Trading is not just about strategies and market analysis; it’s equally about mastering one’s own psychology. The emotional and psychological aspects of trading often play a critical role in the success or failure of traders. In this article, we will explore the top 10 trading psychology books carefully selected for their profound impact and practical advice. Each book is a treasure trove of wisdom, offering unique perspectives on how to align your mindset with your trading goals.

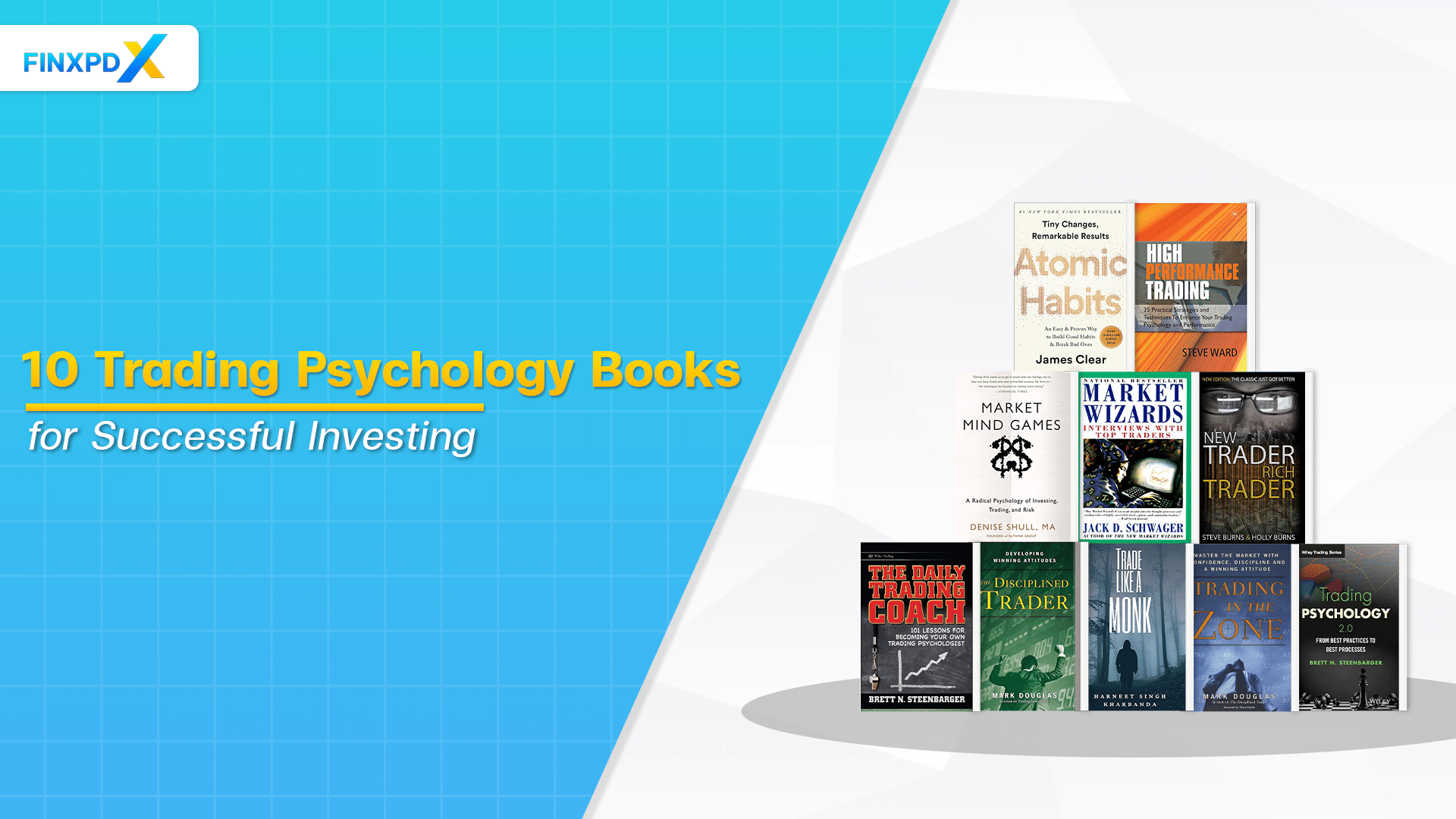

10 Best Trading Psychology Books

Below is a careful selection of best books on trading psychology. Expert-recommended treasures that promise to enhance your trading psychology, paving the way for smarter, more composed, and successful trading decisions.

