: Profits that have been reinvested in the business rather than distributed as dividends.

- Treasury Shares: Shares that the company has bought back but not permanently retired.

For traders, the size and trend of the shareholder’s fund indicate a company’s potential for growth and profitability and its ability to raise additional capital, distribute dividends, and withstand economic downturns. Observing changes in this fund, or its net worth, over time can offer critical insights into the company’s financial strategies and operational efficacy, which can influence trading decisions.

Key Takeaways

- The shareholder’s fund, or equity, represents the net assets shareholders own after all liabilities are deducted from total assets.

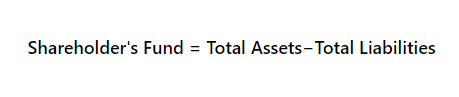

- Shareholder’s fund is calculated by using this formula:

Shareholder’s Fund = Total Assets − Total Liabilities. - The shareholder’s fund changes with earnings accumulation, capital transactions, dividend payments, and asset revaluations, influencing a company’s financial health.

- 2 types of shareholder’s funds are positive and negative types. They impact financial health, investor confidence, debt repayment, dividend distribution, growth potential, and creditworthiness differently.

- The size and trend of the shareholder’s fund are key indicators for investors, affecting decisions regarding company stability, growth potential, and risk assessment.

How Shareholder’s Fund Works

The shareholder’s fund operates as a core financial metric that reflects the cumulative net outcomes of a company’s operations and financial activities over its lifetime. The formula for this is:

This calculation offers an overview of the company’s net worth at any given point, summarizing the economic resources that shareholders would theoretically own outright without any debts. These factors influence the fluctuations in numbers and affect the financial stability of a company:

- Earnings Accumulation

A company’s profits, not including the debt, are added to retained earnings each financial period. This accumulation reflects the company’s ability to generate and retain profit for future growth, stability, and shareholder returns.

- Capital Transactions

Share transactions affect shareholders’ funds. For instance, when a company issues new shares or paid-in capital, a shareholder’s equity segment increases. Conversely, when shares are repurchased and held as treasury shares, the overall shareholder’s fund may decrease unless offset by other equity increases.

- Dividend Payments

Dividend distributions reduce the retained earnings within the fund. However, regular dividends can signal financial strength and reliability, attracting more investment.

- Revaluation Reserves

Changes in the value of certain assets, like real estate or securities, can affect the revaluation reserves component of shareholder’s equity. Increases in asset values typically strengthen this type of fund, reflecting enhanced net worth and financial stability.

2 Types of Shareholder’s Fund

Shareholder funds can manifest in 2 distinct types, which are positive and negative. Each type has a significant impact on a company’s operations and its perception in the market. The following table outlines these effects, comparing the characteristics of positive and negative types and how they influence various aspects of a company’s financial health and strategic potential.

| Characteristic | Positive Shareholder’s Funds | Negative Shareholder’s Funds |

|---|---|---|

| Signaling Financial Health | Indicates a financially healthy company | Indicates potential financial difficulty |

| Boosting Investor Confidence | Suggests a company with strong financial performance, attracting investors | May deter investors due to concerns about solvency |

| Facilitating Debt Repayment | Enhances the likelihood of meeting debt obligations | Complicates the ability to repay debt, potentially leading to defaults |

| Enabling Dividend Distribution | Allows for greater distribution of dividends to shareholders | Limits or prevents dividend distribution |

| Supporting Growth Potential | Provides resources for future investments and growth initiatives | Restricts opportunities for investment and growth |

| Enhancing Creditworthiness | Improves the ability to secure loans and favorable borrowing terms | Hinders securing loans or results in higher interest rates due to weaker financial standing |

5 Common Misconceptions About Shareholder’s Fund

Misunderstandings about the shareholder’s fund are widespread, often leading to skewed perceptions of a company’s financial health. This section will discuss 5 general misconceptions clarifying how to calculated shareholder’s fund, its implications, and its role in investment analysis.

1. Liquid Cash Equivalence

A common misconception is that this fund directly reflects the cash available to a company. However, shareholder’s equity includes assets that are not readily convertible to cash, such as property and equipment.

2. Relying on One Indicator of Financial Stability

Shareholder’s fund is not a standalone metric for stability. Companies must also manage debt, cash flow, and operational efficiency to ensure overall financial health.

3. Static Nature Over Time

Some believe that once established, the shareholder’s fund remains static. In reality, this value is dynamic, influenced by profits, losses, dividend payments, and other financial activities.

4. Origin from Initial Investments

Another common misconception that this fund only comprises the initial capital paid by shareholders. It also includes retained earnings, reserves, and adjustments from asset revaluations.

5. Automatic Benefit of Higher Values

A higher shareholder’s fund is generally positive but doesn’t always indicate a better investment. Factors such as the source of equity (e.g., extensive share issuances) and the company’s strategic use of retained earnings also matter significantly.

Shareholder’s Fund and Investor Decision Making

The shareholder’s fund is crucial for investors assessing a company’s financial health and investment potential. A robust fund indicates financial stability and suggests a company’s capacity for growth and dividend distribution, important factors for investors seeking reliable returns.

It also influences perceptions of creditworthiness, impacting a company’s ability to secure favorable loans for future projects. Conversely, a weak or declining fund raises concerns about financial risk, guiding investors to consider the safety and profitability of their investments carefully. This holistic view helps investors make informed decisions, balancing potential gains against financial vulnerabilities.

⚠️Tip: Consider how the size and condition of the shareholder’s fund influence potential investments. A robust fund can indicate growth potential but requires context from the market and sector performance.

Conclusion

Understanding the shareholder’s fund is necessary for anyone involved in the financial markets, whether traders, investors, or financial analysts. This financial metric overviews a company’s financial health and provides deep insights into its operational capabilities and prospects. By comprehending how to calculate this fund and the factors influencing its fluctuations, stakeholders can make more informed decisions that align with their financial strategies and risk appetites.

As we have explored, the implications of the shareholder’s fund extend far beyond simple financial metrics, affecting investment decisions, company valuations, and business strategic direction. Embracing a clear and comprehensive understanding of this concept will undoubtedly equip investors with the tools needed to navigate the complex landscapes of corporate finance and equity markets.

FAQs

A shareholder’s fund, or shareholder’s equity, is the amount of a company’s assets remaining if all liabilities were settled. It represents the shareholders’ net value and is a crucial indicator of a company’s financial health.

The shareholder’s fund is calculated by subtracting total liabilities from total assets.

Shareholder’s equity typically includes paid-in capital, retained earnings, and treasury shares. It may also include revaluation reserves and other equity instruments.

Yes, it can affect a company’s share price. A substantial shareholder’s fund often signals financial stability and potential for growth, which can positively influence investor confidence and boost share prices. Conversely, a weak fund might lower share prices due to perceived financial risks.

Shareholders can increase the value of their funds through actions that enhance the company’s profitability and asset base, such as reinvesting profits, improving operational efficiency, and making strategic investments. Reducing liabilities and prudent financial management also contribute to increasing shareholders equity.

Related Articles:

- Alternative Investment Funds: Time to Diversify Portfolio

- Short-Term Loans: A Practical Approach for Fast Cash

- Children Mutual Funds: Little Investors, Big Futures

- Loans Against Mutual Funds: Learn How to Leverage It

Read more: Fund & Loans