In technical analysis, the Bearish Marubozu is a powerful candlestick pattern that signals a potential downtrend. Characterized by its lack of shadows and steady downward movement, this pattern indicates strong selling pressure in the market.

In this article, we will explore the Bearish Marubozu, its key characteristics, how to spot it on a chart, and what it indicates for future price action. Additionally, we’ll compare the its to its bullish counterpart, the Bullish Marubozu, to highlight the differences and implications of each pattern.

What Is Bearish Marubozu?

A Bearish Marubozu is a candlestick pattern in technical analysis that signals a strong bearish (downward) trend. It has a long black or red body with no shadows or wicks, meaning the open price equals the high, and the close price equals the low.

A “Black Marubozu” is another term for a Bearish Marubozu candlestick, named for its black color in Japanese charts, symbolizing a price decline. The name highlights its appearance and origin, “Black” signifies a bearish trend, while “Marubozu” means “bald,” referring to its lack of wicks.

Key Takeaways

- A Bearish Marubozu candlestick pattern is known as Black Marubozu in Japan.

- A Bearish Marubozu features a long black or red body with no wicks, showing that the price opened at its high and closed at its low.

- A Bearish Marubozu is a candlestick pattern indicating strong selling pressure in the market.

- The Bearish Marubozu pattern’s significance increases when it appears after an uptrend, signaling a potential trend reversal.

- A Bearish Marubozu is a sell signal, whereas a bullish Marubozu is a buy signal.

Characteristics of the Bearish Marubozu Candlestick

Understanding its characteristics is key to spotting market signals. The Bearish Marubozu candlestick pattern, along with its variations, highlights market sentiment and possible price directions.

Bearish Marubozu: Features a long, solid black or red body with little to no wicks.

Full Bearish Marubozu: Completely wickless, indicating total bearish dominance during the session.

Open Bearish Marubozu: No upper wick but a small lower wick, showing a strong downward move with minor buying at the end.

Close Bearish Marubozu: A small upper wick with no lower wick, suggesting strong selling pressure with a slightly lower opening.

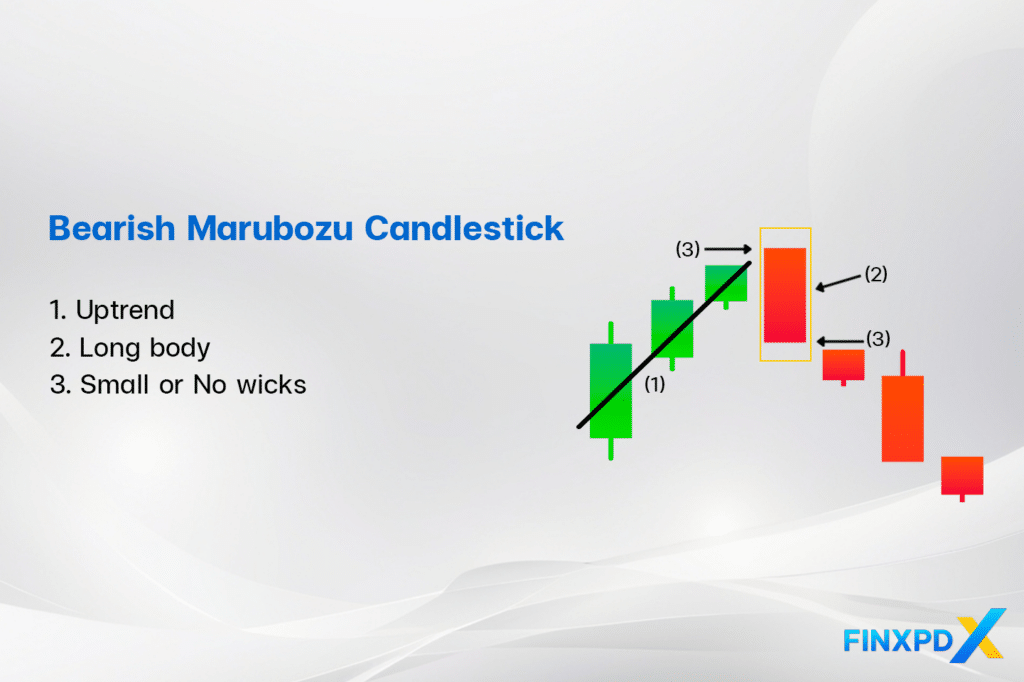

How to Identify the Bearish Marubozu Candlestick

The unique features of this pattern make it simple to identify on a chart. Here’s how to recognize it:

Long Solid Body

It is characterized by a long, solid body, which represents a significant downward price movement during the trading period. The body is typically colored black or red, indicating a bearish trend.

