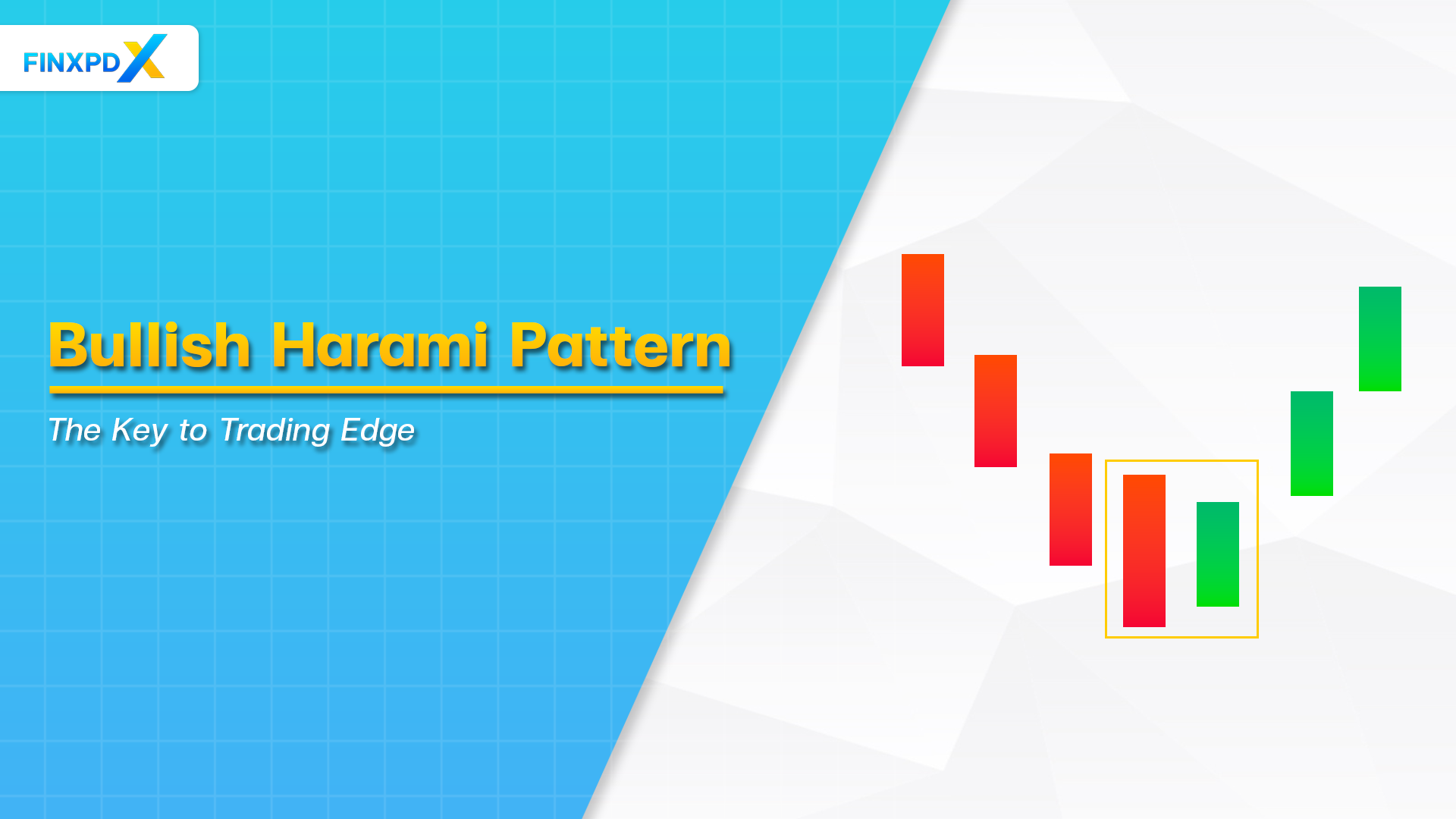

The world of trading is filled with various patterns and indicators that help traders make informed decisions. One such pattern is the Bullish Harami, a candlestick formation that signals a potential market reversal.

Understanding this pattern benefits traders looking to anticipate market movements and capitalize on opportunities. In this article, we’ll delve into the Bullish Harami, exploring its structure, how to identify it, what it indicates, and its pros and cons.

What Is a Bullish Harami?

