Understanding the financial markets is essential for anyone looking to invest wisely. One of the key concepts is the difference between the primary and secondary markets. The primary market involves issuing and selling new securities directly by issuers, often through initial public offerings (IPOs). In contrast, the secondary market is where existing securities are traded among investors without the involvement of the issuing companies.

This article will highlight the key differences between these markets, focusing on their functions, processes, and significance. By understanding these distinctions, you will be able to make smart investment decisions and manage the financial world with confidence.

What Is Primary Market?

Companies frequently enter the primary market to raise capital for long-term business operations and projects by issuing shares to the public for the first time. It is also called the “new issue market” for this reason. The primary market is a capital market segment that allows buyers to purchase securities directly from the issuer, ensuring that the proceeds go directly to the issuing company.

Key Features of the Primary Market

Initial Public Offerings (IPOs): The most well-known activity in the primary market is the initial public offering. An IPO occurs when a company sells its shares to the public for the first time, allowing it to raise capital from a broad base of investors.

Direct Issuance: In the primary market, securities are issued directly by the issuer to investors. This means that the entity creating the security (such as a company or government) receives the funds directly from the sale.

Raising Capital: The primary market is important in helping organizations raise funds for various purposes, such as expanding operations, funding new projects, or paying off debt.

Types of Securities: The primary market also deals with other securities, like bonds and stocks, which governments or corporations issue to secure long-term funding.

Key Takeaways

- Primary markets involve the issuance of new securities directly from companies or governments to investors.

- Secondary markets are designed to make it easier for investors to trade existing securities among other investors.

- Prices in the primary market are fixed during issuance, while prices in the secondary market fluctuate based on supply and demand.

- The primary market operates through public offerings or private placements, while the secondary market functions on stock exchanges or over-the-counter (OTC) platforms.

- The efficiency of the secondary market supports the primary market by reassuring investors they can resell securities and recover their investments.

⚠️Tip: Stock exchanges represent as secondary markets, where investors buy and sell between traders.

How the Primary Market Works

Preparation and Planning

The issuance process begins when the issuer raises funds by issuing new securities, such as stocks or bonds. The issuer must comply with regulatory requirements, typically preparing a prospectus that provides detailed information about the issuer and the securities being offered.

Underwriting

Investment banks act as underwriters. They assist the issuer by valuing the securities, determining the offering price, and managing distribution. Underwriting agreements can be firm commitments (underwriters buy all securities) or best efforts (underwriters sell as many as possible).

Pricing and Marketing

The price of new securities is set based on factors like market conditions, investor demand, and the issuer’s financial health. Securities are marketed to potential investors through roadshows, advertisements, and meetings to generate interest and influence final pricing.

Issuance and Sale

In a public offering, securities are made available to the general public through initial public offerings (IPOs) or public bond issues. Alternatively, securities can be sold through unlisted shares or via rights issues, allowing existing shareholders to purchase additional shares at a discounted price.

Capital Inflow

Once the securities are sold, the issuer receives the funds from investors. This capital can be used for various purposes, such as expanding operations, funding new projects, or paying off existing debt.

What Is Secondary Market?

The secondary market allows investors to buy and sell already existing securities. Unlike the primary market, where new securities are issued directly by companies or governments, the secondary market deals with trading existing securities. The secondary market is crucial for the health and efficiency of the financial system, providing a platform for easy trading, fair price discovery, and effective capital allocation. It offers unrestricted trading and quick processes, enhancing liquidity in the primary market. This reassurance enables investors to resell securities and recover their investments quickly, contributing to market stability.

Key Features of the Secondary Market

Trading of Existing Securities: The primary function of the secondary market is to facilitate the buying and selling of securities that have already been issued in the primary market. This includes stocks, bonds, and other financial instruments.

Stock Exchanges and Over-the-Counter (OTC) Markets: Secondary market transactions can occur on formal exchanges, like the New York Stock Exchange (NYSE) or the Nasdaq, or in over-the-counter (OTC) markets, where trading is done directly between parties without a centralized exchange.

Liquidity Provision: One of the secondary market’s main advantages is that it provides liquidity, allowing investors to quickly convert their securities into cash or buy more securities without significantly affecting their prices.

Price Discovery: The secondary market plays a critical role in determining the market price of securities through supply and demand dynamics. Prices fluctuate based on various factors, including company performance, economic conditions, and investor sentiment.

How the Secondary Market Works

Trading Platforms

Securities in the secondary market are traded on exchanges, like the NYSE and Nasdaq, where transactions occur in a regulated environment. Alternatively, in over-the-counter (OTC) markets, securities are traded directly between parties through a network of dealers.

Participants

Participants in the secondary market include investors, brokers, and market makers. Investors buy and sell based on strategies, brokers execute trades for commissions, and market makers ensure liquidity by being ready to buy and sell at quoted prices.

Transaction Process

Investors place orders through brokers, which are matched on exchanges by price and time priority. Once matched, trades are executed, transferring ownership from seller to buyer. The settlement, typically within a few days, finalizes the transfer of securities and payment.

