Understanding market trends is crucial for any trader, whether experienced or inexperienced. One powerful tool that can help you spot these trends is the pattern of the rising three methods. It is one of the key candlestick formations that signals trend continuation, helping you determine if an upward trend will remain.

In this article, we’ll explore the rising three methods in detail, breaking down its structure, identifying it on charts, and uncovering the psychology behind it. Additionally, we’ll address other triple candlestick patterns equally essential for a well-rounded trading strategy.

What Is Rising Three Methods?

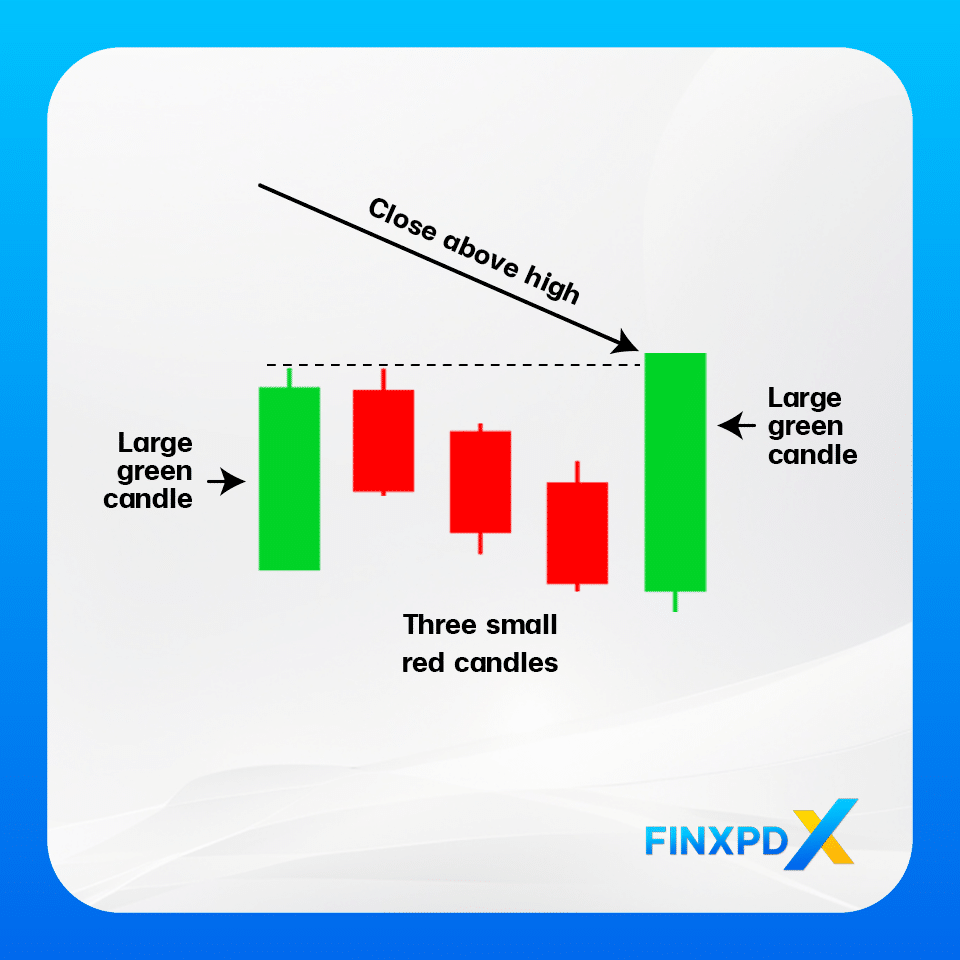

The rising three methods is a bullish continuation candlestick pattern that signals the ongoing strength of an upward trend in the market. It consists of five candles, beginning with a long bullish candle followed by three smaller bearish or neutral candles and ending with another strong bullish candle.

The rising three methods pattern has its roots in traditional Japanese candlestick charting and gained popularity in the West during the late 20th century. This pattern became a widely recognized tool in technical analysis and was valued for its reliability in confirming the continuation of bullish trends.

Key Takeaways

- The rising three methods is a bullish candlestick pattern signaling a potential upward trend continuation.

- The rising three methods candlestick pattern reflects market consolidation before resuming the dominant bullish trend.

- The rising three methods consist of a strong bullish candle, followed by three smaller bearish candles, and ends with another bullish candle.

