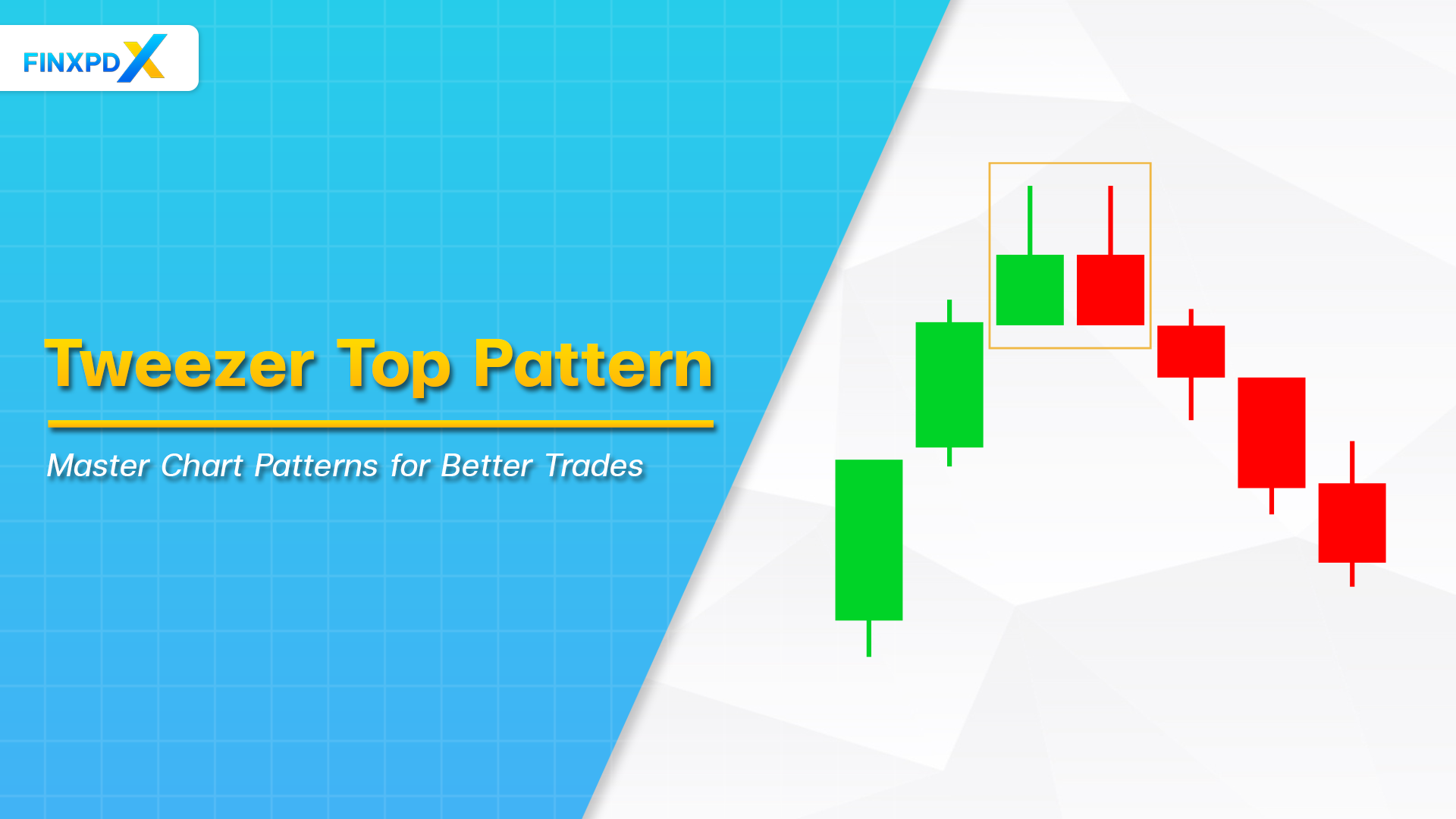

The tweezer top pattern is one of the candlestick patterns that traders use to spot potential bearish reversals in the market. This pattern appears at the end of an uptrend, signaling a shift in momentum from buyers to sellers. In this article, we will define the tweezer top pattern, explore its structure, and explain how to identify it on charts. Moreover, we will discuss how this pattern indicates trend reversals and compare it to the tweezer bottom pattern. Understanding these patterns can help traders make more informed decisions and improve their trading strategies.

