The mat hold candlestick pattern is a significant tool in technical analysis, particularly for traders aiming to leverage ongoing market trends. This pattern is known for its role as a continuation signal, typically emerging during strong market movements to suggest that the current trend is likely to persist. By mastering the identification and interpretation of this pattern, traders can improve their decision-making process, especially in the dynamic environment of forex trading.

This article will explore the structure, importance, and practical application of the mat hold candlestick pattern, equipping traders with the insights to integrate it effectively into their trading strategies.

What Is a Mat Hold Candlestick Pattern?

The mat hold candlestick pattern is a distinct formation in technical analysis, recognized for its role in indicating market behavior during strong trends. The name “mat hold” is derived from the idea of a temporary “hold” or pause in the market before it resumes its original direction. The term “mat” symbolizes a surface that temporarily supports or holds something in place, reflecting the market’s brief consolidation or pullback phase before continuing its previous trend.

This pattern has two versions which are the bullish version and the bearish version. The bullish version, which is more commonly recognized, occurs during an uptrend and signals the continuation of that upward movement. Conversely, the bearish version can appear during a downtrend, indicating a brief pause before the downtrend resumes. Both versions are part of a broader category of advanced candlestick patterns that traders use to gauge market momentum and make informed trading decisions.

Key Takeaways

- The mat hold candlestick pattern is a continuation pattern in technical analysis. It is named for its characteristic pause in market activity before the trend resumes.

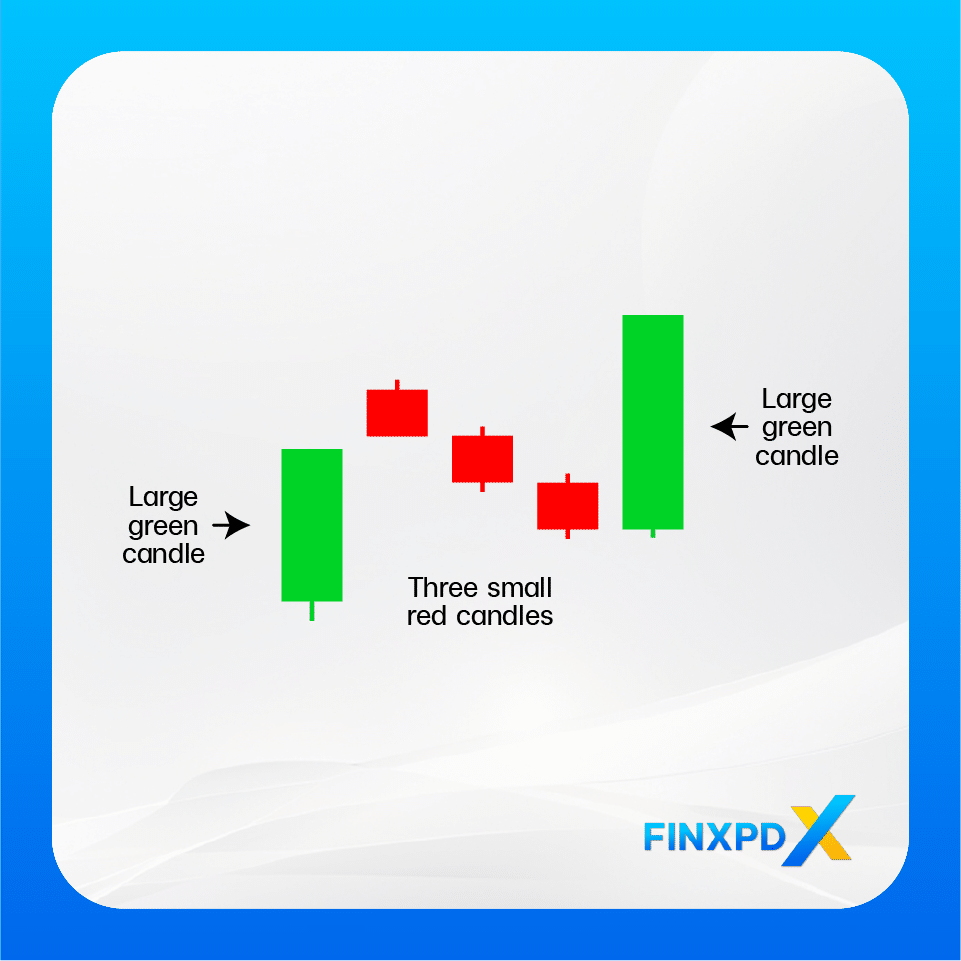

- The structure of the mat hold pattern consists of five candlesticks, beginning with a strong bullish candle, followed by three smaller candles that consolidate the movement, and ending with another bullish candle that reaffirms the trend.

