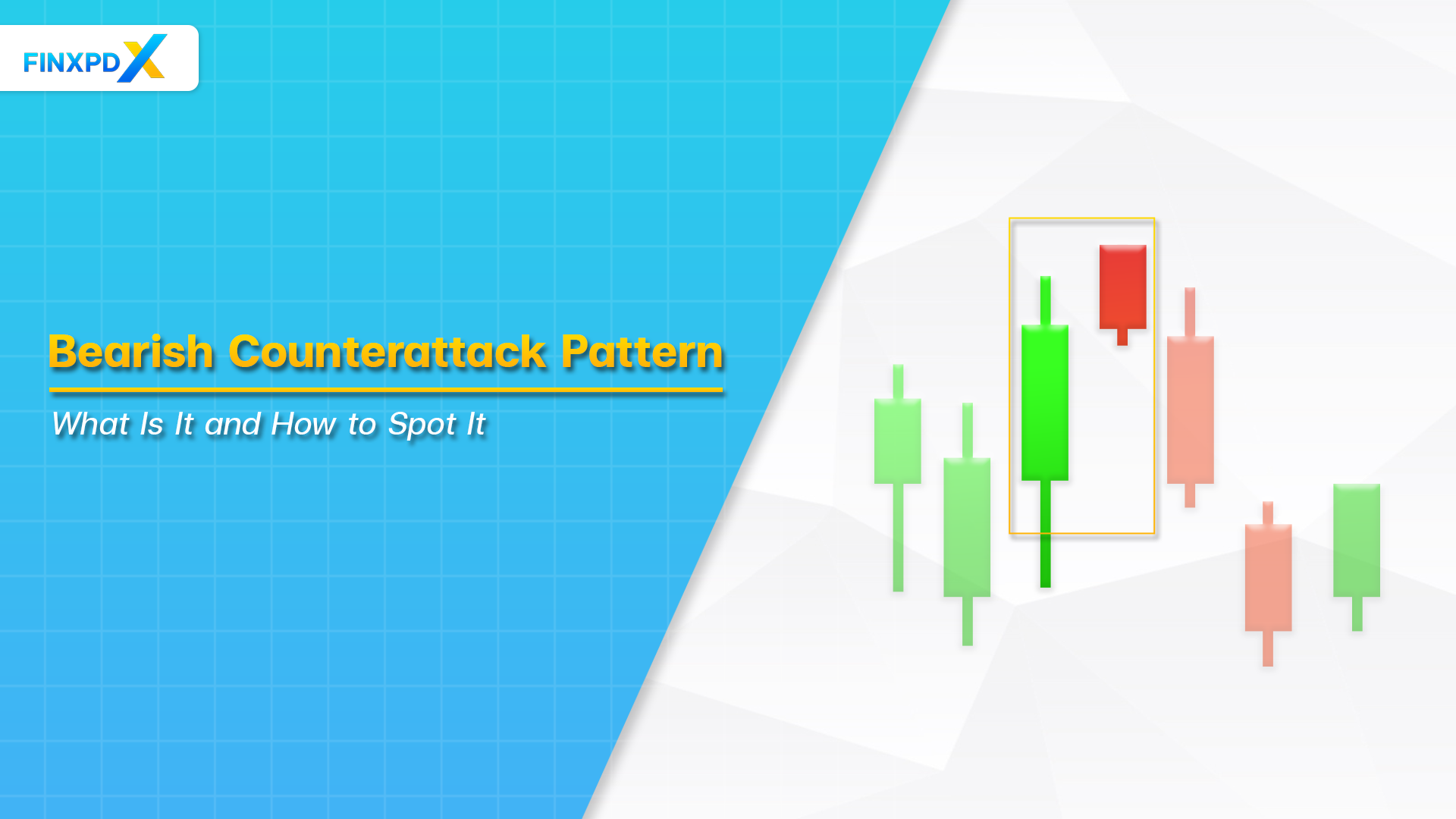

The bearish counterattack pattern is a key signal in technical analysis, often pointing to a potential shift in market momentum. Typically occurring after an uptrend, this pattern consists of a strong bullish candle followed by a bearish candle that opens at the previous close, challenging the established trend. Recognizing and understanding this pattern can be important for traders looking to anticipate market reversals and make informed decisions. By mastering the bearish counterattack pattern, traders can enhance their ability to navigate volatile markets and capitalize on emerging opportunities.

This article explores the pattern’s fundamental aspects, structure, implications, and limitations to provide a comprehensive guide for novice and experienced traders.

What Is the Bearish Counterattack Pattern?

The bearish counterattack pattern is a candlestick formation used in technical analysis to indicate a potential reversal in market direction. Specifically, it suggests a shift from an uptrend to a downtrend, signaling that sellers are beginning to gain the upper hand in the market. This pattern is part of a broader category of candlestick patterns traders use to predict future price movements based on historical price data.