No Shadows or Wicks

This pattern is lacks both upper and lower shadows or wicks. This means that the highest price during the session was the same as the opening price, and the lowest price was the same as the closing price.

Context in the Trend

It often appears at the top of an uptrend or during a downtrend. If you see this pattern after a strong upward move, it could signal a reversal, while its appearance in a downtrend might indicate the continuation of bearish momentum.

What Does the Bearish Marubozu Candlestick Indicate?

The Bearish Marubozu candlestick pattern is a strong indicator of market sentiment, signaling that sellers are totally in control. Here’s what it typically indicates:

Continuation of a Downtrend

When it appears within an existing downtrend, it reinforces the possibility of the trend continuing. The absence of wicks shows no pushback from buyers, suggesting that selling pressure remains strong.

Potential Reversal at the Top of an Uptrend

If this pattern forms after a sustained upward trend, it can signal a potential reversal. This suggests that bullish momentum has faded, and sellers are gaining control, likely leading to a price decline.

Strong Selling Pressure

It shows strong selling pressure, with no wicks, indicating sellers controlled the price from open to close. This pattern suggests a dominant bearish sentiment, signaling the potential for further price drops.

Market Sentiment

This pattern indicates a market where sellers are in control, reflecting a negative outlook. This pattern typically signals ongoing downward movement or the beginning of a new bearish trend.

Candlestick patterns are essential tools for understanding market trends. Dive deeper into their power by downloading our e-book on candlestick patterns.

Click the button below to download the PDF

Bearish Marubozu vs. Bullish Marubozu Candlestick

This comparison emphasizes the different signals given by the Bearish and Bullish Marubozu candlesticks, with each serving as a strong indicator of market direction.

| Aspects | Bearish Marubozu Candlestick | Bullish Marubozu Candlestick |

|---|---|---|

| Characteristics |  |  |

| Open and Close Prices | Opens at the session’s high and closes at the session’s low | Opens at the session’s low and closes at the session’s high |

| Market Sentiment | Bearish – Indicates strong selling pressure | Bullish – Indicates strong buying pressure |

| Implication | Suggests potential downward trend or continuation of a bearish trend | Suggests potential upward trend or continuation of a bullish trend |

| Confirmation | Confirms bearish momentum, encouraging short positions | Confirms bullish momentum, encouraging long positions |

Conclusion

The Bearish Marubozu is a key bearish candlestick pattern that signals strong selling pressure and potential downtrends. Known as the Black Marubozu in Japanese charts, it indicates a market dominated by sellers, often pointing to a continuation of a downtrend or a reversal at the top of an uptrend. Understanding this pattern helps traders anticipate market direction and make informed decisions.

FAQs

A Bearish Marubozu or Black Marubozu is a candlestick pattern that signifies strong selling pressure. It has no upper or lower shadows, meaning the open is at the high, and the close is at the low, reflecting sellers’ dominance throughout the trading session.

Yes, it can be part of larger candlestick patterns like the Evening Star or the Three Black Crows. In these patterns, it often serves as the final confirmation of a bearish reversal.

A Bearish Marubozu can instill a sense of urgency among traders to sell, as it reflects overwhelming selling pressure with no signs of buyers stepping in. This strong bearish sentiment can trigger further selling, accelerating a downtrend.

The longer the Bearish Marubozu candlestick, the stronger the selling pressure and bearish sentiment. A long Bearish Marubozu indicates a decisive move by sellers, whereas a shorter one might suggest less momentum.

Traders should consider it a strong sell signal or a sign to hold off on buying. Confirm the signal with other technical indicators or wait for the next candlestick to avoid false signals.

Related Articles:

- Spinning Top Candlestick: Master It for Better Trades

- Bearish Harami: Proven Technique for Fearless Trading

- Evening Star Pattern: Identify and Improve Trading Skill

- Tweezer Bottom Pattern: A Powerful Tool for Smart Traders

Read more: Forex