- The mat hold candlestick pattern typically occurs during strong upward trends or downward trends, where a brief consolidation happens.

- The signal from the mat hold candlestick pattern suggests that the existing trend is likely to continue. Traders should consider entering or adjusting their positions based on the direction of the trend indicated by the pattern.

- The mat hold candlestick pattern is relatively rare, making it challenging to spot during trading sessions.

The Structure of Mat Hold Candlestick Pattern

The structure of the mat hold candlestick pattern varies slightly depending on whether it is the bullish or bearish version. Here’s how the structure unfolds for both versions:

Bullish Version

First Candlestick

The pattern starts with a large bullish candlestick, representing a strong upward market movement. This candlestick establishes the initial momentum of the trend.

Second to Fourth Candlesticks

The next three candlesticks are smaller and may show a slight retracement or consolidation. These candles do not surpass the first candle’s low. This phase reflects a temporary pause in the upward trend, where the market consolidates its gains.

Fifth Candlestick

The pattern concludes with another strong bullish candlestick, often larger or as large as the first one. This candle confirms the continuation of the uptrend, signaling that the market has gathered enough momentum to push higher.

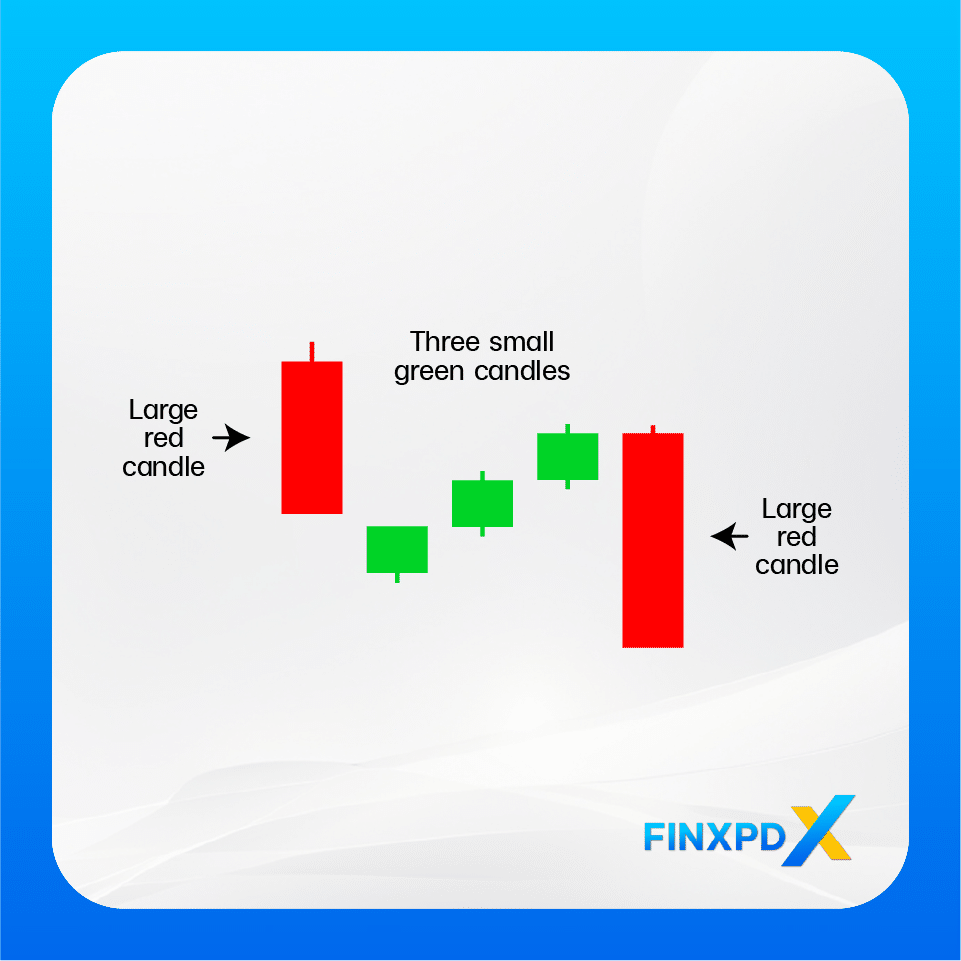

Bearish Version

First Candlestick

The pattern begins with a large bearish candlestick, indicating a strong downward market movement. This initial candle establishes the downward momentum of the trend.

