The Bearish Harami candlestick pattern is a widely recognized formation in technical analysis, particularly within the realm of forex market reversal patterns. Traders often consider this pattern an early warning of a potential downtrend in currency pairs. By exploring this article, forex traders can identify Bearish Harami when an overall uptrend in a currency pair may be losing momentum, which could signal an upcoming reversal.

This article will provide the specifics of the Bearish Harami, from its structure to the signals it provides, helping you enhance your candlestick analysis for Harami patterns and improve your forex trading strategy.

What Is a Bearish Harami Candlestick?

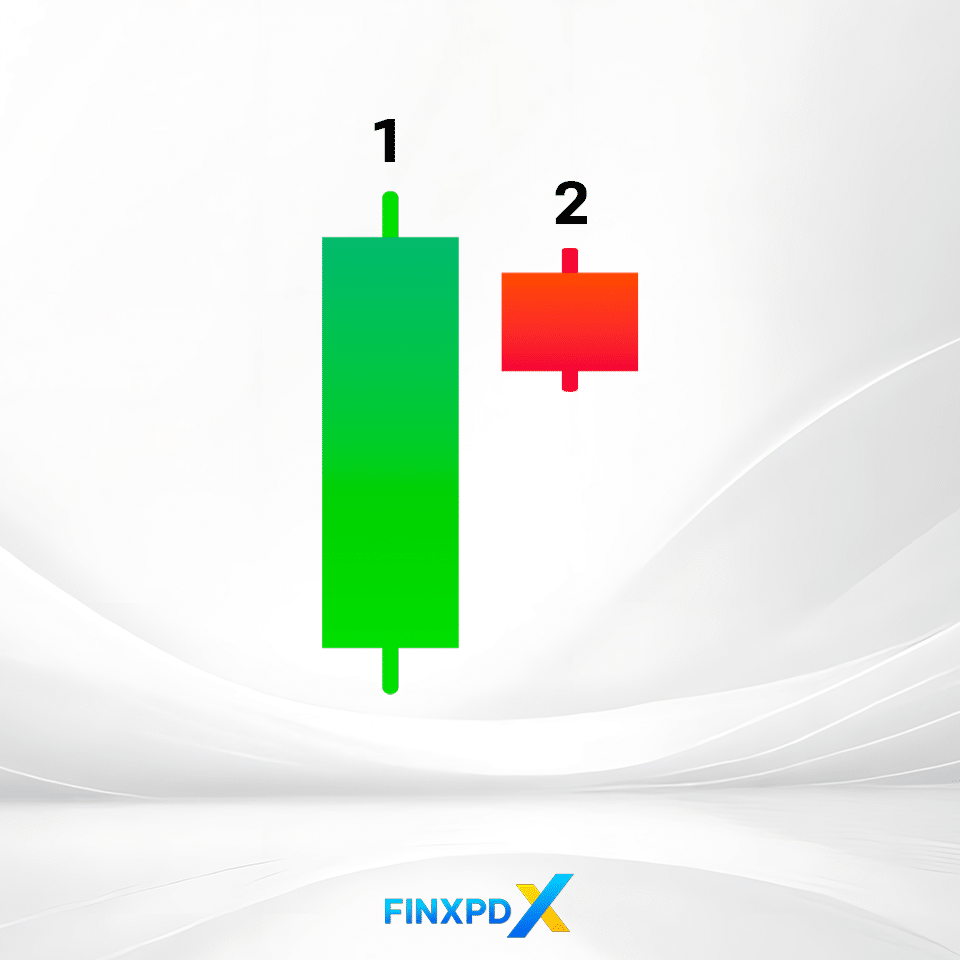

The Bearish Harami candlestick is a two-bar pattern that signals a potential reversal in an ongoing uptrend within the forex market. This pattern typically appears after bullish candlesticks. The first candlestick in the pattern is a large bullish candle, followed by a smaller bearish candle completely contained within the previous candle’s body.

The term “Harami” comes from the Japanese word for “pregnant,” which metaphorically describes the visual structure of the pattern. The pattern resembles a pregnant figure, with the smaller bearish candle “inside” the body of the larger bullish candle. The “pregnancy” of the smaller candle within the larger one symbolizes the potential birth of a new trend, making the name descriptive and meaningful.

Key Takeaways

- The Bearish Harami candlestick is a two-candle pattern in technical analysis that consists of a large bullish candle followed by a smaller bearish candle within its body.

- The Bearish Harami is characterized by a large bullish candle followed by a smaller bearish candle fully contained within the first candle, creating a visual resemblance to a “pregnant” figure.

- The Bearish Harami typically occurs during an uptrend, where the market may be showing signs of weakening momentum.