A Bullish Harami is a pattern in candlestick charting used in technical analysis to predict potential market reversals. The term “harami” is derived from the Japanese word for “pregnant,” which aptly describes the pattern’s appearance. This pattern is formed over two trading periods and is characterized by a large bearish candle followed by a smaller bullish candle. The smaller candle is entirely contained within the body of the preceding larger candle, resembling a pregnant woman. This visual representation suggests a possible reversal in the market trend, where the strong selling pressure might give way to a potential buying opportunity.

Key Takeaways

- A Bullish Harami is a candlestick pattern used in technical analysis to signal a potential reversal from a downtrend to an uptrend.

- The pattern consists of a large bearish candle followed by a smaller bullish candle that fits within the body of the previous bearish candle.

- The Bullish Harami suggests that selling pressure is decreasing, and buyers may start to dominate, indicating a potential upward trend.

- The Bullish Harami can provide early reversal signals and is easy to spot.

- The Bullish Harami can give false signals and should be confirmed with other technical analysis tools.

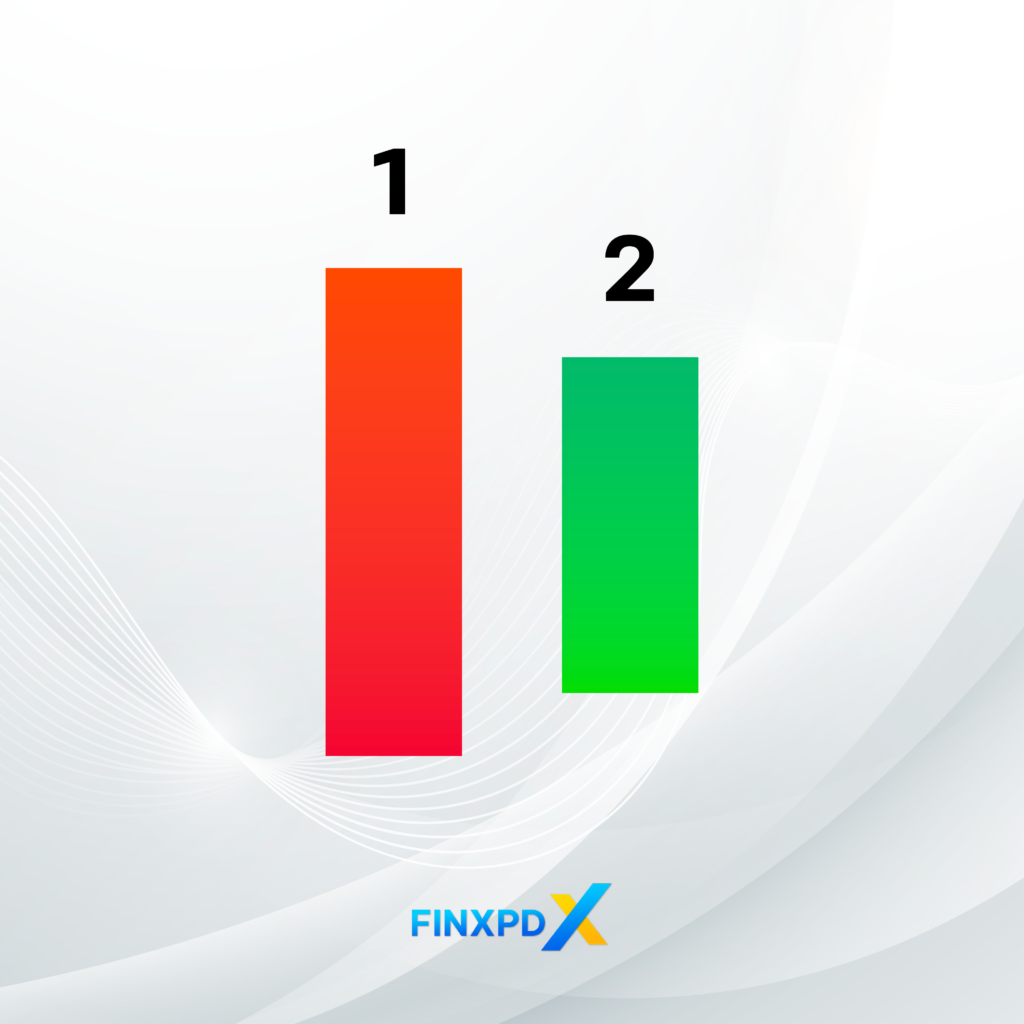

The Structure of Bullish Harami

The structure of a Bullish Harami is composed of two distinct candlesticks on a price chart.