1. The Daily Trading Coach: 101 Lessons for Becoming Your Own Trading Psychologist

This book offers a comprehensive guide for traders to develop their own coaching methods, tailored to fit their personal psychological profile. Brett N. Steenbarger, a well-known trading coach and psychologist, provides practical strategies to overcome the emotional and cognitive challenges that traders face.

Key Lessons:

- Understanding your trading psychology is crucial for consistent success.

- Techniques to manage and overcome emotional trading decisions.

- Strategies for improving self-coaching skills for better trading.

- Importance of discipline and patience in trading psychology.

- Adapting trading strategies to match individual psychological profiles.

Why Is This a Good Trading Psychology Book?

“The Daily Trading Coach” by Brett N. Steenbarger stands out as an indispensable resource for traders due to its unique focus on self-coaching. The book’s detailed approach to understanding and molding one’s psychological makeup is a game-changer in the realm of trading. It doesn’t just offer theoretical insights; it provides actionable strategies that can be implemented immediately. This makes it particularly valuable for traders who are keen on continuous self-improvement and personal growth within the trading context.

2. Trading in the Zone: Master the Market With Confidence, Discipline, and a Winning Attitude

“Trading in The Zone” offers an in-depth look into the mental aspect of trading. Authored by Mark Douglas, this book emphasizes the development of a winning mindset that combines confidence, discipline, and a positive attitude, which are essential for success in the financial markets.

Key Lessons:

- The importance of a trader’s mindset in achieving consistent success.

- Strategies for building self-confidence in trading decisions.

- The role of discipline in adhering to a trading plan.

- Techniques for dealing with the psychological pressures of trading.

- Developing a positive attitude towards trading and market fluctuations.

Why Is This a Good Trading Psychology Book?

“Trading in The Zone” by Mark Douglas is highly regarded in the trading community for its thorough exploration of the psychological elements that influence trading success. Douglas delves into the importance of mental state and attitude, arguing that these are as crucial as technical skills in trading. The book stands out for its clear explanation of how emotional responses can affect trading decisions and its guidance on how to cultivate a mindset.

3. Trading Psychology 2.0: From Best Practices to Best Processes

“Trading Psychology 2.0″ is a forward-thinking exploration into the complex realm of trading psychology, authored by renowned psychologist and trading coach Brett N. Steenbarger. This book goes beyond the basics, offering a nuanced and advanced perspective on the psychological aspects of trading.

Key Lessons:

- Advanced techniques for enhancing trading psychology.

- Integration of psychological methods with trading strategies.

- Personal improvement planning for traders.

- Understanding market behavior psychology.

- Psychological adaptability in response to market changes.

Why Is This a Good Trading Psychology Book?

“Trading Psychology 2.0” by Brett N. Steenbarger stands out for its thorough approach to the mental aspects of trading. Steenbarger’s expertise in psychology and trading shines through in his practical advice on developing a personal improvement plan that aligns with individual trading styles and goals. The book’s emphasis on psychological adaptability is particularly relevant in today’s fast-paced and ever-changing market conditions.

4. New Trader, Rich Trader: How to Make Money in the Stock Market

“New Trader, Rich Trader” by Steve and Holly Burns is a guide designed for newcomers to the stock market. It contrasts the behaviors and mindsets of a ‘New Trader’ with those of a ‘Rich Trader,’ providing valuable insights into the practices that lead to success in trading.

Key Lessons:

- Differences in mindset and approach between new and experienced traders.

- Strategies for developing a successful trading plan.

- Importance of discipline and emotional control in trading.

- Risk management techniques crucial for long-term success.

- Learning from mistakes and the continuous process of self-improvement in trading.

Why Is This a Good Trading Psychology Book?

This book is especially valuable for its direct, accessible approach, making complex trading concepts understandable for beginners. It emphasizes the psychological transformation needed to move from a novice to a successful trader, offering practical advice that’s vital for long-term profitability in the stock market.

