Identifying key signals can be the difference between profit and loss in the fast-paced trading world. One such critical signal is the bearish engulfing candlestick pattern which is a reliable indicator of a potential market reversal. This pattern consists of two contrasting candles highlighting a shift in market sentiment from bullish to bearish. Recognizing this pattern allows traders to anticipate downturns and adjust their strategies accordingly.

This article will explore the fundamentals of the bearish engulfing candlestick, its formation and implications, and how it can be leveraged to make informed trading decisions.

What Is Bearish Engulfing Candlestick?

A bearish engulfing candlestick is a two-candle pattern that signals a potential bearish reversal in the market. This pattern typically appears at the end of an uptrend and consists of a smaller bullish (upward) candle followed by a larger bearish (downward) candle. The key characteristic of this pattern is that the body of the bearish candle completely engulfs the body of the bullish candle, indicating a strong shift in market sentiment.

Key Takeaways

- A bearish engulfing candlestick is a two-candle pattern with a larger bearish candle engulfing a smaller bullish candle.

- A bearish engulfing candlestick pattern typically appears at the end of an uptrend, indicating a shift in market sentiment from bullish to bearish.

- The bearish engulfing candlestick pattern suggests that sellers have taken control of the market.

- The strength of the pattern is underscored by the size and volume of the bearish candle, which should engulf the entire body of the preceding bullish candle.

- Traders should exit long positions after a bearish engulfing candlestick pattern occurs, prepare for short opportunities, and manage risk more effectively.

The Structure of Bearish Engulfing Candlestick

The bearish engulfing candlestick pattern is composed of two distinct candles.

First Candle (Bullish Candle)

The first candle in the pattern is bullish, meaning it has a higher closing price than its opening price. It can be of any size, but it should reflect a positive market sentiment up to that point.

Second Candle (Bearish Candle)

The second candle is bearish, meaning it has a lower closing price than its opening price. Essentially, the body of this bearish candle completely engulfs the body of the preceding bullish candle. This means that the opening price of the bearish candle is higher than the bullish candle’s closing price, and the bearish candle’s closing price is lower than the opening price of the bullish candle.

When Does the Bearish Engulfing Candlestick Pattern Happen?

The bearish engulfing candlestick pattern typically appears at the end of an uptrend. This pattern is a strong indicator that the current bullish momentum is weakening and that sellers are starting to gain control. It often emerges in overbought market conditions, where prices have risen too quickly. The pattern can also form near significant resistance levels, where the price struggles to break through, leading to increased selling pressure.

The Signal From Bearish Engulfing Candlestick Pattern

The bearish engulfing candlestick pattern signals a potential market reversal from bullish to bearish. It indicates that sellers have overtaken buyers. The pattern’s strength is highlighted by a larger bearish candle engulfing the previous bullish candle, especially if accompanied by high trading volume.

Traders should react to this pattern by considering exiting long positions to lock in profits and preparing for short opportunities. Before taking action, it’s crucial to wait for confirmation, such as when the price closes below the low of the bearish candle. Setting stop-loss orders above the high of the bearish candle can help manage risk. Using technical indicators like the Relative Strength Index (RSI) or moving averages can further validate the pattern. High trading volume with the bearish engulfing pattern adds reliability to the signal. Recognizing and acting on this pattern allows traders to adjust their strategies, manage risk effectively, and make informed trading decisions.

⚠️ Tip: The pattern is more reliable in overbought markets. Overbought conditions often lead to stronger reversals.