- The smaller bearish candles typically stay within the range of the first bullish candle, indicating weak selling pressure.

- The final bullish candle surpasses the high of the first bullish candle, confirming the continuation of the uptrend.

Structure of the Rising Three Methods Pattern

First Candle: Strong Bullish Candle

The pattern begins with a long bullish candle. This candle typically has a large body, reflecting a significant upward move, and serves as the base for the pattern.

Middle Candles: Three Small Bearish Candles

The next three candles are smaller and usually bearish or neutral. They remain within the range of the first bullish candle, showing that the sellers do not have enough strength to push the price significantly lower.

Final Candle: Strong Bullish Candle

The large bullish candle that closes above the first candle’s high completes the pattern. The final candle’s strength is important, as it reassures traders that the bullish momentum remains there.

Identify the Rising Three Methods on a Chart

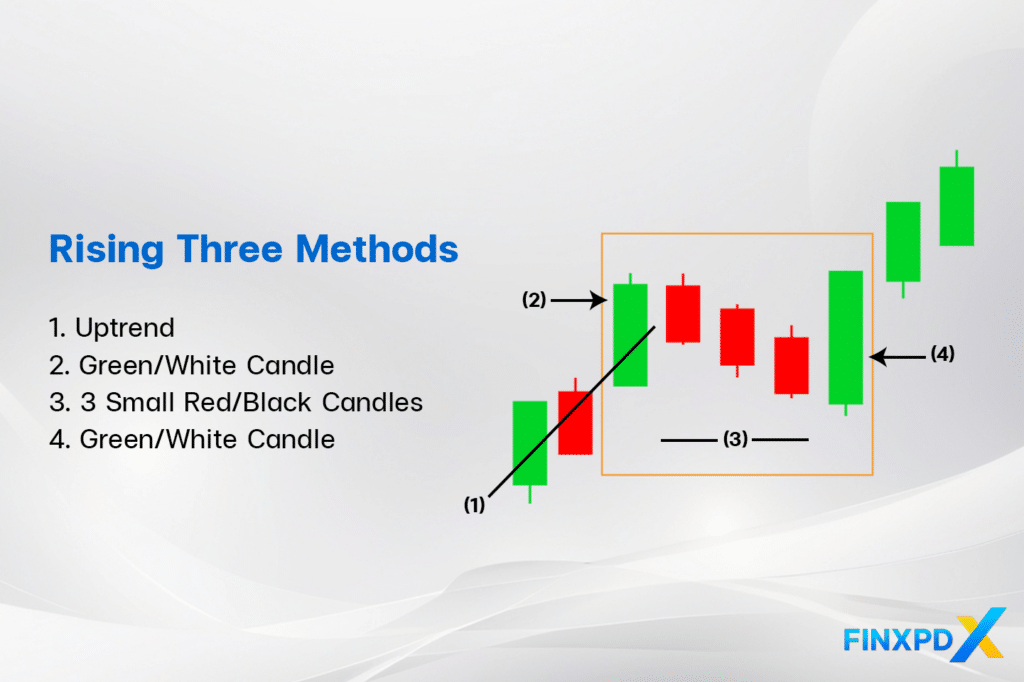

Identifying the rising three methods pattern on a chart is essential for confirming the continuation of an uptrend. Here’s a step-by-step guide to help you spot this pattern effectively:

1. Look for an Existing Uptrend

Ensure the price has been moving upwards before the rising three methods pattern appears, as it forms only within an existing uptrend.

2. Identify the First Bullish Candle

Find a strong bullish candle that starts the pattern. This candle should have a large body, indicating solid buying momentum, and it usually stands out from the surrounding candles due to its size.

3. Spot the Three Small Candles

Next, look for three smaller candles following the first bullish candle. These candles are typically bearish (red) or neutral (small bodies) and should stay within the first candle’s range, indicating a temporary pause in the uptrend, not a reversal.

4. Confirm With the Final Bullish Candle

Confirm that the last part of the pattern, a large bullish candle, closes above the first candle’s high, indicating that buyers have regained control and the uptrend will continue.

5. Check for Volume Confirmation

Confirm that the last part of the pattern, a large bullish candle, closes above the first candle’s high, indicating that buyers have regained control and the uptrend will continue.

The Psychology Behind the Rising Three Methods

Understanding market psychology can be incredibly valuable for traders looking to confirm trend continuations and make informed trading decisions.