The name “bearish counterattack” originates from how the pattern visually and conceptually represents the sellers’ challenge or “counterattack” against the prevailing bullish trend. The term “counterattack” reflects the idea that after strong upward momentum, the sellers push back, halting the advance and potentially reversing the trend.

Key Takeaways

- The bearish counterattack pattern is a candlestick formation signaling a potential reversal from an uptrend to a downtrend.

- The pattern’s name reflects sellers’ idea of a “counterattack” after a strong uptrend.

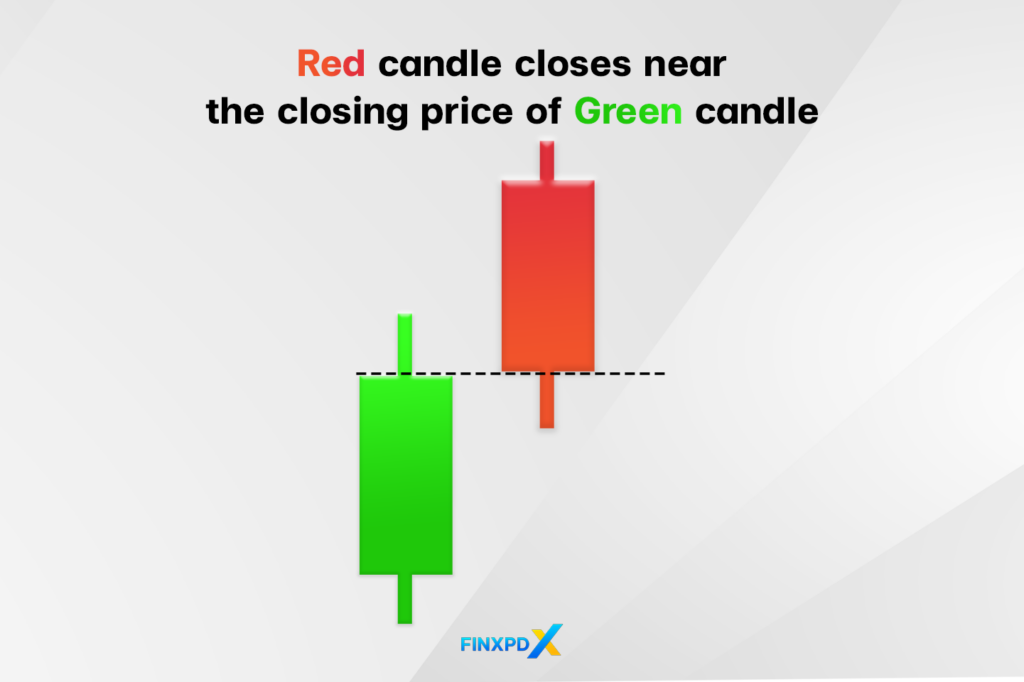

- The bearish counterattack pattern consists of two candles, where the first is bullish, and the second opens at the same level as the first candle’s close but reverses to close near the first candle’s opening price.

- The bearish counterattack pattern indicates that sellers are starting to gain control.

- The effectiveness of the bearish counterattack pattern increases when it appears near resistance levels or after a prolonged uptrend.