Second to Fourth Candlesticks

The next three candles are smaller and may show a slight upward retracement or consolidation. These candles do not surpass the first candle’s high. This phase represents a brief pause in the downtrend, where the market experiences a temporary upward correction.

Fifth Candlestick

The pattern concludes with another strong bearish candlestick, often as large or larger than the first one. This final candle confirms the continuation of the downtrend, signaling that the market has regained enough bearish momentum to push lower.

When Does the Mat Hold Candlestick Pattern Happen?

The mat hold candlestick pattern occurs during strong market trends and can manifest in both bullish and bearish forms. Here’s when you might see each version of this pattern:

Bullish Scenario

A bullish scenario occurs when an uptrend is shortly interrupted by a consolidation phase. This consolidation is marked by three smaller candlesticks showing minor retracement but not reversing the trend. Following this pause, a final strong bullish candle confirms the continuation of the uptrend.

Bearish Scenario

Conversely, in a bearish scenario, the pattern forms during a downtrend that experiences a brief upward correction. Three smaller bullish candles within the downtrend identify the pattern, which signals a temporary break. The pattern concludes with a strong bearish candle, indicating that the downtrend will continue.

The Signal From Mat Hold Candlestick Pattern

The mat hold candlestick patterns, in both their bullish and bearish forms, provide a clear and powerful signal of a continued market trend. Whether the market is in an uptrend or a downtrend, the appearance of this pattern suggests that the current trend is likely to persist after a brief period of consolidation.

In a bullish scenario, the pattern indicates that the upward momentum remains strong, even after a temporary pause. On the other hand, in a bearish context, the mat hold pattern signals that the downtrend is likely to continue following a short-lived upward correction. This reinforces the bearish sentiment in the market.

The Drawback of the Mat Hold Pattern

The mat hold pattern has several drawbacks that traders should consider:

Rarity

This relatively rare pattern makes it difficult to spot during trading sessions. Its rare appearance can limit its usefulness as a reliable tool for traders.

Unpredictable Price Movement

Even when the pattern does appear, the price action that follows is not always as expected. This unpredictability can lead to inconsistent results and complicate trading decisions.

No Defined Profit Target

The mat hold candlestick pattern does not provide a clear indication of how far the price might move once the trend continues. Traders need to rely on additional methods, such as trend analysis or technical indicators, to determine the best exit points.

The Need for Additional Analysis

Due to its limitations, the mat hold pattern is best used alongside other forms of analysis. Relying solely on this pattern can be risky because it may not always give reliable signals, making it crucial to combine it with other strategies to improve accuracy and effectiveness.

For more insights on various candlestick patterns, you can download our comprehensive guide, “35 Powerful Candlestick Patterns PDF Download“, which covers this and other important patterns in detail.

Click the button below to download the PDF

Conclusion

The mat hold candlestick pattern is a valuable continuation signal in technical analysis, helping traders identify whether a bullish or bearish trend is likely to persist. Recognizing its structure and the conditions under which it forms allows traders to make more informed decisions. The bullish version suggests that an uptrend will continue, while the bearish version indicates that a downtrend is expected to continue.

However, the pattern has its limitations. Its rarity, unpredictable price movements, and lack of a defined profit target mean it should be used alongside other analytical tools. By combining the mat hold pattern with additional technical indicators and trend analysis, traders can improve their strategies and make more accurate trading decisions.

FAQs

The mat hold candlestick pattern is a continuation pattern in technical analysis. It suggests that the current trend, whether upward or downward, is likely to continue after a brief period of consolidation.

Traders can identify the mat hold pattern by looking for five candlesticks, including a strong initial trend candle, followed by three smaller candles that show a brief consolidation, and concluding with another strong trend candle in the same direction as the first.

The mat hold pattern signifies that the market is expected to continue in the direction of the initial strong trend after a short consolidation phase. It helps traders anticipate the continuation of the existing trend.

The mat hold pattern can be reliable, but it has limitations. It is rare and may lead to unpredictable results. This indicator should be used with other technical analysis tools for better reliability.

Traders should consider entering or adjusting their positions based on the direction indicated by the mat hold pattern. For a bullish pattern, this might mean entering or increasing long positions. For a bearish pattern, it might mean entering or increasing short positions.

Related Articles:

- 10 Best Trading Books in India You Must Read

- Leverage Trading: Best Tool to Maximizing Profit

- Margin Trading: The Way to Amplifies Your Buying

- Spot Market: Real-Time Trading Simplified

Read more: Forex