What Is Tweezer Top Pattern?

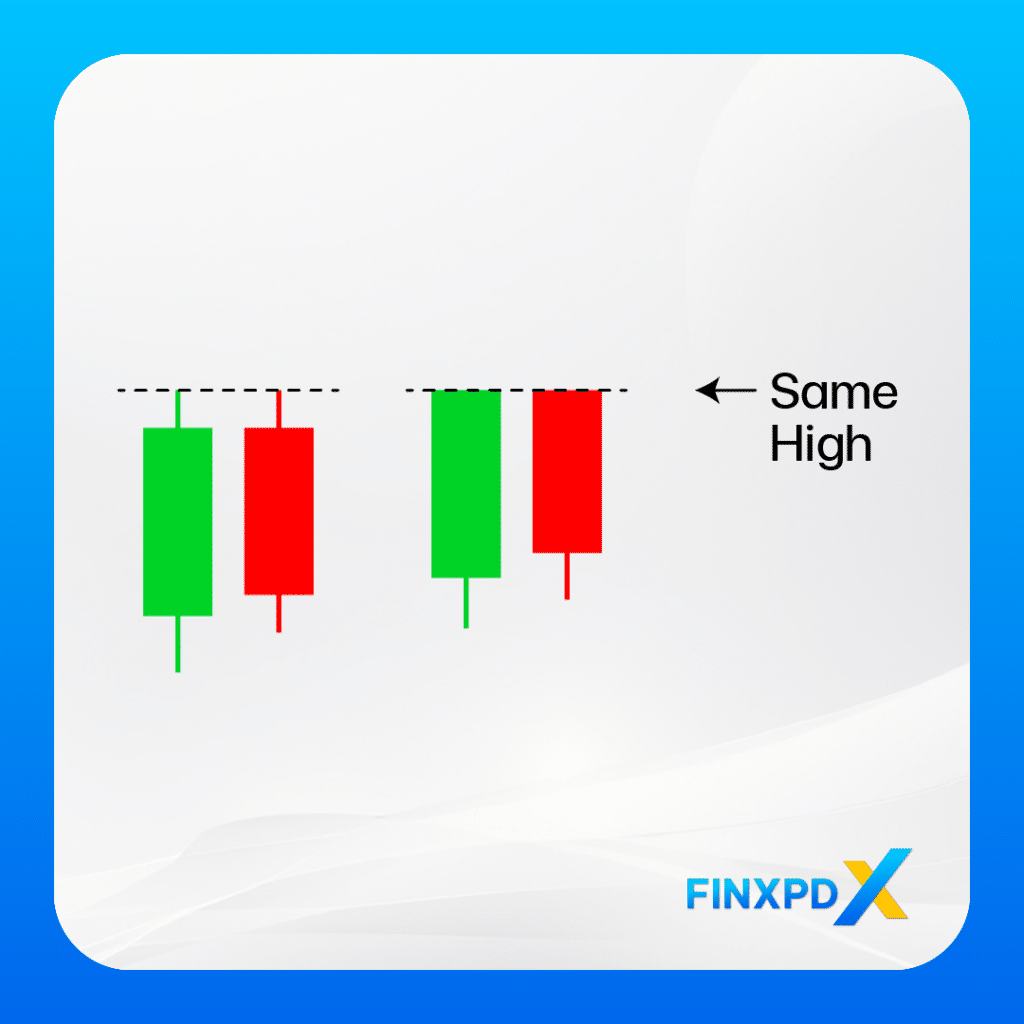

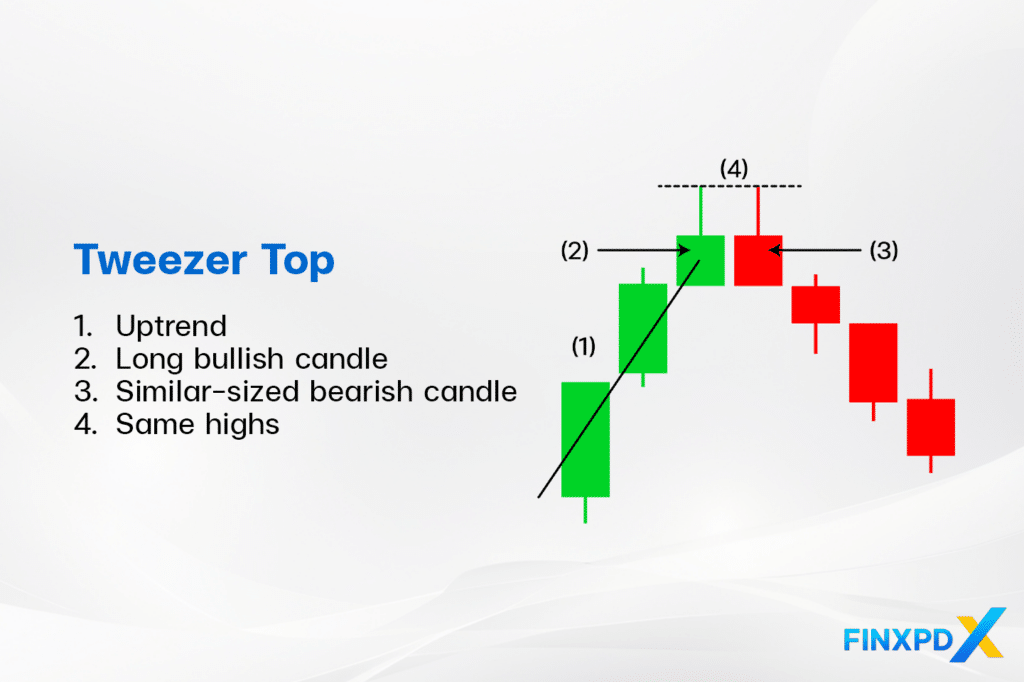

The tweezer top pattern is a bearish reversal pattern that typically appears at the end of an uptrend. Specifically, it is characterized by two or more candlesticks with identical or nearly identical highs. Interestingly, the pattern is named for its resemblance to a pair of tweezers. In particular, it has one or more candlesticks with almost the same peak, thereby making the upper shadows appear like the two parallel prongs of tweezers.

Key Takeaways

- A tweezer top pattern is a bearish reversal candlestick pattern seen in technical analysis.

- A tweezer top candlestick pattern forms at the peak of an uptrend, therefore signaling a potential trend reversal to the downside.

- A tweezer top pattern comprises two or more candles with similar highs, indicating strong resistance at that level.

- In the tweezer top pattern, the first candle is typically bullish, followed by a bearish candle, indicating market indecision.

- Traders consider tweezer top as an opportunity to enter short positions as buyers lose momentum.

What Is the Structure of Tweezer Top Pattern?

This pattern consists of two or more candlesticks with the following characteristics:

- Candlesticks Involved: Consists of at least two candlesticks.

- First Candlestick: Typically bullish with a long body

- Second Candlestick: Typically bearish with a similar-sized body

- Highs: Both candlesticks are almost the same height, creating a resistance level.

⚠️Tip: The resistance level is where the price frequently peaks and then falls back.

The tweezer top is just one of many candlestick patterns. To learn more, you are able to receive our e-book on candlestick patterns as a download by clicking on the button that is provided below.

