In the world of card security, the CVV number plays a crucial role. You might be wondering what CVV number is and where it is on your card. This article will reveal the mystery surrounding the CVV number and provide insights into how it works, ensuring your financial transactions remain secure.

What Is the CVV Number on a Credit Card?

The CVV number on your credit card is an extra security measure to prevent fraud. CVV stands for “Card Verification Value.” In the digital age, this number has become a crucial line of defense against fraudulent activities on your credit or debit card. When you shop online or make a phone purchase, entering the CVV ensures the seller that you’re a legitimate cardholder.

A CVV number is also known by the following terms:

- CSC: Card Security Code (Debit Card)

- CVV2: Card Verification Value 2 (Visa)

- CVC2: Card Validation Code (Mastercard)

- CID: Card Identification Number (Discover)

Types of CVV Numbers

- CVV1: Embedded in the card’s magnetic stripe, used for in-person transactions.

- CVV2: Printed on the card, used for online and phone transactions.

Key Takeaways

- CVV stands for Card Verification Value.

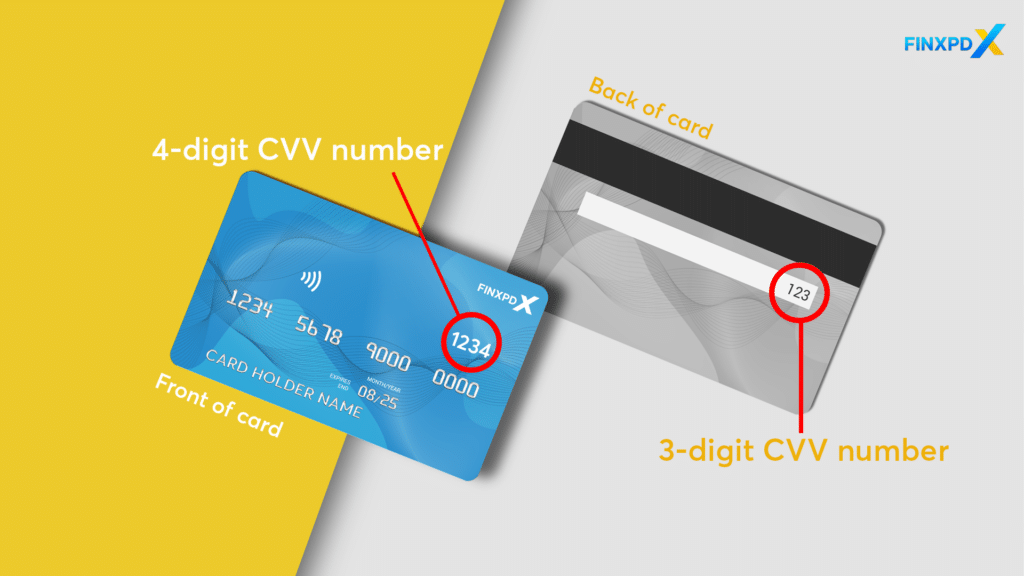

- A CVV number is a 3 or 4-digit security code on your credit or debit card.

- A CVV number is a security feature for credit and debit card transactions.

- A CVV number helps protect against fraud by verifying the card’s authenticity during online and phone purchases.

- A CVV number is used in conjunction with the card number and expiration date for additional security.

Where to Find CVV Number on a Credit Card

For Visa, Mastercard, and Discover cards, you’ll find a three-digit CVV on the back, right next to the signature strip. This number might be adjacent to your full card number or just the last four digits.

If you’re an American Express cardholder, your CVV—referred to as a Card Identification Number (CID)—is on the front of the card. Unlike the others, American Express uses a four-digit CID. So, depending on your card type, the location and length of your CVV or CID will vary.

Why Is a CVV Number Important?

Here is the main importance of CCV number:

- Enhances Security: Confirms the cardholder has the physical card, which reduces fraud.

- Prevents Unauthorized Use: Ensures stolen card details can’t be used without the CVV.

- Not Stored in Databases: Protects card information as CVV numbers aren’t saved in merchant databases.

- Essential for Remote Transactions: Verifies the buyer has the card for online and phone purchases.

- Protects Against Fraud: Identifies and prevents fraudulent activities.

⚠️Tip: The CVV is used to verify the card during remote purchases, whereas the PIN verifies the cardholder’s identity during physical transactions.

How to Protect Your CVV Number

1. Avoid Untrustworthy Websites

Never respond to any emails, advertisements, or websites that you do not immediately recognize as real. This includes not clicking on questionable URLs and not inputting your credit card’s account number, expiration date, or CVV number.

2. Check for a Security Tag

Look for a security tag to the left of the web address of any site where you are making an online purchase. Only secure sites use these tags, so you can be confident that your credit card information is secure in these transactions.

3. Review Card Features First

It is critical to do your homework and choose the best credit card for you. When reviewing a card’s features, you should pay close attention to its security features.

⚠️Tip: Don’t share your debit card number and CVV via email or text.

Conclusion

While online transactions inherently come with some risks, credit card companies have implemented features like CVV numbers to enhance security. However, the responsibility is also on you to be careful. By limiting your online transactions to trustworthy websites and safeguarding your credit card number with CVV, you can further protect your personal financial information.

FAQs

A CVV number is a card verification value, a 3 or 4-digit code found on your credit or debit card. It’s an additional security feature used in online and phone transactions.

Yes, your CVV number is confidential. It’s an extra layer of security, so you should never share it freely.

Providing your CVV number is generally safe when dealing with reputable merchants. However, be cautious and only enter it on secure, trusted websites.

It’s usually safe to give your CVV number over the phone if you initiated the call and you’re speaking to a reputable organization. However, never give it out if you’ve received an unsolicited call.

Some merchants may process transactions without a CVV, but it is generally required for added security, especially for online purchases.

Read more: Credit cards