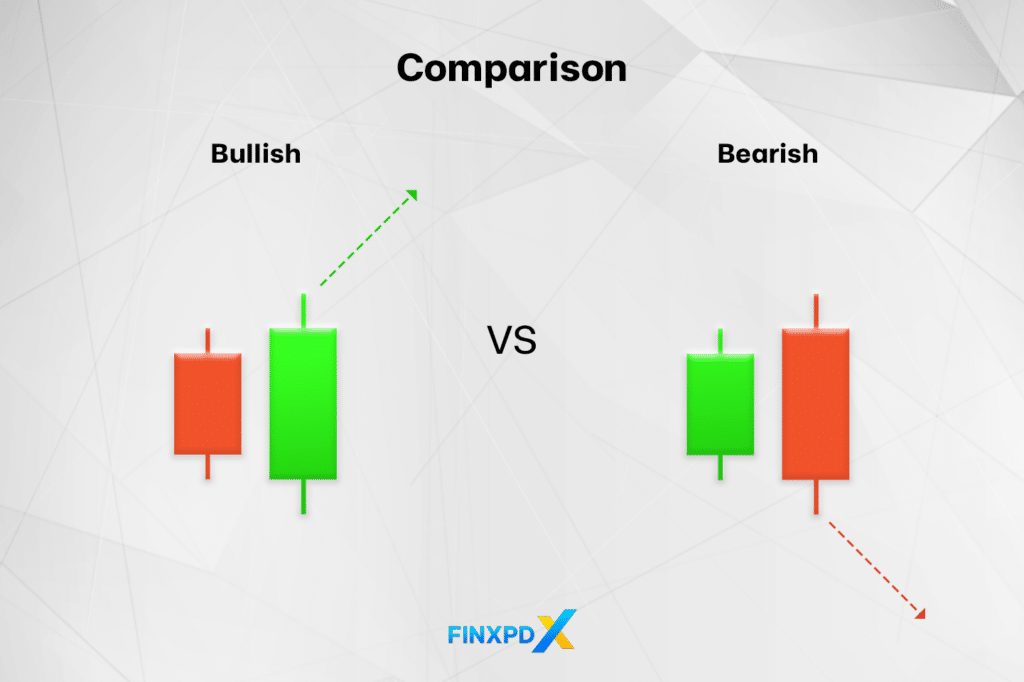

Bearish Engulfing Candlestick vs. Bullish Engulfing Candlestick

The difference between the bearish engulfing candlestick and the bullish engulfing candlestick may seem minimal, but it is crucial for interpreting market sentiment accurately.

| Aspect | Bearish Engulfing Candlestick | Bullish Engulfing Candlestick |

|---|---|---|

| Market Sentiment | Indicates a bearish reversal | Indicates a bullish reversal |

| Appearance | End of an uptrend | End of a downtrend |

| First Candle | Smaller bullish candle | Smaller bearish candle |

| Second Candle | Larger bearish candle that engulfs the first candle | Larger bullish candle that engulfs the first candle |

| Potential Shift | Signals a potential shift to a downtrend | Signals a potential shift to an uptrend |

Furthermore, our website features 35 unique candlestick patterns to enhance the accuracy of the bearish engulfing candlestick pattern by considering other indicators. We suggest exploring the Dark Cloud Cover, the Evening Star, and the Shooting Star. These patterns can validate signals and aid in making well-informed trading choices.

Click the button below to download the PDF

Conclusion

In conclusion, the bearish engulfing candlestick is a vital tool for traders aiming to identify potential market reversals. This two-candle pattern, characterized by a smaller bullish candle followed by a larger bearish candle, signals a shift from an uptrend to a downtrend. Understanding its structure and implications allows traders to make informed decisions, whether exiting long positions or preparing for short opportunities. Comparing the bearish engulfing pattern with its bullish counterpart highlights the significance of these reversal indicators in opposite market conditions.

By incorporating the bearish engulfing pattern into their technical analysis, traders can enhance their strategies and better navigate the complexities of the financial markets. Recognizing and reacting to this pattern effectively can lead to more profitable and strategic trading decisions.

FAQs

A bearish engulfing candlestick is a two-candle pattern. It consists of a smaller bullish candle and a larger bearish candle that completely engulfs the previous candle’s body.

Traders can identify a bearish engulfing pattern by looking for a smaller bullish candle followed by a larger bearish candle that engulfs the entire body of the previous candle. This pattern typically forms at the end of an uptrend.

While a bearish engulfing pattern is most significant at the end of an uptrend, it can theoretically appear in other market conditions. However, its reliability as a bearish signal is highest when it forms after a clear uptrend.

A bearish engulfing pattern indicates that the market sentiment is shifting from bullish to bearish. It suggests that sellers have taken control, overpowering the buyers, and signals a potential downward trend.

Traders should consider exiting long positions and preparing for potential short opportunities when they identify a bearish engulfing pattern. It’s necessary to wait for confirmation, such as a close below the low of the bearish candle, and to set stop-loss orders to manage risk effectively.

Related Articles:

- Cashback Forex: Your Guide to Extra Earnings

- Forex Gods: The Secrets of Top-Level Traders

- Non Deliverable Forward: Ultimate Trader Guide

- Profit Factor: Gateway to More Effective Trading

Read more: Forex