Click the button below to download the PDF

How to Identify Tweezer Top Pattern on a Chart

Identifying the tweezer top pattern on a chart involves analyzing candlestick formations. Therefore, here’s a detailed guide on how to identify the this candlestick pattern on a chart:

1. Look for an Uptrend: Ensure the market is in a sustained uptrend with higher highs and higher lows.

2. Identify Two Consecutive Candlesticks:

- First Candlestick: Bullish with a long body.

- Second Candlestick: Bearish with a similar-sized body.

3. Check for Similar Highs: Ensure both candlesticks reach nearly the same high point to form a clear resistance level.

4. Confirm With Volume: Verify the formation’s validity by observing higher trading volume on the second candlestick.

5. Use Additional Indicators: Validate the pattern with other technical indicators like RSI or MACD for increased reliability.

6. Observe Follow-Through: Monitor subsequent price action for additional bearish candlesticks to confirm the reversal.

⚠️Tip: Traders should set stop-loss orders above the high of the pattern to manage risk and avoid potential false breakouts.

How Tweezer Top Pattern Indicates Trend Reversals

The tweezer top pattern is a valuable candlestick formation for traders, signaling a potential reversal from an uptrend to a downtrend. Here’s a detailed explanation of how the this pattern indicates trend reversals:

1. Appearance at the End of an Uptrend

This pattern occurs after a sustained uptrend, suggesting that the bullish momentum might be exhausting. This context is important because it sets the stage for a possible change in market direction.