Regulation and Oversight

Financial authorities, like the SEC in the U.S. and SEBI in India, regulate secondary markets to ensure fair trading. Participants must adhere to regulations aimed at preventing fraud, maintaining market integrity, protecting investors, and ensuring smooth market operations.

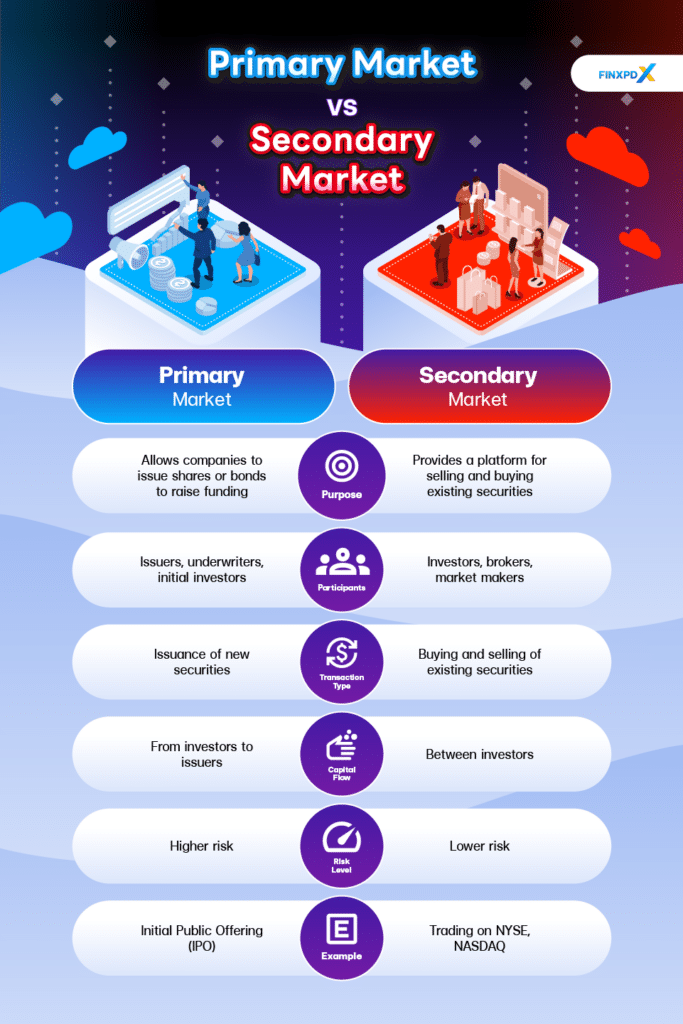

Differences Between Primary Market and Secondary Market

Here is a table summarizing the key differences between the primary market and the secondary market:

| Aspect | Primary Market | Secondary Market |

|---|---|---|

| Definition | Market for new securities | Market for trading existing securities |

| Purpose | Allows companies to issue shares or bonds to raise funding. | Provides a platform for selling and buying existing securities. |

| Participants | Issuers, underwriters, initial investors | Investors, brokers, market makers |

| Transaction Type | Issuance of new securities | Buying and selling of existing securities |

| Intermediaries | Underwriters, investment banks | Brokers, dealers, market makers |

| Price Determination | Set by issuer and underwriters | Determined by supply and demand |

| Risk Level | Higher risk for investors | Generally lower risk compared to the primary market |

| Frequency of Trading | Infrequent, usually at issuance events | Continuous trading |

| Capital Flow | From investors to issuers | Between investors |

| Example | Initial Public Offering (IPO) | Trading on NYSE, Nasdaq |

Conclusion

To sum up, understanding the differences between the primary and secondary markets is important for investors. The primary market allows companies and governments to issue new securities to raise funds. On the other hand, the secondary market offers a platform for trading existing securities and providing liquidity through market dynamics. Knowledge of these markets helps investors make informed decisions, manage their investment portfolios effectively, and capitalize on opportunities in both markets.

FAQs

The primary market impacts the secondary market by introducing new securities, which can influence market sentiment and liquidity. Successful IPOs can boost investor confidence and activity in the secondary market.

Economic news, such as changes in interest rates, employment reports, or GDP growth, can impact investor sentiment, leading to price fluctuations and changes in trading volume.

Yes, investors can participate in both markets. They can buy new issues in the primary market and trade existing securities in the secondary market.

Investment banks underwrite new securities, helping to set their prices and selling them to investors. They play a crucial role in facilitating the initial sale of securities.

The secondary market provides liquidity, allowing investors to buy and sell securities easily. This enables investors to convert their investments into cash quickly.

Related Articles:

- Averaging in the Stock Market: Long-Term Value

- AMO Order: Time Value in After-Hours Trading in India

- Valuation of Shares: How Does It Important to Investor?

- Operators in the Stock Market: How They Influence Prices

Read more: Stocks