5. Market Wizards: Interviews With Top Traders

“Market Wizards” by Jack D. Schwager is a compilation of interviews with some of the most successful traders in the 1970s and 1980s. It provides a rare glimpse into the minds and strategies of these trading legends, offering invaluable lessons from their experiences.

Key Lessons:

- Diverse trading strategies and philosophies from top traders.

- The psychological makeup of successful traders.

- Common traits and habits that contribute to trading success.

- Insights into risk management from experienced traders.

- Learning from the experiences and mistakes of market wizards.

Why Is This a Good Trading Psychology Book?

Schwager’s “Market Wizards” is a treasure trove of wisdom, offering a unique perspective on trading success through the experiences of renowned traders. Its real-world insights make it an essential read for understanding the psychological factors behind successful trading.

6. Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones

“Atomic Habits” by James Clear isn’t specifically about trading, but it offers invaluable advice on habit formation and behavior change. Clear provides a framework for building positive habits and breaking negative ones, which are essential skills for traders in managing their discipline and decision-making processes.

Key Lessons:

- Strategies for developing and maintaining positive trading habits.

- Understanding the impact of small, consistent changes on long-term success.

- Techniques for breaking bad habits that can hinder trading performance.

- The importance of an environment conducive to good trading habits.

- Aligning habits with trading goals and values for sustained success.

Why Is This a Good Trading Psychology Book?

Although not a traditional trading psychology book, “Atomic Habits” is crucial for traders in understanding and shaping the habits that underpin successful trading practices. Clear’s principles are widely applicable and highly relevant for developing the discipline and consistency needed in trading.

7. Market Mind Games: A Radical Psychology of Investing, Trading, and Risk

“Market Mind Games” by Denise Shull presents a novel approach to understanding the psychological and emotional aspects of trading. Shull, combining her background in neuropsychology with real trading experience, offers a unique perspective on how emotions and psychology influence trading decisions.

Key Lessons:

- The role of emotions in financial decision-making.

- Understanding the psychological challenges faced by traders.

- Techniques for managing emotional responses in trading.

- The importance of self-awareness and emotional intelligence in trading.

- Applying psychological insights to improve risk management.

Why Is This a Good Trading Psychology Book?

Denise Shull’s “Market Mind Games” stands out for its emphasis on the emotional and psychological aspects of trading, offering valuable insights into how traders can harness their emotional responses for better decision-making and risk management.

8. High Performance Trading: 35 Practical Strategies and Techniques to Enhance Your Trading Psychology and Performance

“High Performance Trading” by Steve Ward offers a collection of 35 strategies and techniques aimed at enhancing both trading psychology and performance. This book provides practical advice and tools for traders looking to improve their mental game and overall trading effectiveness.

Key Lessons:

- Practical strategies for improving trading psychology.

- Techniques for enhancing decision-making and performance in trading.

- The importance of mental and emotional fitness in trading.

- Tools for dealing with stress and pressure in the trading environment.

- Methods for maintaining focus and discipline in trading.

Why Is This a Good Trading Psychology Book?

“High Performance Trading” by Steve Ward is particularly persuasive for its practicality and applicability in the real world of trading. Ward’s book stands out for its direct approach to enhancing the mental and emotional aspects of trading, offering concrete strategies and techniques that can be immediately implemented.

9. The Disciplined Trader: Developing Winning Attitudes

Mark Douglas’s “The Disciplined Trader” is a pioneering work in the field of trading psychology. It focuses on developing the discipline and mental control essential for trading success, delving into the psychological challenges that traders face and offering strategies to overcome them.

Key Lessons:

- The pivotal role of discipline in successful trading.

- Methods to overcome emotional and psychological barriers.

- Developing a mindset conducive to winning in trading.

- Identifying and addressing psychological pitfalls in trading decisions.

- Techniques for maintaining focus and objectivity in the markets.

Why Is This a Good Trading Psychology Book?

“The Disciplined Trader” by Mark Douglas is influential for its in-depth exploration of the mental discipline required for successful trading. Douglas’s insights into overcoming psychological barriers offer invaluable guidance for traders, making it an essential read for those looking to develop a disciplined, winning approach in the markets.