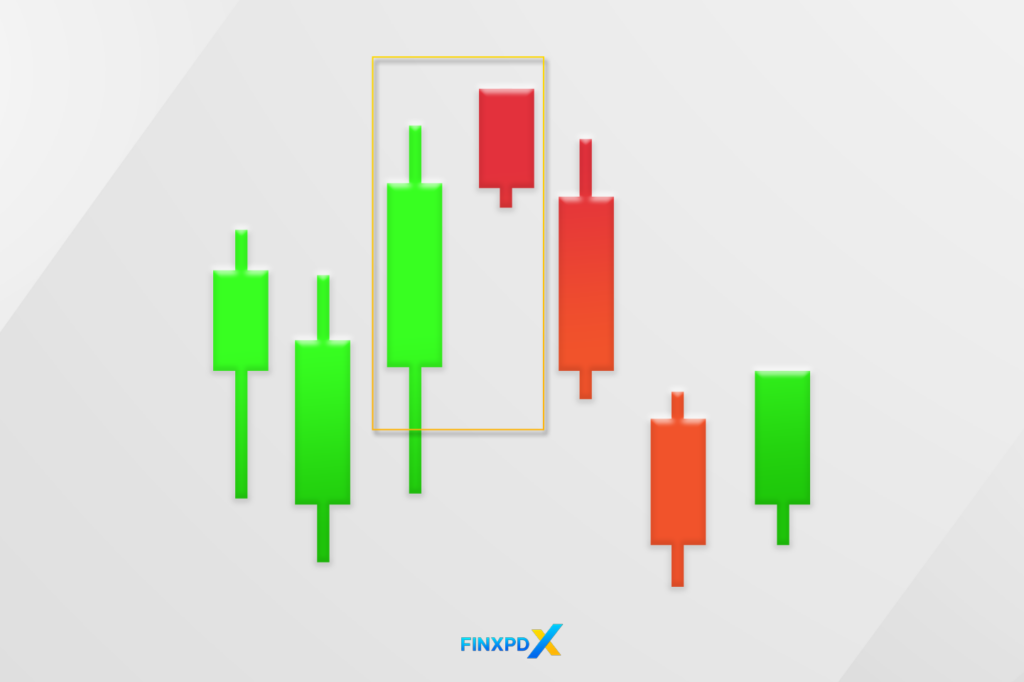

The Structure of Bearish Counterattack Pattern

This pattern is defined by its distinctive two-candle formation.

The First Candle

The first candle in the pattern is bullish. This candle closes higher than its opening price, reflecting strong buying pressure and the continuation of the uptrend.

The Second Candle

The second candle is where the main shift occurs. This candle opens at the exact level where the first candle closed. However, instead of continuing the upward trend, the second candle reverses direction. It closes near the opening price of the first candle, creating a significant bearish signal.

When Does the Bearish Counterattack Pattern Occur?

The bearish counterattack pattern typically occurs after a sustained uptrend. This pattern forms during a period of strong buying momentum, where the market has been moving upward.

However, this pattern appears specifically in market conditions where the buying pressure starts to meet resistance, usually after an extended period of price increases. It’s most commonly observed when the market is at or near significant resistance levels, where traders are cautious of potential price reversals.

⚠️Tip: Trader should consider protecting their positions by setting stop-loss orders above the pattern’s high. This limits potential losses in case the market does not reverse as expected.

What Does the Bearish Counterattack Pattern Indicate?

The bearish counterattack pattern indicates a potential reversal from an uptrend to a downtrend, signaling that the strong buying momentum is weakening and sellers are starting to take control. This pattern suggests that the bullish trend may be losing steam, and a shift in market sentiment is underway.

In response to this pattern, traders should consider taking action to protect their positions or capitalize on the potential reversal. This could include preparing to enter short positions, setting stop-loss orders above the pattern’s high to limit potential losses, or closely monitoring other technical indicators for additional confirmation of the downward movement.

To expand your knowledge of candlestick patterns beyond this candlestick pattern, there is a detailed guide on 35 powerful candlestick patterns available on our website. This resource offers valuable insights into different patterns that can help refine your trading approach.

Click the button below to download the PDF

4 Limitations of Using Bearish Counterattack Pattern

The bearish counterattack pattern has several limitations that traders should consider.

1. False Signals in Volatile Markets

This pattern can produce false signals, particularly in markets with erratic price movements, leading to potential misinterpretation.

2. Effectiveness Depends on Market Conditions

It is most reliable near resistance levels or after a prolonged uptrend. On the other hand, it may be less effective in different situations.

3. Lack of Insight on Reversal Strength or Duration

The pattern does not indicate how strong or long-lasting the potential reversal will be, which can lead to overcommitting based on the pattern alone.

4. Need for Additional Confirmation

The pattern should be used along with other technical indicators, such as volume analysis or support and resistance levels.

Conclusion

The bearish counterattack pattern is a valuable tool for traders identifying potential reversals from an uptrend to a downtrend. Understanding its structure, origins, and the conditions under which it typically forms can provide traders with critical insights into market dynamics. However, while this pattern can signal important shifts, it has limitations. Traders should be mindful of the potential for false signals and the need for additional confirmation through other technical indicators.

By incorporating this pattern into a broader trading strategy, traders can effectively enhance their ability to navigate market changes. As with any technical tool, its power lies in its careful and considered application within the overall market environment.

FAQs

The bearish counterattack pattern is a two-candle bearish reversal pattern that typically occurs after an uptrend.

Traders can identify this pattern by spotting a strong bullish candle followed by a bearish candle that opens at the same level as the first candle’s close. However, the second candle closes near the opening price of the first candle, creating a counterattack against the prevailing trend.

This pattern signifies a potential reversal from an uptrend to a downtrend. It indicates that sellers gain strength after an upward move.

This pattern is moderately reliable as a reversal signal, especially when it appears near resistance levels or after an extended uptrend. Traders often seek additional confirmation before taking action.

After identifying the pattern, traders should consider preparing for a potential downtrend, entering short positions, setting stop-loss orders above the pattern’s high, and looking for additional bearish confirmation.

Related Articles:

- 10 Best Trading Books in India You Must Read

- Balance of Trade: Its Impact in Global Markets

- Forex Trading: The Complete Guide to Success

- Forex vs. Stock Trading: Choose the Best Market

Read more: Forex