Confidence in the Uptrend

The first candle in the rising three methods pattern is a strong bullish candle, reflecting significant buying pressure and strong market confidence. This candle indicates that the bulls are firmly in control, pushing prices higher and setting the stage for continued upward momentum.

Temporary Pause

After the first bullish candle, the next three smaller candles usually move slightly downward or sideways. This happens because some traders start selling to take profits, causing a brief pause in the uptrend. However, these candles stay within the first candle’s range, indicating that the selling pressure is not strong enough to reverse the trend, only slowing it down temporarily.

Bullish Comeback

The last candle in the pattern is another strong bullish candle that closes above the first candle’s closing price. This indicates that buyers are back in control, pushing the price higher again. The pattern ends with a clear signal that the uptrend is still strong and likely to continue.

Market Sentiment Analysis

At first, traders are confident, pushing prices higher. The temporary pullback suggests some hesitation or profit-taking, but it’s not enough to disrupt the overall bullish sentiment.

The last candle in the pattern is another strong bullish candle that closes above the first candle’s closing price. This indicates that buyers are back in control, pushing the price higher again. The pattern ends with a clear signal that the uptrend is still strong and likely to continue.

Trader Behavior

This pattern reflects typical trader behavior. Many traders might hesitate after a strong bullish move, leading to the short consolidation phase. When the final bullish candle appears, it often triggers more buying as traders who were waiting jump in, afraid of missing out on further gains. This pushes the uptrend further, confirming the pattern as a strong continuation signal.

Other Triple Candlestick Patterns Aside From Rising Three Methods

Alongside the rising three methods pattern, three other similar triple candlestick patterns are essential for traders to understand.

Three Inside Down

- Structure: The three inside down pattern starts with a long bullish candle, followed by a smaller bearish candle within the range of the first candle, and ends with another bearish candle that closes below the first candle’s open.

- Significance: The three inside down signal a potential reversal from an uptrend to a downtrend, indicating that sellers are gaining strength.

Three Black Crows

- Structure: The three black crows patterns feature three consecutive long bearish candles, each opening within the previous candle’s body and closing progressively lower.

- Significance: The three black crows pattern is a bearish reversal signal, indicating that an uptrend is losing strength and a downtrend may be starting. It shows increasing selling pressure and a shift in market sentiment.

Mat Hold

- Structure: The mat hold candlestick pattern begins with a strong bullish candle, followed by two or three smaller candles that consolidate within the first bullish candle range. It ends with a final bullish candle that breaks above the consolidation and closes higher.

- Significance: The mat hold pattern is a bullish continuation signal, indicating that sellers try to push the price down, but buyers regain control, and then the trend increases.

Candlestick patterns are essential tools for analyzing market trends. To learn more, download our e-book, which covers over 35 patterns to enhance your trading knowledge.

Click the button below to download the PDF

Conclusion

The rising three methods is a reliable bullish continuation pattern, marked by a strong bullish candle, a brief consolidation of three smaller candles, and a final bullish candle that confirms the uptrend. This pattern reflects a market where buyers maintain control despite temporary pauses, signaling ongoing strength in the uptrend. Understanding this pattern and similar ones like three inside down, three black crows, and mat hold provides traders with valuable tools to predict market movements and make informed decisions.

FAQs

The rising three methods is a bullish continuation candlestick pattern in technical analysis. It typically occurs during an uptrend and consists of three small bearish candles sandwiched between two larger bullish candles. This pattern signals that the market is taking a brief pause before continuing its upward trend.

The key components include two large bullish candles on either side and three smaller bearish candles in the middle. The bearish candles must remain within the range of the first bullish candle, indicating a consolidation phase.

Traders can use this pattern to confirm that an existing uptrend is likely to continue. It’s a signal to hold onto long positions or consider entering new ones after the pattern completes, especially if other indicators align with the bullish outlook.

No, the rising three methods pattern is specific to uptrends. In a downtrend, a similar pattern called the “falling three methods” would occur, indicating a continuation of the downward movement.

The rising three methods pattern occurs in an uptrend and signals a continuation of the upward movement, whereas the falling three methods occur in a downtrend, signaling a continuation of the downward trend.

Related Articles:

- Doji Candlestick: Gain an Edge in Trading

- Spot Market: Real-Time Trading Simplified

- Currency Hedging: Secure Your Investments

- Leverage Trading: Best Tool to Maximizing Profit

Read more: Forex