10. Trade Like a Monk: 36 Rules for Investment Success

“Trade Like a Monk” by Harneet Singh Kharabanda presents a unique approach to trading, intertwining investment strategies with principles akin to those found in monastic life. This book focuses on cultivating discipline, patience, and a Zen-like approach to decision-making in investments.

Key Lessons:

- The importance of discipline and patience in trading.

- Applying principles of mindfulness and focus to investment strategies.

- The role of emotional control and detachment in successful trading.

- Strategies for long-term investment success.

- Cultivating a calm, collected approach to decision-making in volatile markets.

Why Is This a Good Trading Psychology Book?

“Trade Like a Monk” stands out for its unique blend of investment strategies and monastic principles. Kharabanda’s approach to trading, emphasizing mindfulness and emotional control, offers a refreshing perspective that is particularly relevant in today’s fast-paced and often stressful trading environments. This book is a valuable resource for traders seeking to balance the mental and emotional demands of trading with a calm, disciplined approach.

How Do You Choose the Right Trading Psychology Book?

To choose the right trading psychology book that meets your needs, here are five practical steps:

Identify Your Specific Needs

Begin by pinpointing the exact areas in trading psychology you need help with. Are you struggling with emotional control, decision-making, risk management, or maintaining discipline? Different books focus on different aspects of psychological challenges in trading that will help solve your problems.

Evaluate Your Trading Experience Level

Choose a book that matches your experience level in trading. Beginners may benefit from books that introduce basic concepts in a straightforward manner, while more experienced traders might seek advanced materials that delve into deeper psychological strategies.

Research the Authors

Look into the authors’ backgrounds. Prefer authors who have hands-on experience in trading and a solid understanding of psychology. Their real-world experience combined with psychological expertise often translates into more practical and applicable advice.

Seek Actionable Content

Search for books that provide actionable strategies or exercises, not just theory. The most useful trading psychology books are those that offer tools and techniques you can apply to your daily trading activities.

Read Reviews and Recommendations

Check online reviews and seek recommendations from fellow traders or trading communities. Reviews can give you a sense of how useful the book has been to others with similar needs and can help gauge the book’s effectiveness in addressing real-world trading psychology issues.

Conclusion

Selecting the right trading psychology book is a critical step towards enhancing your trading skills and mindset. By focusing on your specific needs and challenges, considering the author’s expertise, ensuring content relevance, reading reviews, and previewing the book, you can make an informed decision that will contribute positively to your trading journey.

Each of these steps guides you towards a book that not only aligns with your current trading level but also addresses the unique psychological aspects you’re aiming to improve. Remember, the goal is to find a resource that not only informs but also empowers and inspires you to elevate your trading to the next level.

FAQs

Notable ones include “Trading in the Zone” by Mark Douglas, “New Trader, Rich Trader” by Steve and Holly Burns, and “The Daily Trading Coach” by Brett N. Steenbarger. These books offer a comprehensive introduction to the psychological aspects of trading.

Books on trading psychology can significantly enhance your trading strategy by helping you understand and manage your emotions, develop discipline, and maintain a consistent approach. They offer insights into overcoming common psychological barriers like fear, greed, and impulsive decision-making.

Yes, some trading psychology books cater specifically to day traders. “The Disciplined Trader” by Mark Douglas and “High Performance Trading” by Steve Ward are excellent resources, offering strategies tailored to the fast-paced and high-pressure environment of day trading.

“Trading in The Zone” by Mark Douglas is highly recommended. It provides deep insights into how emotions affect trading decisions and strategies to develop emotional resilience. Another good read is “Market Mind Games” by Denise Shull, which focuses on understanding and harnessing emotional responses for better trading outcomes.

Yes, books on trading psychology often cover topics like risk tolerance, emotional responses to losses, and the psychological aspects of risk management. Books like “The Daily Trading Coach” by Brett N. Steenbarger and “Trading Psychology 2.0” by Brett N. Steenbarge.

Related Articles:

- 15 Essential Trading Discipline for Successful Investors

- Top 10 Trading Quotes: Financial Advice from the Greats

- FOMO Trading: Spotting and Tackling the Hidden Enemy

- Find Best Types of Trading in the Stock Market Now!

Read more: Stocks