2. Formation of Identical Highs

The pattern typically consists of two or more candlesticks with nearly identical highs, which, in turn, indicates a strong resistance level. Consequently, this level acts as a psychological barrier because buyers repeatedly fail to push prices higher, thereby hinting at weakening buying pressure.

3. Transition From Bullish to Bearish Candlesticks

The tweezer top pattern initially transitions from a bullish to a bearish candlestick. First, the initial candlestick is bullish, reflecting strong buying pressure and the continuation of the uptrend. Then, the second candlestick is bearish and similar in size, indicating that selling pressure is beginning to outweigh buying pressure. As a result, this shift marks a change in market sentiment, because sellers begin to gain control over price movement.

4. Psychological Impact

The pattern clearly highlights buyer exhaustion, since buyers are unable to push the price above the established highs. As a result, this failure leads to a shift in momentum, providing sellers with the opportunity to dominate the market, thus increasing selling activity and supporting the potential for a trend reversal.

Tweezer Top vs. Tweezer Bottom Pattern

The tweezer top and Tweezer Bottom patterns are candlestick formations used in technical analysis to signal potential reversals in market trends. Although both patterns indicate possible trend changes, each has distinct characteristics. Below, is a comparison table that clearly highlights the key differences and similarities between the tweezer top pattern and the tweezer bottom pattern.

| Feature | Tweezer Top Pattern | Tweezer Bottom Pattern |

|---|---|---|

| Characteristics |  |  |

| Trend Reversal Signal | Bearish reversal from an uptrend | Bullish reversal from a downtrend |

| Market Sentiment | Shift from bullish to bearish | Shift from bearish to bullish |

| Candlestick Formation | Two or more candlesticks with similar highs | Two or more candlesticks with similar lows |

| First Candlestick | Bullish | Bearish |

| Second Candlestick | Bearish | Bullish |

| Occurrence | Appears at the top of an uptrend | Appears at the bottom of a downtrend |

| Volume Consideration | Higher volume strengthens the signal | Higher volume strengthens the signal |

| Trading Strategy | Enter short positions | Enter long positions |

| Risk Management | Set stop-loss above resistance | Set stop-loss below support |

| Reliability | Need confirmation to avoid false signals | Need confirmation to avoid false signal |

Conclusion

To sum up, the tweezer top pattern is a bearish reversal signal that typically occurs at the end of an uptrend, marked by two or more candlesticks with nearly identical high points. Consequently, this pattern indicates weakening buying pressure and the emergence of seller dominance, suggesting a potential shift to a downtrend. Moreover, traders use the tweezer top pattern to identify market reversals and often confirm it with other technical indicators. Therefore, understanding these patterns and their implications can help traders make more informed decisions and, ultimately, enhance their trading strategies by identifying critical turning points in market trends.

FAQs

A tweezer top pattern is a bearish reversal candlestick pattern typically seen at the end of an uptrend. It consists of two or more candlesticks with nearly identical highs, indicating strong resistance at that price level. This pattern suggests that the upward momentum is weakening, and a downward reversal might occur.

A tweezer top pattern forms when two consecutive candlesticks have almost the same high price. The first candlestick is bullish, showing strong upward movement, and the second is bearish, indicating selling pressure. The equal highs suggest resistance, signaling a potential reversal from an uptrend to a downtrend.

Traders use the tweezer top pattern to identify potential entry and exit points for short positions. When this pattern forms, traders might consider to sell or short-sell their assets. They often combine it with other technical indicators, such as moving averages or RSI, to confirm the reversal signal and improve accuracy.

Yes, a tweezer top pattern can appear in various financial markets, including forex, commodities, and cryptocurrencies. It serves as a technical analysis tool across different asset classes to indicate potential reversals. Traders should adapt their analysis to market-specific conditions when applying this pattern.

Yes, similar patterns include the double top, evening star, and bearish engulfing patterns. These patterns also signal potential bearish reversals. While each pattern has distinct characteristics, traders often use them alongside tweezer top to confirm reversal signals and enhance their trading strategies.

Related Articles:

- Doji Candlestick: Gain an Edge in Trading

- Spinning Top Candlestick: Master It for Better Trades

- Three Black Crows Pattern: Expert Guide of Bearish Markets

- Evening Star Pattern: Identify and Improve Your Trading Skill

Read more: Forex