- The Bearish Harami pattern typically signals a potential downtrend to traders.

- Traders should consider reducing long positions or preparing for short opportunities after the Bearish Harami pattern forms.

The Structure of Bearish Harami Candlestick

This candlestick pattern consists of two distinct candles that indicate a potential market reversal.

First Candle (Bullish Candle)

The first candle in the pattern is bullish, which closes at a higher price than it opened. This candle is usually large, with a clear difference between its opening and closing prices. The size of this candle often suggests that the market was experiencing strong upward movement at the time.

Second Candle (Bearish Candle)

The second candle is bearish, meaning it closes at a lower price than it opened. This candle is notably smaller and is entirely contained within the body of the first bullish candle. The fact that the bearish candle’s opening and closing prices fall within the range of the previous candle’s body is a defining feature of the pattern, giving it its distinctive “pregnant” appearance on the chart.

When Does the Bearish Harami Pattern Happen?

The Bearish Harami pattern typically occurs during an uptrend in the forex market. It appears when the market shows strong upward momentum, and then suddenly, a smaller bearish candle forms within the body of the previous bullish candle. This pattern indicates the buying pressure may be decreasing.

The appearance of this pattern often happens during a time of market indecision, where traders start to doubt whether the uptrend can continue. This pattern is more likely to form near the peak of an uptrend, as it indicates that the market may be hesitant to push prices higher.

The Signal From Bearish Harami Pattern

The Bearish Harami pattern provides a signal that the current uptrend in the forex market might be losing strength and potentially leading to a downtrend.

For traders, this pattern is a warning to reassess their positions. After spotting this pattern, traders might consider reducing their long positions or preparing to enter short positions in anticipation of a possible decline in the currency pair’s price. However, waiting for further confirmation, such as a continuation of bearish candles or other indicators, is important before fully committing to a trading decision.

⚠️ Tip: The effectiveness of the Bearish Harami can vary depending on market conditions. Traders should analyze the broader market trend before relying on this pattern.

To deepen your understanding of the candlestick patterns, consider exploring additional resources that cover a wide range of patterns used in technical analysis. One such resource is the comprehensive guide available at 35 Powerful Candlestick Patterns, which offers valuable insights and detailed explanations on various patterns.

Click the button below to download the PDF

This guide is an excellent tool for traders who want to improve their ability to read market signals and make informed trading decisions based on candlestick analysis.

The Differences Between Bearish Harami and Bullish Harami

The Bearish and Bullish Harami are both two-candlestick patterns used in technical analysis, but they signal different potential market movements and appear in opposite market conditions.

Key Differences

| Aspects | Bearish Harami | Bullish Harami |

|---|---|---|

| Market Condition | Occurs during an uptrend, signaling a potential reversal to a downtrend | Occurs during a downtrend, indicating a possible shift to an uptrend |

| Candle Structure | Large bullish candle followed by a smaller bearish candle contained within the first | Large bearish candle followed by a smaller bullish candle contained within the first |

| Signal Interpretation | Warns of a potential downward movement, suggesting traders consider reducing long positions | Signals a possible upward shift, suggesting traders consider entering long positions or closing short positions |

Conclusion

Recognizing the Bearish Harami candlestick pattern can significantly enhance a trader’s ability to interpret market movements, particularly in the forex market. This pattern, defined by a large bullish candle followed by a smaller bearish one, indicates a potential reversal to a downtrend. By understanding when and how this pattern emerges, traders can better anticipate possible market reversals and adjust their strategies accordingly.

Additionally, contrasting the Bearish Harami with the Bullish Harami helps traders understand how these patterns function in different market environments. This knowledge can be applied to develop more effective trading strategies, allowing traders to navigate market trends confidently.

FAQs

A Bearish Harami candlestick pattern is a two-candle formation on a chart that suggests a potential reversal from an uptrend to a downtrend.

Traders can identify a Bearish Harami pattern by looking for a large bullish candle followed by a smaller bearish candle within the body of the first. The key feature is that the second candle’s body should be entirely inside the first candle’s body.

A Bearish Harami pattern indicates that the current uptrend might be losing momentum, with a possible shift toward a downtrend.

The Bearish Harami pattern is not always reliable on its own. Traders should seek additional confirmation from other technical indicators or patterns before making trading decisions.

When a Bearish Harami pattern forms, traders should consider reviewing their long positions and preparing for a potential downturn. It might be an excellent time to reduce exposure to upward positions or explore short opportunities.

Related Articles:

- Balance of Trade: Its Impact in Global Markets

- Leverage Trading: Best Tool to Maximizing Profit

- Margin Trading: The Way to Amplifies Your Buying

- Spot Market: Real-Time Trading Simplified

Read more: Forex