1. First candle (bearish candle)

- This candle is typically long and bearish, indicating strong selling pressure.

- It signifies that the market was in a downtrend with sellers in control.

2. Second candle (bullish candle)

- The second candle is smaller and bullish, which fits entirely within the body of the first bearish candle.

- This smaller candle suggests a decrease in selling pressure and the emergence of buyers.

The pattern’s significance lies in the contrast between the two candles. The first candle shows a continuation of the bearish trend, while the second candle’s smaller size within the first candle’s range indicates a potential shift in momentum.

How to Identify Bullish Harami?

Identifying a Bullish Harami pattern can help traders spot potential market reversals. This pattern consists of specific candlestick formations that indicate a shift in market sentiment. There are three key steps to identify this important pattern:

1. Look for a Downtrend

- Ensure the pattern appears after a sustained downtrend, reflecting the market’s bearish sentiment.

2. Identify the Two Candles

- Initiate with a large, bearish first candle. Then, ensure the smaller, bullish second candle is contained within the first candle’s body.

3. Confirm With Additional Indicators

- Use other technical indicators, like moving averages or volume analysis, to validate the Bullish Harami pattern and avoid false signals.

⚠️Tip: Practice identifying the pattern on historical charts. This helps build confidence and accuracy in real-time trading.

There are 35 different candlestick patterns to study, each providing unique insights into market behavior. Understanding these patterns, including the Bullish Harami, enhances a trader’s ability to make informed decisions and better navigate market trends.

You can click the button below to download PDF

What Does Bullish Harami Indicate?

A Bullish Harami pattern is an important signal in technical analysis, indicating a potential shift in market sentiment. The appearance of a smaller bullish candle within the body of a larger bearish candle suggests that sellers are losing control and buyers are gaining confidence, increasing the likelihood of a trend reversal. This can be an early signal for traders to consider entering long positions or reducing short positions.

The Advantages and Disadvantages of Bullish Harami

Understanding the advantages and disadvantages of the Bullish Harami pattern can help traders utilize it more effectively in their strategies. These are the key pros and cons of using this pattern in technical analysis.

Advantages of Bullish Harami

Early Reversal Signal: The pattern can provide an early indication of a potential trend reversal, allowing traders to enter positions before the market fully shifts.

Simplicity: The pattern is relatively easy to spot on candlestick charts, making it accessible for traders of all experience levels.

Complementary Use: It can be effectively used alongside other technical indicators, such as moving averages and volume analysis, to increase the accuracy of trading decisions.

Disadvantages of Bullish Harami

False Signals: Like many technical patterns, the Harami pattern can sometimes produce false signals, particularly in volatile markets where price movements are unpredictable.

Reliance on Confirmation: The pattern often requires confirmation from other technical indicators to increase reliability, which can complicate the analysis process.

Limited Use in Isolation: This pattern should not be used as the sole basis for trading decisions; it is most effective when integrated into a broader analysis strategy.

Conclusion

The Bullish Harami pattern is a valuable tool in the arsenal of technical analysis, providing early signals of potential market reversals. By understanding its structure and knowing how to identify it, traders can anticipate shifts from bearish to bullish trends, making more informed trading decisions.

However, it is crucial to remember that no single pattern should be used in isolation. Confirming the Bullish Harami with additional technical indicators enhances its reliability and helps avoid false signals. By integrating the Bullish Harami into a comprehensive analysis strategy, traders can improve their ability to navigate the complexities of the financial markets effectively.

FAQs

A Bullish Harami is a candlestick pattern indicating a potential reversal from a downtrend to an uptrend, consisting of a large bearish candle followed by a smaller bullish candle within its body.

Traders identify it by spotting a large bearish candle followed by a smaller bullish candle within the bearish candle’s body, usually after a downtrend.

It signals a potential reversal from a bearish to a bullish trend, suggesting decreasing selling pressure and increasing buyer control.

The pattern’s accuracy improves when confirmed with other technical indicators; it should not be used alone for trading decisions.

The pattern reflects a shift in sentiment from strong selling pressure to emerging buyer confidence, indicating a potential trend reversal.

Related Articles:

- Cashback Forex: Your Guide to Extra Earnings

- Currency Hedging: Secure Your Investments

- Profit Factor: Gateway to More Effective Trading

- Xmaster Formula Indicator: Reliable Signal Tool

Read more: Forex